T4K3.news

Tariffs Rising

New tariffs increase import taxes to the highest level since the 1930s, with carveouts softening some impacts.

Markets absorb a fresh tariff round as analysts weigh short-term resilience against longer-term costs.

Trump Tests Wall Street Tariff Bluff

New tariffs lift the average US import tax to the highest level since the 1930s, as President Trump presses ahead with a policy he has mixed in the past. Carveouts and delayed dates help soften the blow for some industries, but the move signals a clear push to reshape trade rules even as markets stay stable for now.

Stocks closed higher for the week, with tech gains helping offset tariff concerns. Analysts say the real effects could take weeks or months to appear, making this a test of how much markets can tolerate in the near term while policy evolves.

Key Takeaways

"He always tries again"

Harris on the persistence of tariff policy

"The tariff wall being built by the administration also has many holes"

Kurt Reiman on exemptions and delays

"Markets are focused elsewhere"

Observation about AI-driven market momentum

"Markets are priced for nothing to go wrong, and yet we still have an important inflection point ahead of us"

Arun Sai on investor optimism and risk

Politically, the plan rests on a gamble: impose penalties to compel changes, then shield some products from the full impact to limit pushback. That strategy seems to be working so far, but the risk remains that costs spill into consumer prices and investment plans. The market’s calm also reflects a broader tech-driven confidence that AI leaders will keep powering earnings, softening the tariff shock.

For investors, the key question is about timing and scale. If inflation heats up or if supply chains slow, the same tariffs that were shrugged off could become a drag on growth. The absence of a broad retaliatory cycle is helpful, but it is not a guarantee of durable stability. The coming inflation readings and labor data will tell us whether the market’s faith in policy persistence is justified.

Highlights

- Trump always tries again when markets push back

- The tariff wall has holes because of carveouts

- Markets are focused elsewhere as AI drives gains

- Markets are priced for nothing to go wrong, for now

Tariffs risk political backlash

The latest tariff round blends policy aims with market risk. Carveouts soften impact but long-run effects on inflation, investment, and global relations remain uncertain.

Tariffs are a live policy experiment that will keep testing the balance between market tolerance and economic reality.

Enjoyed this? Let your friends know!

Related News

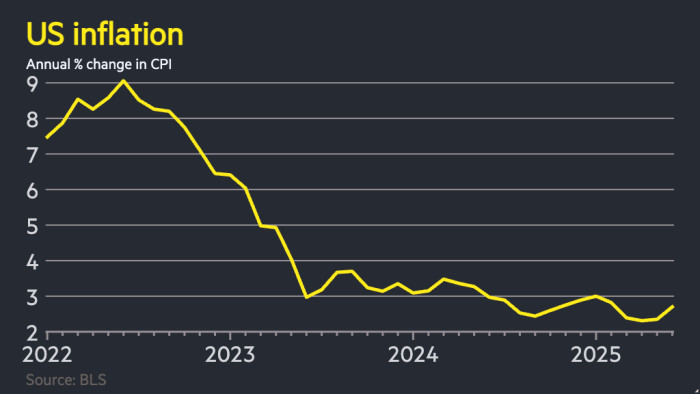

Inflation rises in the US as tariffs increase

New Trump Tariffs Set To Increase Prices

US inflation rises to 2.7 percent amid tariffs

Trump tariffs on Brazil threaten orange juice prices

Chief economist points to tariff-driven inflation peak

U.S. inflation rises as tariffs influence prices

PlayStation 5 prices to rise in the UK and Europe

Tariffs may lift prices for US households