T4K3.news

Chip Stocks Rally On Trump Tariff Clarity

Chip stocks rise after Trump signals exemptions for U.S. chip manufacturing investments, while Intel faces scrutiny.

Chip stocks rise after Trump signals exemptions for U.S. chip manufacturing investments, while Intel faces scrutiny and its stock falls.

Chip Stocks Rally On Trump Tariff Clarity

Chip stocks edged higher on Thursday after President Trump outlined a framework that would exempt semiconductors from tariffs if a company invests in U.S. manufacturing or expands existing plants here, while those that do not would face a 100 percent tariff. The move spurred gains across the sector, with Taiwan Semiconductor Manufacturing Co (TSMC) up about 4.9 percent and closing around 242.62 as it advances new factories in Arizona. U.S. chipmakers such as GlobalFoundries and Texas Instruments also benefited.

Key Takeaways

"100% tariff on all chips and semiconductors coming into the United States"

Trump's tariff stance announced at the White House event

"If you've committed but don't build, we'll add up the charges"

Conditional exemptions tied to U.S. manufacturing commitments

"Intel and Mr. Tan are deeply committed to the national security of the United States and the integrity of our role in the U.S. defense ecosystem"

Official response from Intel to concerns raised in the article

"Tan is a legend in the semi industry"

Analyst comment on Tan's reputation in the sector

The policy shift signals a rare blend of protectionist leverage and industrial policy aimed at reviving domestic chip production. If carried through, it could accelerate reshoring and push suppliers of equipment and materials to rethink timelines and capacity. Yet the politics are fragile; markets may bounce while lawmakers debate details and potential side effects for global supply chains. The immediate market response shows relief for investors and a tilt toward a more U.S.-centric chip ecosystem, but clarity on enforcement and timelines remains essential.

Highlights

- 100% tariff on all chips and semiconductors coming into the United States

- If you've committed but don't build, we'll add up the charges

- Intel and Mr. Tan are deeply committed to the national security of the United States

- Tan is a legend in the semi industry

Political and financial risk from tariff policy

Tariff policy tied to domestic investments creates policy uncertainty that can swing markets and corporate strategy, risking political backlash and investor volatility.

The policy path will unfold in the weeks ahead.

Enjoyed this? Let your friends know!

Related News

TSMC stock soars after US tariff exemption

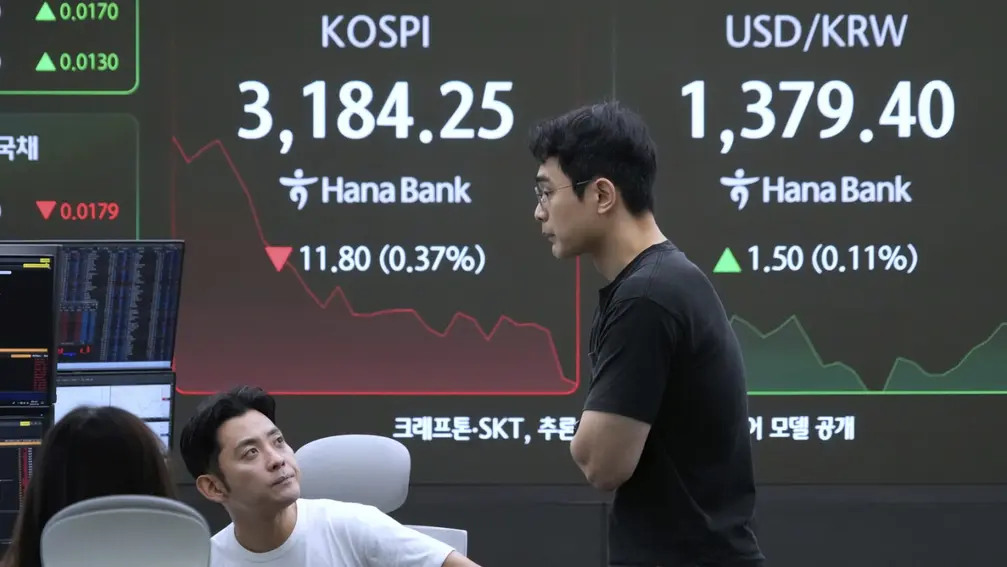

Stocks Fall as Tariff News Shakes Market

Tech Rally Pushes Markets Higher

Trump announces 100% tariffs on semiconductor imports

Stock market struggles as tariffs take effect

Markets steady after Trump tariff announcements

World markets mixed as Tokyo climbs on tariff news

Stocks Decline as Powell Shares Outlook on Interest Rates