T4K3.news

Entertainer founder transfers shares to employee trust

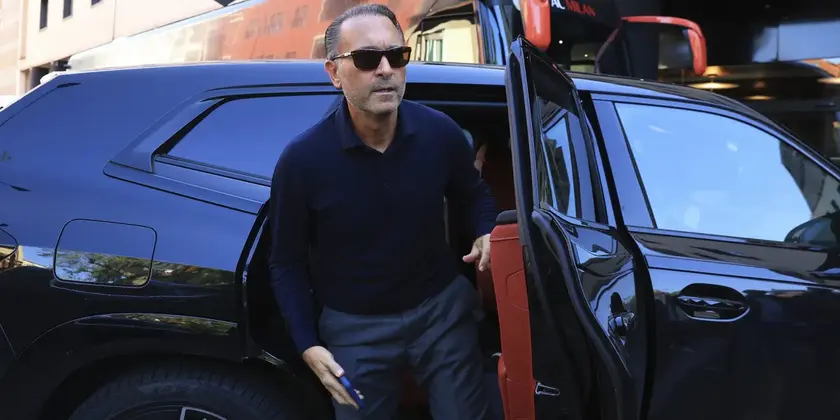

Gary Grant and his family will place Entertainer shares into an employee trust giving staff a stake in profits and governance.

Gary Grant and his family will transfer shares in Entertainer to an employee trust, giving 1,900 staff a stake and a say in profits and governance.

The Entertainer founder puts toy retailer in hands of employees

Gary Grant, 66, and his wife Catherine built The Entertainer from a single shop into the largest toy retailer in Britain with more than 160 stores and 1,900 staff. Next month they will transfer all shares to an employee trust, allowing staff to participate in profits and to have governance influence through the structure of the trust.

Grant says the move is about finishing well and leaving a business that has tried to be a force for good. He adds that selling the company only for money would not have allowed the baton to pass in the way the family hopes, and staff could benefit from John Lewis style bonuses.

Key Takeaways

"This is good for the business and it is really good for our staff."

Grant on staff benefits and purpose.

"If the business had been sold just for money that would not have been passing on the baton."

Grant on governance and succession.

"Finishing well and leaving a business that has for decades tried to be a force for good is really important to us."

Grant on legacy and values.

The plan reflects a broader shift toward worker ownership in UK commerce. If managed well, it could improve retention and alignment between staff and strategy, especially in a low margin, high competition sector. It also introduces governance complexity and questions about how profits will be shared and how outside partners or lenders would respond.

For other family businesses the Entertainer example offers a test case in succession planning and value creation beyond cashing out. It could influence investor views if the model proves scalable and transparent.

Highlights

- A new chapter written by the people who work there

- Employee ownership changes more than balance sheets

- Passing the baton to staff signals a new kind of leadership

- Trust builds a company that lasts beyond the founder

Finance and governance risk from employee ownership

Transferring control to an employee trust changes governance dynamics and profit sharing. It may affect investors and future sale options and requires strong governance to avoid conflict.

The next chapter for Entertainer will reveal how well the model travels in a tougher market.

Enjoyed this? Let your friends know!

Related News

Entertainer owner hands over toy chain

Entertainer to hand ownership to staff

Entertainer toy chain becomes employee owned

Revolut continues to seek UK banking licence amid regulatory challenges

Thinking Machines set to launch new AI product

Krafton sued for allegedly sabotaging Subnautica 2's release

Mehdi Hasan on Surrounded draws global attention

Wise seeks approval for US listing and voting changes