T4K3.news

Bitcoin Falls as Inflation Fears Grow and Markets Drop

Crypto markets slide as Bitcoin dips below 113000 amid inflation worries and policy uncertainty.

Crypto markets slide as Bitcoin dips below 113000 amid inflation worries, rising yields, and policy uncertainty.

Bitcoin Falls as Inflation Fears Grow and Markets Drop

Bitcoin slipped below 113,000 for the first time since August as traders priced in inflation risk, rising yields and ongoing trade tensions. Ethereum hovered near a recent peak but traded lower, while XRP and Solana also fell. The largest crypto by market value was around 113,000 in the latest session as risk appetite cooled.

Analysts described the move as a mix of macro jitters and profit taking after a rapid run higher. Higher Treasury yields and stronger than expected U.S. data have cooled appetite for risk assets, and crypto has followed suit. The Federal Reserve kept rates in a narrow range, while minutes showed dissent over keeping policy unchanged. Traders also watched for unemployment claims, upcoming manufacturing data and Powell's remarks at Jackson Hole to gauge the policy path. Bitwise's Juan Leon noted cascading liquidations from leveraged trades as investors lock in gains.

Key Takeaways

"The pullback looks like a mix of macro jitters and positioning after the recent run-up."

Joe DiPasquale, BitBull Capital, on the market pullback

"profit taking from last week all time high was leading to cascading liquidations from leveraged trades"

Juan Leon, Bitwise Investments, on liquidity and leverage

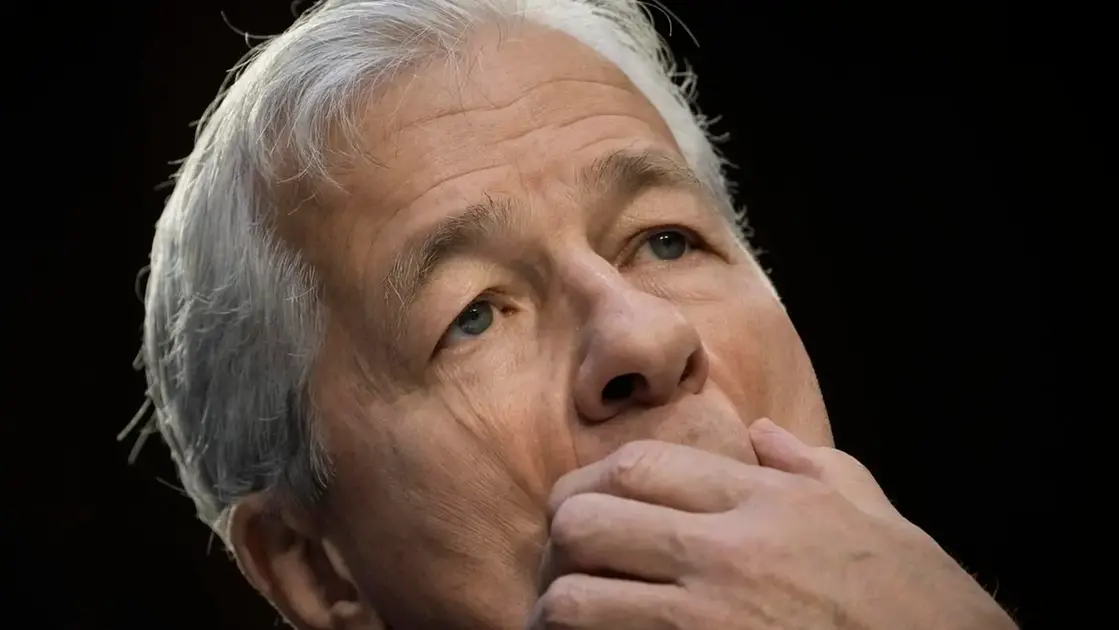

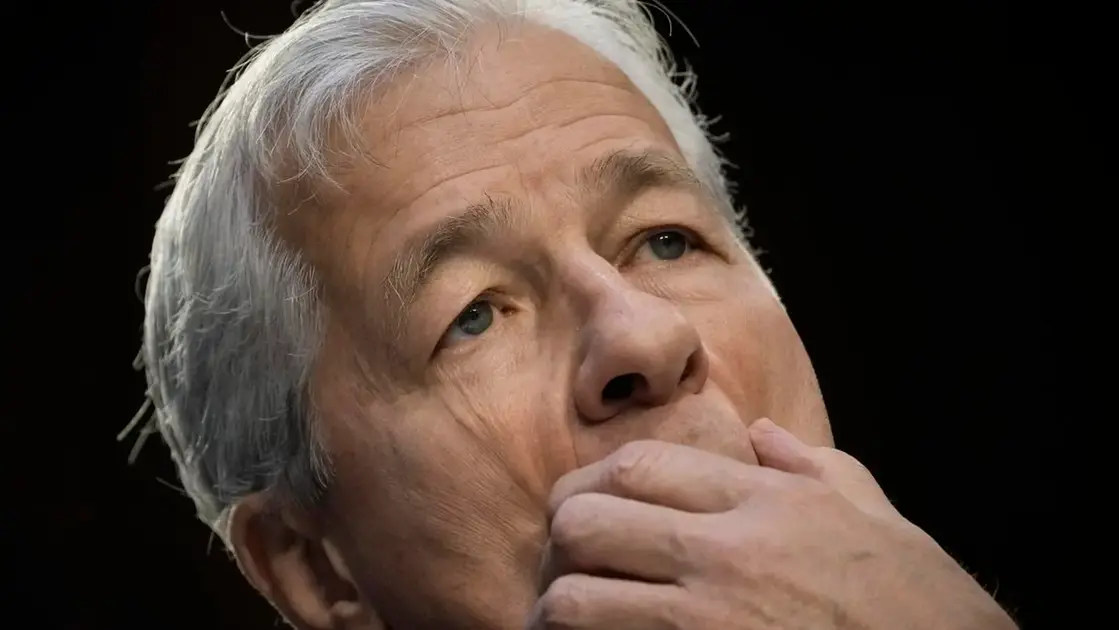

"increased tariffs are pushing up prices in some categories of goods"

Federal Reserve Chair Jerome Powell, on tariffs and inflation

The fall underscores how crypto prices are tethered to traditional markets. Inflation data, tariff announcements and policy expectations move prices quickly, reminding investors that digital assets still ride the same macro wave as stocks and bonds.

Looking ahead, the next data releases and policy signals will shape the next leg of the move. If data softens, Bitcoin could bounce; if not, the selloff may extend. The episode highlights how leverage and liquidity dynamics amplify swings in a risk-off environment and how policy signals at Jackson Hole will set the tone for the weeks ahead.

Highlights

- Crypto moves with macro fears not in isolation

- Profit taking turns a rally into a test of support

- Markets crave data and policy signals more than headlines

- Leverage can magnify moves in a risk off moment

Political and financial risk amid policy shifts

The article discusses inflation data, policy decisions, and political pressure related to tariffs, which can trigger investor backlash and market volatility. This could influence public reaction and policy debates.

The market will reveal whether this is a pause or a new trend in crypto volatility.

Enjoyed this? Let your friends know!

Related News

Bitcoin falls sharply amid global market decline

Crypto selloff deepens

Bitcoin Price Slump Signals Policy and Liquidity Watch

Keir Starmer to discuss steel tariffs with Donald Trump

Crypto Market Alert

Thames Water contingency plans approved

Markets Rally on CPI Beat Spurs Fed Rate Cut Bets

Bitcoin Surges Above $120K