T4K3.news

Market Slip Deepens as Walmart Weighs on Stocks

U.S. stocks fall led by Walmart after earnings miss; rate cut hopes wobble as inflation signals persist.

U.S. stocks drift lower with Walmart dragging the market as rate cut hopes waver.

Market Slump Deepens as Walmart Weighs on Stocks

U.S. stock indexes edged lower on Thursday, led by Walmart after its profit miss, sending the S&P 500 down 0.4% and leaving the index on track for a fifth straight modest decline. The Dow fell about 137 points and the Nasdaq slipped roughly 0.4%. Nvidia and other leading tech names steadied after recent swings, while bond traders pushed yields higher on renewed doubts about near term rate relief.

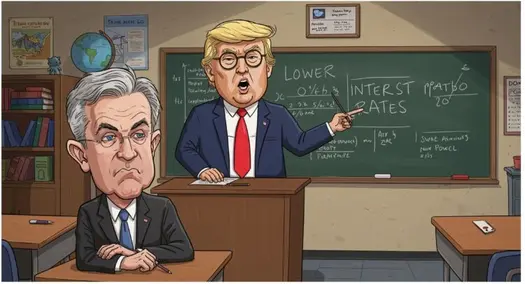

Data from S&P Global suggested a pickup in U.S. business activity, but tariffs helped push average selling prices up at the fastest pace in three years. That inflation signal complicates the outlook for monetary policy and has tempered expectations for immediate rate cuts. Traders still price in a strong chance of a pullback at the next Fed meeting, yet the path remains uncertain as investors await Powell’s remarks in Jackson Hole.

Key Takeaways

"Tariffs helped push up average selling prices at the fastest rate in three years."

S&P Global PMI data cited in the report

"No one expects a rate hike to happen soon, but the market has priced in coming cuts."

Market interpretation of Fed policy path

"Tariffs could push inflation higher."

Inflation risk linked to policy moves

"The yield on the 10 year rose to 4.33%."

Debt market reaction described in the article

Market sentiment is showing that earnings misses can quicken the pace of price moves even when the broader economy looks resilient. Walmart’s setback highlights consumer spending as a potential choke point for a market that has grown reliant on AI driven optimism for higher profits. The pricing power implied by tariffs adds a stubborn inflation thread that policy makers cannot easily ignore.

In this tug of war between growth optimism and policy risk, the Jackson Hole gathering becomes a focal point. If Powell signals caution on rate relief, markets may reassess how quickly risk assets should be priced for the remainder of the year. The episode underscores a broader theme: policy credibility matters more than ever when earnings and inflation data diverge.

Highlights

- A single earnings miss can tilt the whole market

- Investors chase rate cuts even as inflation signals persist

- Tariffs push prices higher and complicate policy

- Powell’s Jackson Hole speech could shift the policy outlook

Market sensitivity to earnings and policy signals

Walmart earnings miss and tariff related inflation signals raise policy and market risk. Tariffs and Fed moves could spark volatility and affect budgets and investment plans.

Policy signals will keep driving price moves in the weeks ahead.

Enjoyed this? Let your friends know!

Related News

Markets edge down as Walmart weighs on index

Dow Falls as Powell Speech Looms and Walmart Drops After Earnings

Markets slip on tech pullback before Jackson Hole

Markets slip as Powell readies policy remarks

Dow Jones Edges Lower as Markets Hover Near Record Highs Ahead of Powell Speech

Futures Fall as Trump Ukraine Meeting Looms

Markets move as Berkshire stake in UnitedHealth draws attention

Dow Futures Slide on Trump Fed Clash