T4K3.news

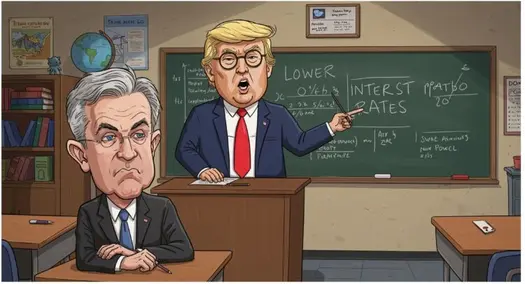

Powell speech sets tone for rate path

Markets edge higher as Powell prepares to speak at Jackson Hole, with a cautious stance on rate moves and inflation.

Investors weigh Powell’s Jackson Hole remarks as Treasury yields edge higher.

Powell speech tests market nerves

U.S. Treasury yields rose slightly on Friday as traders look ahead to Federal Reserve Chair Jerome Powell’s remarks at the Jackson Hole symposium. The 10-year yield climbed to 4.308% and the 2-year yield rose to 3.758% as markets priced in roughly an 80% chance of a rate cut at the Fed’s September meeting, according to CME Group's FedWatch tool. Investors also await data on existing home sales and weekly initial jobless claims.

Key Takeaways

"The Fed is worried about inflation accelerating as companies pass tariffs on to consumers."

David Russell on inflation and tariffs

"The minutes are consistent with Powell's hawkish comments last meeting. The bulls might get some cold water splashed in their faces at Jackson Hole."

Market interpretation of the FOMC minutes

The Jackson Hole gathering has become a testing ground for central bank signals as much as for policy. Powell's speech could steer near-term expectations, but the market still faces a tug of war between higher-for-longer inflation risks and the prospect of a cut later this year. The Fed’s minutes show inflation and the labor market remain central watch points, underscoring data dependence over any swift shift in policy.

Tariffs and lingering price pressures add complexity to the outlook. If inflationary pressures persist, the Fed may hesitate to move quickly, even as market pricing tilts toward a September move. The event also highlights how policy discussion can influence market mood beyond the letter of the minutes, inviting volatility if guidance signals change.

Highlights

- Powell's next remarks will set the tempo for rate moves

- Inflation sticks even as tariffs bite

- Markets crave clarity not hedged guidance

- Jackson Hole becomes a stage for policy signals

Market policy risk ahead of Powell speech

Powell's Jackson Hole remarks could move markets as investors weigh inflation, tariffs, and the Fed's future path. Internal dissent at the Fed and data-dependent guidance raise volatility risk.

Policy signals at Jackson Hole will guide sentiment in the weeks ahead.

Enjoyed this? Let your friends know!

Related News

Powell Speech Sets Market Tone

Powell Under Pressure Shapes Fed Jackson Hole Moment

Powell faces crucial test at Jackson Hole

Dow Falls as Powell Speech Looms and Walmart Drops After Earnings

Powell Signals Possible September Rate Move

Dow Futures Slide on Trump Fed Clash

Dow Jones Edges Lower as Markets Hover Near Record Highs Ahead of Powell Speech

Market Slip Deepens as Walmart Weighs on Stocks