T4K3.news

Tariff era reshapes chip deals and AI plans

Nvidia and AMD reportedly pledge 15% of China revenue for export licenses; OpenAI releases GPT-5 with noted limits; AOL ends dial-up service this year.

An analysis of tariff era deals involving Nvidia and AMD, OpenAI's GPT-5 reveal, and AOL's dial-up retirement.

Tariff era reshapes chip deals and AI plans

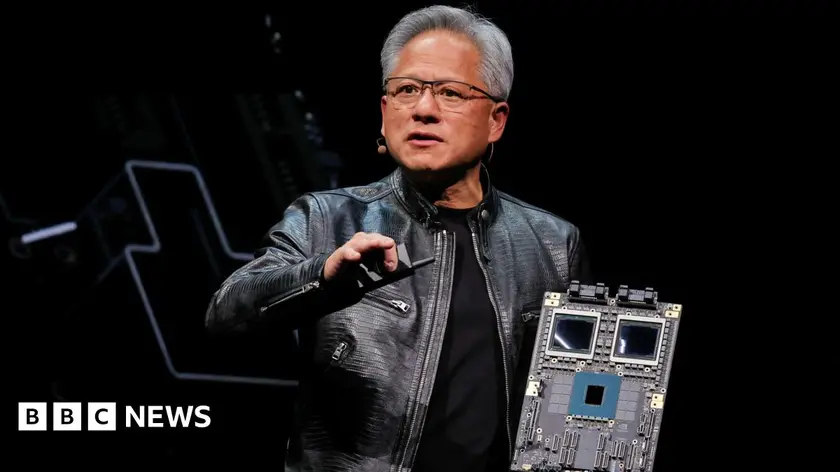

Two U.S. chipmakers, Nvidia and AMD, are reported to have agreed to pay 15 percent of revenue from sales in China to the U.S. government in exchange for export licenses to the key market. The move comes as restrictions on Nvidia’s advanced chips and alternatives like the H20 and MI308 are being renegotiated amid a broader push and pull over access to China. Nvidia’s Jensen Huang has been pushing for market access in China, while the Trump administration has adjusted some policies in July, including potential tariff considerations. Separately, Apple has signaled a stay-at-home manufacturing push with a $100 billion commitment, a reminder that policy choices can be rewarded with domestic investment. In another flashpoint, Trump floated a 100 percent tariff on semiconductor chips during a meeting with Tim Cook, though he also suggested there would be no charge for chips built in the United States. OpenAI introduced GPT-5, touting improved coding and writing abilities while acknowledging that some capabilities are still missing, highlighting the fast pace and limits of the AI race. The company’s claims sit alongside coverage that the new model will demand more power and resources, underscoring environmental and infrastructure considerations. Finally, AOL will discontinue dial-up service later this year, ending a 30‑year era and leaving a visible trace of the internet’s early days as broadband and mobile networks dominate.

Key Takeaways

"This is a significant step forward toward AGI"

OpenAI CEO Sam Altman described GPT-5 as a major advance toward AGI

"There are still many things missing"

Altman on GPT-5 limitations

"If you’re building in the United States of America, there’s no charge"

Trump on tariff exemptions for domestic manufacturing

The article frames a moment when policy and market power collide in tech. Revenue-sharing as a condition for export licenses signals a shift from pure market competition to policy-influenced bargaining. That creates potential political backlash and investor uncertainty as firms navigate a shifting balance of risk and reward. It also raises questions about the durability of licensing deals that depend on ongoing government authorization rather than market demand.

Beyond policy moves, the GPT-5 launch illustrates the high-stakes race for artificial general intelligence, with executives framing progress as a significant step even as they admit gaps. That tension matters for investors and workers who monitor energy use, hardware demand, and the long arc of AI capability. The AOL shutdown adds a reflective counterpoint, reminding readers that tech progress often comes with abrupt retirement of once-dominant technologies. Taken together, these threads map a tech landscape where innovation, policy, and infrastructure are increasingly tied in ways that shape everyday life and regional influence.

Highlights

- Tariffs turn the tech map into a bargaining table

- GPT-5 dazzles yet hides a big energy bill

- A dial-up memory fades as fast as it arrived

- Policy meetings are driving the hardware business now

Tariff politics heighten political and market risk

The article links government revenue sharing and export licenses to corporate deals, raising concerns about political backlash, regulatory uncertainty, and investor sentiment amid a volatile tariff environment.

The coming weeks will show how markets and policymakers respond to this blend of ambition and pressure.

Enjoyed this? Let your friends know!

Related News

Tariffs and Trump merch push tighten grip on tech market

Tariffs and Chips Plan Threaten Auto Makers

Nvidia and AMD to pay 15 percent of China revenue to US

Stock Markets Climb as Earnings Reports Approach

Stocks Fall as Tariff News Shakes Market

Export Deal Faces Constitutional Questions

Billion-dollar Nvidia AI chips smuggled to China

Fed rate cut pressure grows after Bessent remarks