T4K3.news

Thames Water contingency plans approved

UK ministers appoint insolvency advisers to map out contingency steps for a possible Thames Water collapse.

UK ministers appoint insolvency advisers to plan for Thames Water potential collapse, highlighting regulatory and fiscal risks.

Thames Water Contingency Plans Put to the Test as UK Faces Possible Collapse

UK ministers have appointed FTI Consulting to advise on contingency plans should Thames Water face insolvency. A Special Administration regime would keep water taps flowing while debt and assets are reorganized, with a court approval required to trigger SAR. Officials warn the method could transfer heavy costs to taxpayers or higher customer bills depending on how the regime is structured.

Thames Water serves around 16 million customers and carries substantial debt, focusing attention on Ofwat and the broader governance of essential services. Critics from the opposition argue the episode underscores the need for a stronger regulator and a credible reform plan, while supporters say the government is acting to prevent a worse outcome for customers and the public purse.

Key Takeaways

"The final whistle needs to be blown on Thames Water and we need a new, capable regulator in place as soon as possible"

Charlie Maynard urging Special Administration and regulator reform

"Special Administration will allow debt to be written down so more money can be spent on cleaning up the sewage in our lakes and rivers"

Maynard explaining the SAR benefit

"These figures signal growing turmoil in the UK labour market"

Suren Thiru on jobs data

"Today’s figures show real progress with economic inactivity down"

Hannah Slaughter on labour market trend

The Thames Water episode exposes a persistent tension between private finance and public responsibility in essential services. Contingency planning has moved from a theoretical risk to a live policy option, raising questions about how costs are shared and who bears the ultimate burden if a crisis deepens. If SAR costs wind up in consumer bills, public trust in how utilities are funded could erode.

Beyond the immediate utility, the case could reshape debates on infrastructure financing and regulatory reform. The government’s decision to appoint advisers signals preparedness to step in, but it also invites scrutiny over accountability, transparency, and the pace of reform in a sector that touches daily life for millions of people.

Highlights

- Water services should not become a test case for taxpayer bailouts

- Contingency plans are a sign of seriousness not a blank check

- Regulators must prove they can prevent the next crisis

- Taxpayers deserve governance that prevents the next crisis

Taxpayer risk if Thames Water collapses

A government Special Administration plan could push large costs onto taxpayers and customers, raising budget pressures and political accountability concerns.

The coming weeks will test Britain's resolve to protect essential services without defaulting to public bailouts.

Enjoyed this? Let your friends know!

Related News

Thames Water rescue plan moves forward

Thames Water could face government intervention

Thames Water appoints advisers to plan for potential collapse

Abingdon reservoir cost rises

Middle class families face rising water bills

FTSE 100 share index reaches 9,000 points

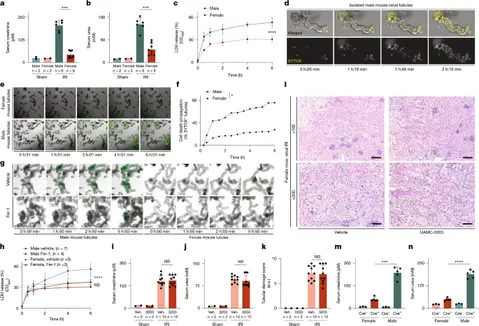

Estrogen protects kidneys from ferroptosis

Water companies sidestep Labour's bonus ban