T4K3.news

UK vacancies fall as hiring slows

ONS data show vacancies down 5.8% to 718,000 from May to July, with payrolls edging lower and wage growth steady at 5%.

Official data show vacancies fell and payrolls contracted, signaling a gradual cooling of the UK's labor market.

UK vacancies fall as the jobs market cools

The Office for National Statistics says vacancies fell 5.8% between May and July to 718,000, with a broad pullback across sectors. Payroll numbers declined by 8,000 from June to July, while unemployment remained at 4.7% and wage growth stayed at 5%.

Analysts say some firms are delaying recruitment or not replacing leavers, and wage dynamics still influence the inflation outlook. The Living Wage rose to 12.21 pounds per hour and employer National Insurance contributions increased, raising the cost of hiring. The data show the cooling has not yet pushed unemployment higher, suggesting resilience in parts of the economy. BoE watchers will scan payrolls and wage trends for clues on rate moves this autumn.

Key Takeaways

"The slow grind of hiring is the new normal"

reflects overall pace of hiring

"Wage costs are the real friction in recruitment today"

emphasizes wage pressure as hiring barrier

"A soft climate for wages could cool inflation without hurting growth"

editorial take on inflation dynamics

"Wider policy changes ripple through every payroll"

links policy to payroll costs

The data point to a gradual tightening of conditions rather than a sharp shift. With vacancies backing off and pay growth persistent, employers face higher hiring costs even as demand eases. This mix could keep inflation in focus while offering a window for a cautious stance from the Bank of England. If wage growth cools further, the BoE might loosen policy; if not, rates could stay higher for longer.

Looking ahead, policy makers face a delicate balance. If wage growth stays sticky, inflation might resist falling, keeping interest rates higher longer. But a continued soft patch could open room for a cautious rate cut later this year, easing borrowing costs for households and firms.

Highlights

- The slow grind of hiring is the new normal

- Wage costs are the real friction in recruitment today

- A soft climate for wages could cool inflation without hurting growth

- Wider policy changes ripple through every payroll

Economic policy changes may trigger budget and political debate

The data touch on living wage and employer NIC changes, which could fuel political controversy and affect public perception and budgeting. A clear link exists between hiring costs and economic stability, inviting debate over policy direction.

Autumn data will reveal whether the cooling trend holds and how policy responds

Enjoyed this? Let your friends know!

Related News

UK jobs market cools as vacancies fall and pay growth slows

UK jobs market cools as vacancies fall

UK firms pause hiring amid rising costs

Thames Water contingency plans approved

Inflation pressures Bank of England rate cut plans

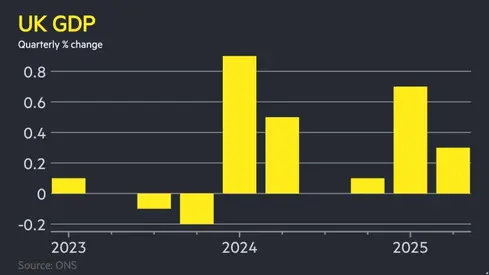

UK growth slows in Q2

FTSE 100 reaches record high of 9,000 points

Markets rise as Ukraine talks loom