T4K3.news

UK growth slows in Q2

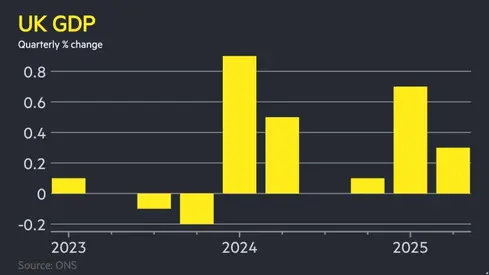

GDP growth eased to 0.3 percent in the second quarter as Reeves faces a tight budget cycle and potential tax measures.

GDP data shows a modest rise as policy choices loom ahead of the Autumn Budget

UK growth slows to 0.3 percent in the second quarter

GDP expanded 0.3 percent in the April to June quarter, beating economists forecast but marking a sharp slowdown from 0.7 percent in the first three months of the year. Growth was driven by services, construction and manufacturing, with June up 0.4 percent after declines in April and May. The trade picture worsened as the trade deficit widened to £9.2 billion, with exports to the US falling to the lowest level since early 2022.

Public sector spending rose 1.2 percent while business investment dropped 4 percent, reversing a 3.9 percent rise in the prior quarter. Household consumption edged up 0.1 percent. The data highlight a fragile economy and add pressure on the Bank of England to decide when to cut more rates. The chancellor faces calls for tax rises in the autumn budget to plug a large fiscal gap, with some estimates exceeding 20 billion pounds. Reeves says the figures are positive but there is more to do to deliver for working people. The opposition warns that higher taxes could slow hiring and dent confidence as inflation and unemployment trends remain uneven.

Key Takeaways

"Growth remains fragile and policy space is shrinking"

analyst view on macro outlook

"there is more to do to deliver an economy that works for working people"

direct quote from chancellor Reeves

"Autumn tax rises look likely to close the fiscal gap"

policy forecast

"The economy walks a thin line between resilience and stagnation"

editorial observation

The numbers point to a recovery that relies on public spending and domestic demand rather than broad private investment. With business investment down and an uncertain global backdrop, policymakers face a thin margin for maneuver. Fiscal space is shrinking as higher rates and debt service limit options, making the autumn budget a test of whether taxes or tighter public finances can be balanced against the need to sustain growth. The Bank of England will weigh the data against inflation dynamics and jobs data, keeping the path to further rate cuts uncertain. In this climate, political signals from both Labour and the opposition will affect business confidence just as the economy tries to gain momentum.

Highlights

- Growth stays fragile as policy space tightens

- Autumn budget will test public patience and business nerves

- The economy walks a fine edge between progress and stall

Budget and political risk

The GDP data shows a fragile economy while the autumn budget many require tax rises. Moves to raise taxes could trigger political backlash and affect investor sentiment, creating volatility in financial markets and consumer confidence.

Policy makers will need data on inflation and jobs as much as on growth to steer the recovery.

Enjoyed this? Let your friends know!

Related News

UK economy grows in Q2

UK economy growth in Q2

FTSE 100 share index reaches 9,000 points

UK jobs market cools as vacancies fall and pay growth slows

New mortgage rules boost UK home buying

UK economy grows modestly

Amazon stock drops 8.3% after disappointing earnings

UK vacancies fall as hiring slows