T4K3.news

UK jobs market cools as vacancies fall and pay growth slows

Unemployment holds at 4.7% in the latest ONS release, with vacancies and wage growth cooling amid higher hiring costs.

ONS data shows unemployment steady but vacancies fall and pay growth slows, signaling a cooling labour market.

UK employers curb bonuses and hiring amid slower jobs market

Unemployment remained steady at 4.7% in the three months to June, while pay growth including bonuses slowed to 4.6%. The vacancy rate fell by 44,000, a drop of more than 5% from the prior quarter, marking the 37th consecutive decline and bringing vacancies to 718,000, well below pre-pandemic levels.

The ONS said the figures suggest some firms may not be recruiting or replacing staff who have left. Earlier data showed unemployment at 4.7% in the three months to May, with pay growth easing from 5.3% to 5%. Analysts note higher employer National Insurance contributions and other costs are weighing on hiring, and surveys point to fewer job postings as firms brace for a weaker outlook. A separate KPMG and REC report shows recruitment falling in July, while more graduates and workers returning to the labor pool have kept the candidate supply relatively high relative to openings.

Key Takeaways

"The UK jobs market is facing more pain in the coming months"

Attributed to Suren Thiru about the outlook for hiring and pay

"While these disheartening figures reassure rate-setters that last week's policy loosening was the right call, the pace at which the labour market is cooling is unlikely to prompt another rate cut in September"

Thiru commenting on BoE policy trajectory

"The rise in employer national insurance in April was still taking a toll on firms hiring new staff"

Quoted on the impact of NI changes on recruitment

"Young people hit hardest by the drop in recruitment"

CIPD observation on who bears the cost of the slowdown

The slowdown in vacancies and wage growth paints a picture of a cautious economy. Firms are prioritizing cost control and productivity over expansion, even as low unemployment hides underlying fatigue in the labor market. The Bank of England has already eased policy once, and the data suggest it is unlikely to cut again soon unless hiring and pay stabilize at lower levels. For policymakers, the challenge is to balance support for households with the risk of fueling inflation or delaying a broader recovery. For workers, the shift means less job security and more negotiation power for pay and benefits remains limited.

Highlights

- Hiring slows as costs rise and confidence falls

- Pay packets get a breather even as inflation lingers

- The job market cools not collapses

- Policy choices this autumn will shape the next phase

Budget and tax changes weigh on hiring and incomes

Higher labour costs from April's NI increase and looming budget decisions could slow hiring further and press unemployment up. The policy environment is politically sensitive and could provoke public reaction if job losses mount.

Policy choices this autumn will shape the next phase of Britain's jobs market.

Enjoyed this? Let your friends know!

Related News

UK vacancies fall as hiring slows

UK jobs market cools as vacancies fall

Thames Water contingency plans approved

UK firms pause hiring amid rising costs

Jobs data shows cooling economy

Markets Rally on CPI Beat Spurs Fed Rate Cut Bets

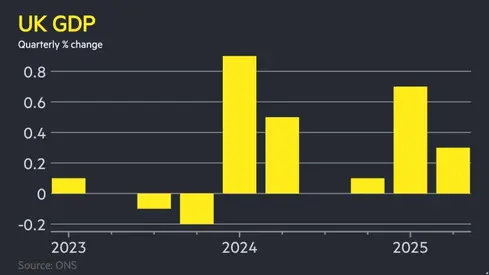

UK growth slows in Q2

Inflation pressures Bank of England rate cut plans