T4K3.news

TSMC stock soars after US tariff exemption

Shares rise sharply after confirmation that TSMC is exempt from a proposed 100% tariff on chip imports.

TSMC's stock skyrockets as US investment secures a tariff exemption.

TSMC Surges After Tariff Exemption Announcement

Shares of Taiwan Semiconductor Manufacturing Co. reached a record high, climbing nearly 5% to NT$1,180. This surge follows the news that TSMC will not face a proposed 100% US tariff on semiconductor imports due to its investment in the US, including substantial projects in Arizona. TSMC's commitment to invest $165 billion will significantly advance its US operations, while also supporting the domestic chip market. Investors responded positively, leading to a spike in foreign equity inflows and a rise in the Taiwan dollar. Experts suggest this exemption removes uncertainty for TSMC, which constitutes about 40% of Taiwan's benchmark stock index. In contrast, other global chipmakers must consider their positions in the wake of potential tariffs and may need to establish or expand their US bases to stay competitive. Malaysia's chip industry seeks clarity amid concerns over the tariff's impact on its operations.

Key Takeaways

"If you're building in the US, you're in the clear."

This statement underlines the strategy driving TSMC's investments in the US and hints at future relations between US and Taiwanese firms.

"Investors had been on edge awaiting clarity on the chip tariff rate."

Khoon Goh's observation reflects the anxiety in the market before TSMC's exemption was confirmed.

The exemption from Trump's proposed tariff illustrates the delicate balance between US policies and global tech industries. As TSMC enhances its American footprint, it signals to competitors the necessity of local investment. This trend may reshape global manufacturing, compelling companies to respond strategically to US economic pressures. Furthermore, as AI demand escalates, TSMC's pivotal role could strengthen its market position and influence future trade negotiations. This situation highlights how geopolitical strategies increasingly intersect with technological advancements, reshaping the landscape for investors and companies alike.

Highlights

- Investing in America has never been more crucial for global chipmakers.

- TSMC's record stock reflects the confidence of investors in a shifting landscape.

- The era of avoiding US investments is coming to an end for tech firms.

- Surviving the tariff storm requires a strong US presence.

Trade Policy Sensitivity

The exemption from tariffs is a significant development that may reshape trade policies and relationships in the semiconductor industry, creating potential backlash from other nations.

The evolving landscape of chip manufacturing signals significant changes for global technology.

Enjoyed this? Let your friends know!

Related News

Tariffs Rising

Trump announces 100% computer chip tariff unless firms invest in US

Stocks Retreat as Investors Await Key Technology Earnings

Trump announces 100% tariffs on semiconductor imports

Stocks Fall as Tariff News Shakes Market

Stock Markets Climb as Earnings Reports Approach

Chip Stocks Rally On Trump Tariff Clarity

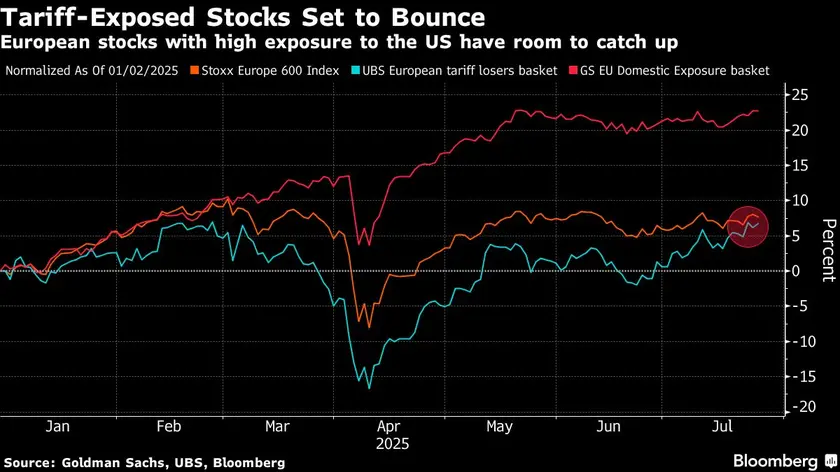

European stock market poised for rally after US trade deal