T4K3.news

Tariffs and Trump merch push tighten grip on tech market

New tariffs and Schedule A lawsuits could reshape Nvidia and AMD China sales and the Trump merch ecosystem.

An editorial take on how new tariffs, China sales for Nvidia and AMD, and a Schedule A lawsuit push reshape tech and Trump era commerce.

Tariffs and Schedule A lawsuits test Trump era tech and merch markets

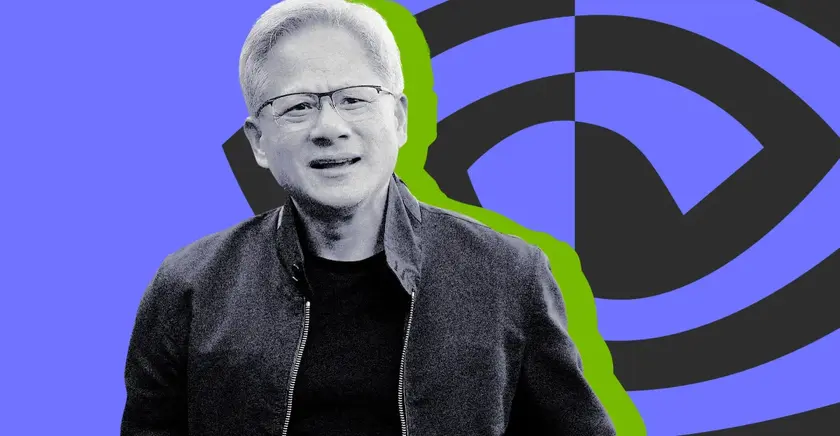

Nvidia and AMD reportedly struck a deal with the Trump administration to pay roughly 15 percent of their China revenue to the U.S. government, a move seen as a costly patch for the tech supply chain. The deal, described in The New York Times, could help keep these chipmakers afloat as tariffs loom. Earlier tariff announcements had people wondering which microchips would be taxed and how broadly electronics with chips would be covered. Apple was singled out for relief because of its large pledge to move manufacturing to the United States. The policy remains chaotic and confusing, with white house staff arguing over exemptions and classifications.

A separate headline in the piece focuses on the Trump Organization and a Schedule A lawsuit against bootleg Trump merchandise makers. Mia Sato explains that Schedule A lets rights holders sue many storefronts at once, often using usernames instead of legal names, and can freeze assets before a case even starts. This tactic highlights a broader push to control the Trump merchandise ecosystem, which includes hats and other items sold outside official channels. The case illustrates how the Trump brand extends into a vibrant, sometimes murky DIY commerce world, and how enforcement tools can affect small sellers who lack legal representation.

Key Takeaways

"you can just say SmileyGirl123 or whatever someone’s eBay username is"

Explains how Schedule A identifies defendants

"the bigger the target, the more litigious the group gets"

Author commentary on enforcement dynamics

"Schedule A is like one weird trick to get things taken offline"

Describes Schedule A technique

"the DIY Trump merch is central to the Trump ecosystem"

Links merchandise culture to the Trump brand

What stands out is the tension between safeguarding national tech leadership and policing intellectual property in a sprawling market. The tariffs show a willingness to leverage manufacturing shifts for leverage abroad, yet the same policy leaves questions about how effectively the United States can compete in AI while granting access to China. The Schedule A move signals a different kind of leverage: it concentrates enforcement power and can punish many players at once, often without due process. This dual approach risks chilling innovation, hurting small sellers, and shaping a political economy where brands are policed as much as products are sold. In short, a tough stance on one front can undercut strategic advantages on another, with taxpayers, workers, and entrepreneurs catching the fallout.

Highlights

- you can just say SmileyGirl123 or whatever someone’s ebay username is

- the bigger the target the more litigious the group gets

- schedule A is like one weird trick to get things taken offline

- the doi diy Trump merch is central to the Trump ecosystem

Political and economic sensitivity risk

The article engages with high impact topics including tariffs, China market access, and aggressive IP enforcement. These intersect with political debates, corporate strategy, and potential investor backlash. The content could provoke public reaction and policy scrutiny.

Policy moves shape markets as much as markets shape policy, a reminder that regulation travels fast when it steps into the pocketbooks of everyday entrepreneurs.

Enjoyed this? Let your friends know!

Related News

Tariffs and Chips Plan Threaten Auto Makers

Markets mixed ahead of tariff deadline

Tariffs Rising

Tariff era reshapes chip deals and AI plans

Stock Markets Climb as Earnings Reports Approach

India Stops Buying Russian Oil Amid US Tariff Threats

S&P 500 and Nasdaq hit record highs

Trump tightens grip on corporate America