T4K3.news

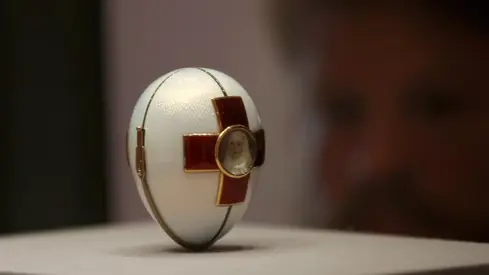

Fabergé sold to tech investor

Tech entrepreneur Sergei Mosunov buys Fabergé from Gemfields for 50 million dollars; closing expected later this month.

Tech entrepreneur Sergei Mosunov buys Fabergé from Gemfields, reshaping ownership of the historic brand.

Fabergé sold to tech investor for 50 million

Tech entrepreneur Sergei Mosunov has agreed to buy Fabergé from Gemfields for 50 million dollars. The deal includes 45 million paid on closing and five million in quarterly royalties, with Gemfields set to receive the full amount as the transaction closes later this month. Fabergé, known for its jeweled eggs and high-end timepieces, will continue to operate under Mosunov's SMG Capital, with a focus on jewellery, accessories and watches.

Mosunov, a partner at The Garage Syndicate, said he is honoured to become the custodian of a globally recognised brand. Gemfields chief executive Sean Gilbertson called the sale the end of an era for the miner and noted Fabergé helped raise the profile of their coloured gemstones. Gemfields reported a loss of 100.8 million dollars in 2024, with revenue of 213 million dollars, while a strategic review flagged challenges. Analysts described the sale as freeing up capital for Gemfields.

Key Takeaways

"a great honour for me to become the custodian of such an outstanding and globally recognised brand"

Mosunov on acquiring Fabergé

"today’s sale marks the end of an era"

Sean Gilbertson, Gemfields CEO, on sale

"Fabergé has played a key role in raising the profile of Gemfields’ coloured gemstones"

Gilbertson on brand leverage

The deal shows how private capital is moving into heritage brands. A tech backed investor may bring new growth tools, but it risks steering Fabergé away from its craft roots if short term returns drive decisions.

Gemfields uses the sale to free up capital amid a weak year, but the loss making year underscores the fragility of mining led diversification. The sale also raises questions about the long term value of such branding in a market where consumers value authenticity.

Highlights

- a great honour for me to become the custodian of such an outstanding and globally recognised brand

- today’s sale marks the end of an era

- fabergé has raised the profile of gemfields’ gemstones

- a new chapter begins under smg capital

Investment sale could attract investor scrutiny

The sale ties a luxury heritage brand to a tech investor at a time when the parent miner faces losses. The arrangement could draw scrutiny from investors and markets about long term value, alignment of branding with profitability, and potential backlash from stakeholders.

The brand now faces a challenge to balance heritage with growth under new ownership.

Enjoyed this? Let your friends know!

Related News

Fabergé sold to tech investor in 50 million deal

Markets rise as Ukraine talks loom

Peter Thiel's Facebook Shares Could Be Worth Billions

Stocks Retreat as Investors Await Key Technology Earnings

Figma Raises $1.2 Billion in Successful IPO

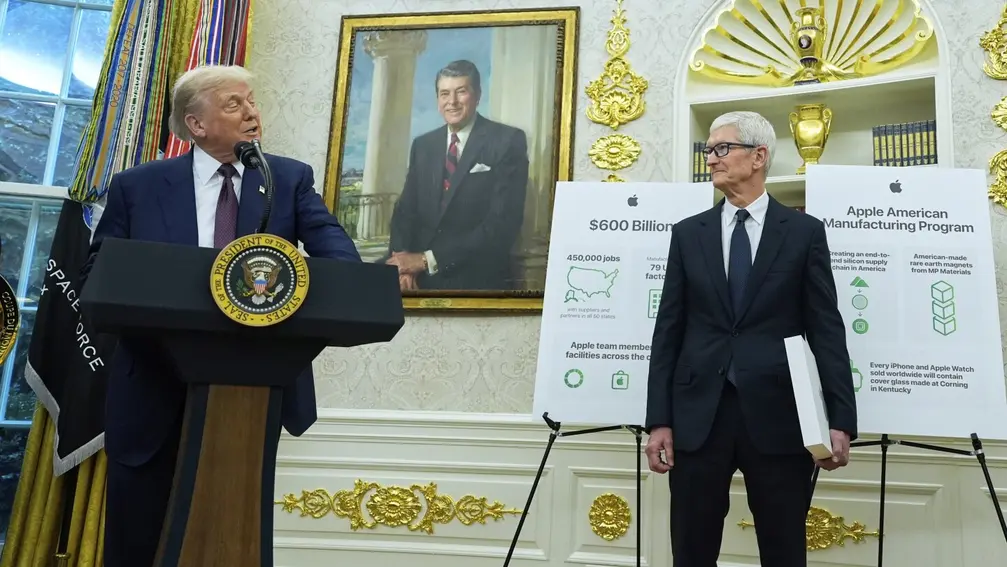

Apple announces $100 billion investment in U.S. manufacturing

YieldMax Announces New Distributions on Major ETFs

Elon Musk's xAI signs significant Pentagon contract