T4K3.news

Oil and stocks slip ahead of Zelenskyy Trump talks

Markets edge lower as energy and housing data hinge on Washington diplomacy and Jackson Hole signals.

Markets drift lower as high level diplomacy looms while UK housing shows signs of cooling and energy markets stay sensitive to policy signals.

Oil and stocks slip before Zelenskyy Trump meeting in Washington

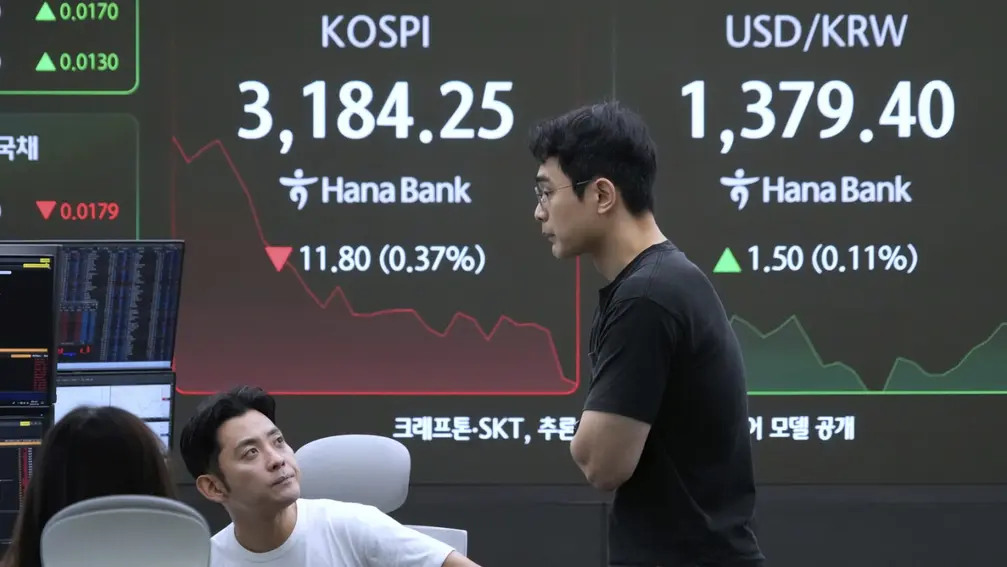

Oil and stock markets moved in a cautious vein ahead of the Washington talks involving Ukrainian president Volodymyr Zelenskiy, US president Donald Trump, and European leaders. Asian shares were firmer earlier in the session, but European indices turned negative as traders awaited concrete steps from the diplomacy front and any policy cues from major central bankers. Brent crude hovered near the mid-sixties per barrel while investors watched for clarity on energy flows and sanctions. Futures on major US indices suggested a tentative start to the week as traders weighed the risks of renewed geopolitical friction against potential policy relief from later events in the week.

In the UK, property data underscored a cooling housing market. Rightmove reported that 34% of homes were priced lower than their listing price in August, a signal of softening demand in a year when affordability remains stretched. The figures come as the Bank of England’s rate cut in August continues to filter through the market, helping to prop up buyer sentiment but not enough to reverse a two-speed market where some areas still command robust activity. Investors also kept an eye on the Jackson Hole gathering for fresh guidance on US monetary policy amid a shifting inflation picture.

Key Takeaways

"There’s a swell of optimism at the start of the week, amid hopes for an easing of geopolitical risk and a more clement global economic environment."

Susannah Streeter, head of money and markets at Hargreaves Lansdown

"Oil prices have steadied but investors are watching supply and demand cues closely."

Commodity desk note in market briefing

"The market needs real policy signals not more promises."

Market participant reaction

"Investors are pricing a soft landing but will reprice on any sign of conflict."

Portfolio manager remark

The talks in Washington sit at a crossroads of geopolitics and global finance. A breakthrough could calm energy and defense markets, while a setback would compound volatility across stocks and currencies. The UK housing data points to domestic fragility even as central banks debate easing paths, reminding readers that policy signals travel far beyond national borders. In this environment, markets are not chasing a single outcome but a spectrum of possibilities, pricing in both potential peace and the risk of renewed conflict. The week will test whether markets trust policymakers to steer through uncertainty or if they will swing further on headlines from Washington and beyond.

Highlights

- Markets want clarity not more talking points

- Geopolitics is priced into energy and risk

- Jackson Hole could set the next market direction

- Investors crave concrete policy moves not warm hopes

Political and economic tensions risk

The story blends diplomacy, energy policy, and market reactions, raising the potential for political backlash and investor volatility if expectations diverge from outcomes.

The coming days will reveal how much markets can rely on diplomacy to anchor prices and expectations.

Enjoyed this? Let your friends know!

Related News

Oil and gold rise before crucial talks in Washington

Markets mixed ahead of tariff deadline

FTSE 100 hits new high on tariff cues

Global markets surge after US-EU trade agreement

European stocks mixed ahead of Trump Zelensky talks

Markets rise as Ukraine talks loom

Ukraine unity shows in advance of Alaska talks

Trump Putin Alaska summit stirs Ukraine worries