T4K3.news

RedBirds 2 Billion Stake Reshapes Paramount Skydance

RedBird Capital takes a 2 billion stake in the Paramount Skydance merger, signaling a new era of private equity influence in Hollywood.

RedBird Capital takes a $2 billion stake in the Paramount Skydance merger, signaling a new era of private equity influence in Hollywood.

RedBird Capital's 2 Billion Power Play in Paramount Skydance Deal

Paramount Global and Skydance Media closed an $8.4 billion merger, marking a landmark shift in Hollywood power. RedBird Capital attached a $2 billion stake to the deal, shaping governance as David Ellison and his father, Larry Ellison, take major voting rights. The arrangement follows months of strategic maneuvering that redefine who holds leverage in the industry.

Paramount is pursuing cost cuts and leadership changes, including a pledge to find another $2 billion in savings. Skydance gains influence as an owner and content partner, while RedBird’s strategy centers on monetizing existing IP, trimming costs, and driving efficiency in a streaming economy. The deal has drawn scrutiny over potential effects on creative decision making and employee morale amid layoffs.

Key Takeaways

"We're an IP monetization engine. That's what we do."

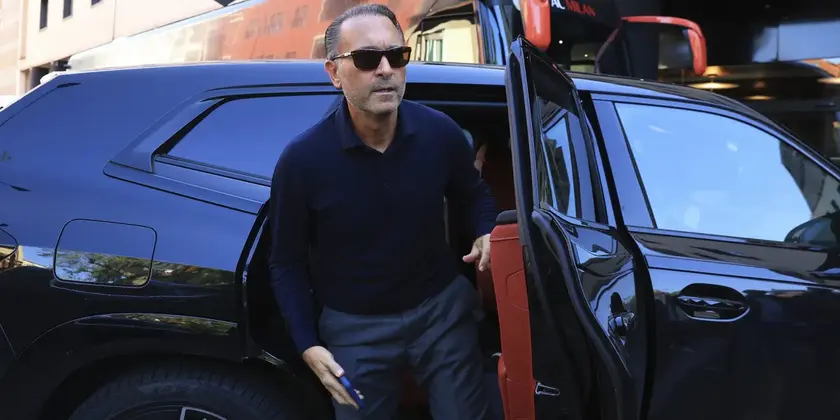

Cardinale describing RedBird's strategic focus.

"Being from outside that ecosystem, one foot in and one foot out, is a huge competitive advantage."

Cardinale on his external perspective shaping decisions.

"We should be able to make movies for half the cost."

Cardinale outlining cost discipline at Paramount.

"Great IP is beachfront property."

Bob Iger on the enduring value of IP.

This deal signals a shift in the Hollywood power map, with private equity moving from backroom finance to a central role in studio governance. Cardinale presents himself as a dispassionate operator, focused on disciplined execution and long term value, not headlines. If successful, the model could redefine how studios balance creative risk with financial engineering.

Still, the road ahead is rocky. Heavy debt, a fragile linear TV market, and ongoing layoffs raise questions about whether efficiency can coexist with artistic autonomy. The true test will be whether Paramount can sustain big bets on IP while keeping its storytelling ethos intact and preserving trust with creators and audiences.

Highlights

- IP is the new beachfront property for entertainment value

- Being outside the ecosystem is a huge competitive edge

- We are an IP monetization engine not just a fund

- Great IP is beachfront property says Iger about the value of stories

Budget and political risk in Paramount Skydance deal

The deal ties a large studio to private equity control, with substantial cost cuts and governance changes. Potential backlash from workers, creators, and regulators could affect public perception and deal stability.

The industry will watch how this blend of private capital and creative legacy unfolds in a business built on stories.

Enjoyed this? Let your friends know!

Related News

David Ellison Takes Control of Paramount

NFL and ESPN reach major agreement

New Naked Gun film launches amid Paramount restructuring

Paramount and Skydance merger now official

Paramount sets executive salaries following Skydance deal

Paramount Executives to Receive Multi-Million Dollar Payouts

FCC Approves Merger Between Paramount and Skydance

Paramount sale to Skydance closed