T4K3.news

European stock market poised for rally after US trade deal

A new trade agreement is expected to boost European automakers and luxury goods when markets reopen.

Analysts believe European automakers will benefit from a new US trade deal.

European stock rally anticipated after US trade agreement

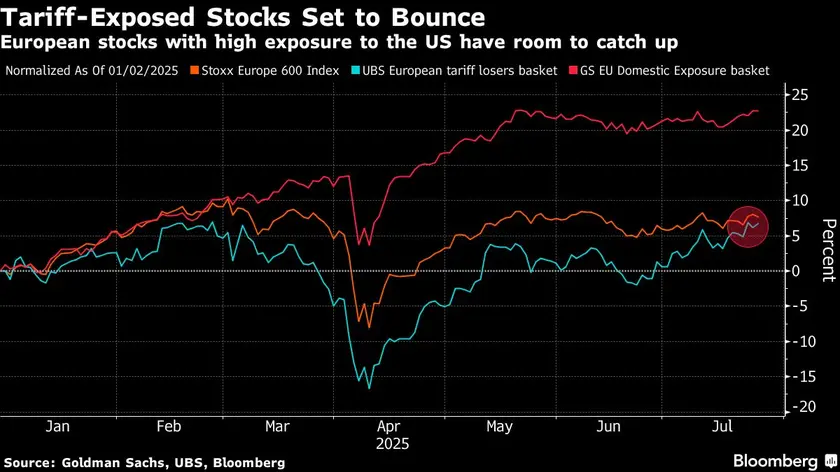

Investors are optimistic that the European stock market will experience a rally when it opens on Monday. The excitement follows a newly agreed trade deal between the United States and the European Union. This agreement, announced by President Donald Trump, details a 15% tariff on most European exports, particularly affecting the automotive and luxury goods sectors. While European Commission President Ursula von der Leyen confirmed the broad inclusion of tariffs, Trump specified that certain items such as pharmaceuticals and metals would be exempt.

Key Takeaways

"Investors expect a sharp rise in European stocks next week as optimism grows around the new trade deal."

This quote highlights the positive sentiment driving investment decisions post-announcement.

"The trade deal imposes a 15% tariff on most exports, including autos, but certain products remain exempt."

This factual statement clarifies the specific terms of the newly established trade agreement.

This trade agreement signals a major shift in transatlantic relations, promising potential benefits for specific sectors within Europe. Automakers, which have been struggling under tariffs, might find new opportunities for growth as trade becomes less restrictive. However, caution remains essential as unexpected pitfalls in implementation could disrupt these expectations. The effectiveness of this deal in actually boosting the market is yet to be seen, with investor sentiment largely riding on how companies respond. Moreover, the political implications of such tariffs could spark reactions that might complicate future negotiations.

Highlights

- European stocks could surge as trade barriers lower.

- Trump's new tariffs might reshape European markets.

- Investors are betting big on European automakers now.

- The fate of luxury goods lies in new trade terms.

Potential backlash due to trade terms

The imposition of tariffs may lead to political backlash both inside the EU and from trading partners. The public reaction could complicate future negotiations and lead to economic frustration in sectors not favored by the agreement.

Market reactions will reveal the true impact of this trade deal on European industries.

Enjoyed this? Let your friends know!

Related News

Positive market trends as US-EU trade deal forms

US strikes a trade deal with Japan

Markets rise after Trump tariff agreement with Japan

Supreme Court overturns convictions of two City traders

Stock markets gain after Trump's trade threat reversal

Financial sector reacts to EU-US tariff agreement

Global markets surge after US-EU trade agreement

Markets rise as Ukraine talks loom