T4K3.news

Fabergé sold to tech investor in 50 million deal

Gemfields sells Fabergé to SMG Capital amid market headwinds and Mozambican mining challenges.

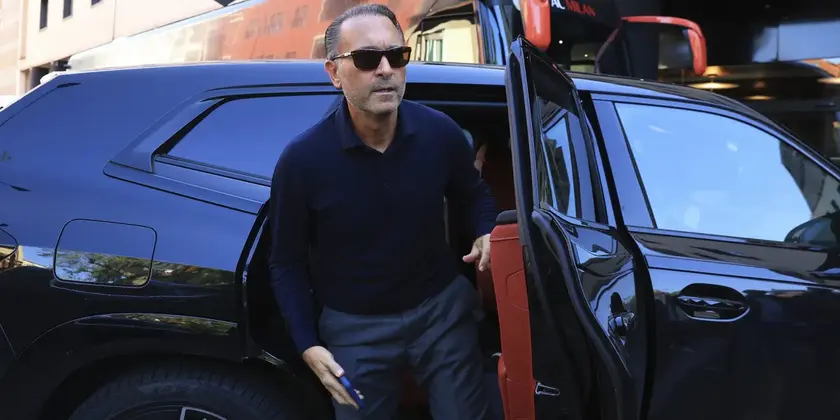

Gemfields sells Fabergé to SMG Capital led by Sergei Mosunov, a move that shifts a historic luxury house into new ownership amid market headwinds.

Fabergé sold to tech investor in 50 million deal

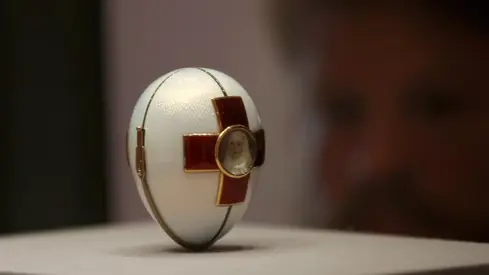

Fabergé, the luxury jeweller famed for its Imperial Easter eggs, has been sold for 50 million to SMG Capital, a US investment firm controlled by Sergei Mosunov. Gemfields, the miner that owns the Fabergé brand, announced the deal after a strategic review prompted by political unrest in Mozambique that forced a temporary halt to operations at its ruby mine. The sale price highlights the value of the Fabergé name even as the business has faced softer demand for luxury goods and a downturn in the colored gemstone market. Fabergé last reported revenues of 13.4 million in 2024, down from 15.7 million the year before.

Gemfields said it would use the proceeds to fund its mining operations in Mozambique and Zambia. Mosunov described the purchase as a chance to extend Fabergé’s reach on a global stage. Founded in 1842, Fabergé has endured revolutions and restructurings and remains a symbol of craftsmanship and prestige in the luxury market. The deal signals a broader shift in how heritage brands are managed, with investment groups taking a lead role in steering growth and distribution alongside traditional design and marketing expertise.

Key Takeaways

"Fabergé has played a key role in raising the profile of the coloured gemstones mined by Gemfields and we will certainly miss its marketing leverage and star power."

Gemfields CEO Sean Gilbertson on the deal

"great honour to become the custodian of such an outstanding and globally recognised brand"

Sergei Mosunov on acquiring Fabergé

"Fabergé is one of the most renowned jewellers in the world."

Brand recognition mentioned in coverage

"There are 50 Imperial Easter eggs in collections around the world."

Historical fact about Fabergé eggs

The sale illustrates a broader trend of historic brands moving into the hands of investment groups seeking scale and portfolio diversification. A technology investor taking control hints at a future where global distribution and digital reach are as important as craft. However, the arrangement also raises questions about governance, brand identity, and the sustainability of high value items under new ownership.

Beyond branding, the deal sits against two risk factors: political and regulatory risk in the regions tied to Gemfields’ mining and the sensitivity around ownership linked to Russia. Stakeholders will watch how Fabergé’s product strategy, marketing, and luxury positioning evolve under SMG Capital while external scrutiny over sanctions, supply chains, and public reaction to the ownership mix remains high.

Highlights

- Fabergé finds a new custodian on the global stage

- Heritage meets venture capital in the luxury arc

- A historic brand seeks growth beyond eggs

- The stake in Fabergé now rides on risk and revival

Potential risks linked to ownership and regional operations

The sale ties a historic brand to a tech investor with ties to Russia, raising questions about brand stewardship, regulatory risk, and potential public reaction. Mozambique’s political and regulatory environment adds further risk to ongoing mining operations.

History will test how far a brand can travel with new owners.

Enjoyed this? Let your friends know!

Related News

Fabergé sold to tech investor

Elon Musk awarded shares worth $29 billion

New Princes targets autumn London IPO

RedBirds 2 Billion Stake Reshapes Paramount Skydance

Lovable becomes fastest-growing software startup

Markets rise as Ukraine talks loom

Elon Musk's xAI signs significant Pentagon contract

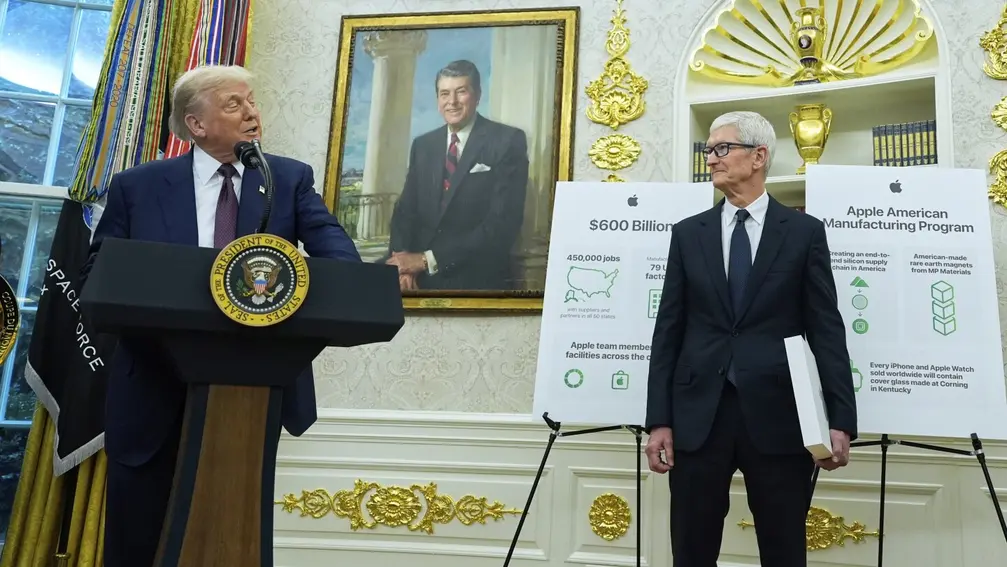

Apple announces $100 billion investment in U.S. manufacturing