T4K3.news

Dow Falls as Powell Speech Looms and Walmart Drops After Earnings

Stocks slide in late trading as Powell's Jackson Hole remarks loom; Walmart sinks after earnings, tech names slip.

Stocks drift lower in late trading as investors await Powell's Jackson Hole speech, with Walmart tumbling after earnings and tech shares under pressure.

Dow Falls as Powell Speech Looms and Walmart Drops After Earnings

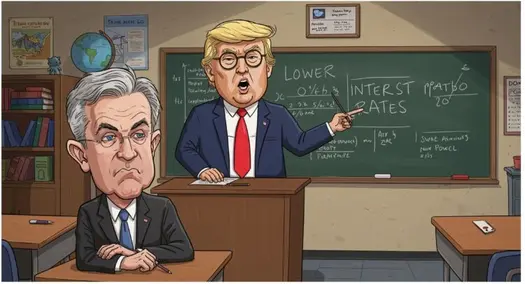

U.S. stocks slid in late trading Thursday, with the Dow Jones Industrial Average, the S&P 500 and the Nasdaq all down about 0.4%. The market is waiting for Federal Reserve Chair Jerome Powell's remarks at the Jackson Hole Economic Policy Symposium, where policy signals could set the tone for the rest of the year. The S&P 500 had been on a four-session losing streak after earlier gains, as investors reassess the pace of rate cuts in light of inflation readings.

Walmart fell about 5% after weaker than expected earnings, weighing on Dow performance. Tech names were again under pressure, with Amazon, Meta Platforms and Broadcom slipping, while Nvidia, Apple and Tesla also fell. Palantir edged up after several sessions of declines. In other markets, bitcoin traded around 112,100 dollars, oil rose to about 63.45 a barrel, the 10 year yield climbed to 4.33% and the dollar rose, as investors weigh the policy outlook.

Key Takeaways

"Powell's signal will shape the next leg for rates"

Editorial highlight on policy direction

"Walmart's earnings miss dents the mood for consumer stocks"

Impact on market sentiment

"Investors crave clarity on the pace of rate cuts"

Market expectation

"Jackson Hole testing risk appetite as markets await guidance"

Event significance

Powell’s remarks at Jackson Hole are a litmus test for what comes next. The market is trying to price in a policy path that could shift risk appetite for equities and debt alike. The tension between strong earnings from some retailers and the macro drag from inflation keeps traders anxious.

If Powell signals caution and holds off on rate cuts, volatility could stay elevated and rotation into defensives may intensify. If he signals a quicker path to cuts, a relief rally could follow, but that would depend on fresh inflation data and global signals. The coming days will set a new baseline for how investors balance policy risk with corporate results.

Highlights

- Powell's signal will shape the next leg for rates

- Walmart's earnings miss rattles consumer stocks

- Investors crave clarity on the pace of rate cuts

- Jackson Hole testing risk appetite as markets await guidance

Market sensitivity to policy signals raises risk

The article links policy signals to market moves and notes earnings results affecting sentiment. Volatility could rise if Powell’s guidance diverges from expectations.

The road ahead will hinge on new data and Powell's guidance rather than yesterday's headlines.

Enjoyed this? Let your friends know!

Related News

Dow Jones Edges Lower as Markets Hover Near Record Highs Ahead of Powell Speech

Tech stocks retreat as markets pause after record highs

Markets slip as Powell readies policy remarks

Markets edge down as Walmart weighs on index

Markets slip on tech pullback before Jackson Hole

Market Slip Deepens as Walmart Weighs on Stocks

Markets slide as AI shares retreat

Dow Futures Slide on Trump Fed Clash