T4K3.news

Samsung gains US market share as foldables gain momentum

Samsung expands its lead in US shipments as foldable devices grow in popularity.

A shift in shipments shows Samsung gaining traction in the United States as foldable devices and pricing strategies reshape the competition with Apple.

Samsung widens US market share as foldables gain momentum

In the second quarter, Canalys data show Samsung's US market share rising from 23% to 31% while Apple's fell to 49% from 56%. Samsung rolled out folding devices the Z Fold 7 and Z Flip 7, along with the Galaxy S25 Edge, and social media chatter around durability tests boosted visibility. Analysts say tariffs disrupted shipments as companies adjusted pricing and sourcing to blunt the impact.

Samsung's price breadth now spans a wide range, giving it more price points than Apple and helping it reach buyers at different levels of spending. Analysts see potential for Apple to join the foldable race, with JPMorgan Chase analyst Samik Chatterjee noting a folding iPhone could arrive to compete with Samsung's Z Fold, and Loop Capital's John Donovan suggesting a new form factor could refresh demand in the near term. The trend is reinforced by AI driven interfaces and broader social media visibility that can convert a durable device into a must have.

Key Takeaways

"There really are no longer trade-offs towards owning a foldable device."

Samsung executive comments on durability as a selling point

"There is an idea that you can target people at every single price point, and you can meet them at every spot."

Runar Bjorhovde on pricing strategy

"Apple may release a folding iPhone next year to compete with Samsung’s Z Fold."

Samik Chatterjee on Apple's foldable plans

"Apple is clearly betting that its 5.5mm Air model is going to lift its fortunes."

John Donovan on product strategy

The data marks a turning point in a market long led by the iPhone. Samsung’s foldables are moving from novelty to mainstream option and are expanding the price ladder for the category. This shift puts pressure on Apple to move beyond its traditional rigid form factor without eroding its premium image. The other layer is policy and economics; tariffs are bending how devices are priced and shipped, a factor that investors are watching closely.

Looking ahead, Apple faces a choice between sticking to a proven premium formula and embracing new form factors. If it hesitates, rivals may capture attention with broader price points and more versatile designs. The real test will be whether Apple can translate loyalty into willingness to switch when foldables become ubiquitous.

Highlights

- Foldables are no longer a novelty they are a strategy

- Prices meet customers at every pocket

- The screen is the battleground for the next wave of smartphones

- Apple may roll out a folding iPhone to keep pace with Samsung

Market risks from tariffs and investor sensitivity

Shifts in US market share tied to tariff policies and pricing strategies can influence investor confidence and profits for both Samsung and Apple.

The screen remains the focal point of the mobile battleground and likely to steer the next round of decisions.

Enjoyed this? Let your friends know!

Related News

US-EU trade deal limits tariffs to 15%

One UI 8 Beta 4 Update

Pixel leaks reveal Pixel 10 and Watch 4 details

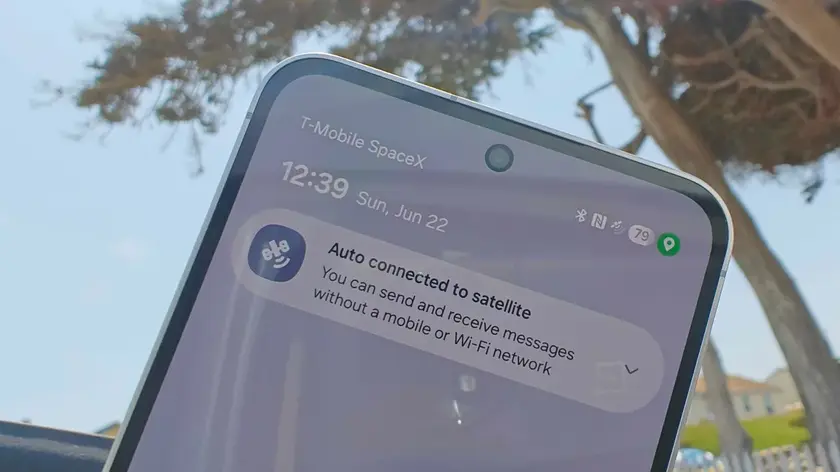

T-Mobile Launches T-Satellite Service Today

US strikes a trade deal with Japan

Thames Water contingency plans approved

Google Pixel ranks fourth in US smartphone sales

Gen Z seeks private market access