T4K3.news

Gen Z seeks private market access

Gen Z eyes OpenAI and SpaceX style opportunities as IPOs lag and private funding thrives.

Gen Z investors chase private tech powerhouses as IPOs slow and access to private equity remains gated.

Gen Z Investors Miss a Generation-Defining Moment

OpenAI and SpaceX have remained private while venture capital funds keep swelling, with global startup funding projected to hit about $400 billion this year. In the last decade private rounds have tripled, and public listings have become rarer as companies delay IPOs for years. Jay Ritter notes that the average time to go public has grown, and when IPOs do occur, prices can be high and liquidity limited. Fewer public names and higher price tags make it harder for retail investors to participate in big tech gains. When a hot IPO happens, it often rewards institutions more than individual investors, as seen with the initial surge in Figma before a pullback. Meanwhile private rounds continue to power OpenAI and SpaceX, attracting billions from VC and big tech backers.

Key Takeaways

"The people who have access to the highest quality companies that are creating the most amount of value are the people in VC who are already rich"

Elson on access bias in private markets

"If you're already rich, you can invest in this stuff, and if you're not, sucks to suck. You're locked out of the club"

Vivian Tu on access barriers for Gen Z

"There's more margin of safety with a company that has $100 million or more in revenue"

Kennedy on risk levels in private markets

"History tells us the odds are you cannot"

Ritholtz on the odds against private market bets

The piece shows a clear tension between opportunity and access. Gen Z wants to copy the early moves of past tech mega favorites, but private rounds are locked behind accredited investor rules and expensive fees. That mix of promise and gatekeeping risks widening wealth gaps while fueling the sense that true wealth comes from insiders. Policy debates and market changes will shape whether retail investors gain a real foothold in the private market landscape.

In a broader sense, the story hints at a shift in what investing means. It is not just about owning shares in public companies anymore; it is about participating in new asset classes and later-stage private rounds. That shift demands stronger disclosure, better education, and smart safeguards to protect less-sophisticated investors while preserving the incentives that fuel innovation.

Highlights

- If you're not already rich, you're locked out of the club

- Private markets are where the bulk of the interesting appreciation is nowadays

- There's more margin of safety with a company that has 100 million in revenue

- History tells us the odds are you cannot

Access to private markets raises concerns about fairness and investor protection

The push to broaden access to private equity faces barriers from accreditation rules, high costs, and opaque valuations. Regulators may weigh changes as retail interest grows, risking political and regulatory tensions.

The market will continue to evolve as policy and capital align.

Enjoyed this? Let your friends know!

Related News

Kampaoh blends nature and design with comfort in a new kind of camping

Swiss watch tariffs may alter buying habits

TSG Consumer Partners Acquires Indie Fragrance Brand Phlur

Wash sale risk rises with meme stock comeback

Spice up your love life with 26 ideas

Musk Sues OpenAI Apple in Antitrust Clash Over AI and App Store Power

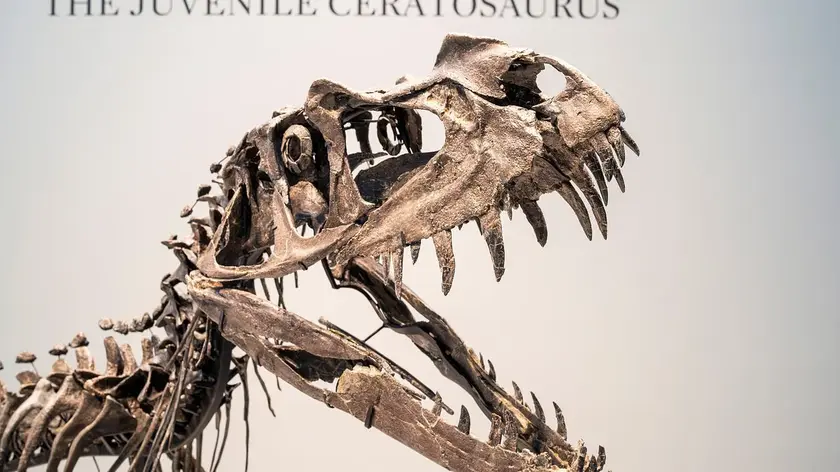

Dinosaur fossil auctions raise alarm

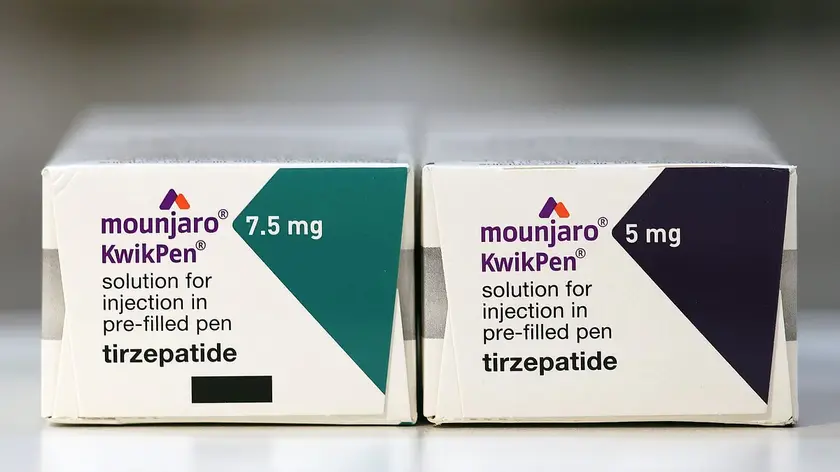

Mounjaro safety warning amid price rise