T4K3.news

Debt rises in Labour's first year

ONS data show the national debt at £2.71 trillion, up £186.2 billion in a year under Labour.

A new official analysis shows the national debt rose by £186.2 billion in Labour's first year in power.

Britain's debt climbs under Labour to £2.71 trillion

Britain’s national debt jumped by £186.2 billion between July 2024 and last month, lifting the total to £2.71 trillion. The Office for National Statistics shows debt per household rising by about £6,510 and debt per taxpayer by about £5,880 over the year. In the first four months of this financial year borrowing stood at £60 billion, higher than the same period last year, while July borrowing was £1.1 billion, the lowest for July in three years.

Public debt as a share of GDP reached 96.1% at the end of last month, a level last seen in the early 1960s. The data underscore ongoing pressures even as tax receipts helped July’s numbers come in better than some forecasts. A recent think tank forecast warned of a £51 billion annual deficit hole by 2029/30 if current plans hold, adding to the fiscal challenge ahead of the autumn Budget.

Key Takeaways

"The fundamental truth is that Britain has a borrowing problem because politicians have a chronic spending addiction."

TaxPayers' Alliance spokesman Darwin Friend on fiscal behavior

"Borrowing this July was the lowest July figure for three years."

ONS deputy director Rob Doody on monthly borrowing

"The public finances are in chronically weak condition."

Pantheon Macroeconomics senior UK economist Elliott Jordan-Doak on the broader trend

"The Chancellor will have to raise taxes in October despite borrowing matching official forecasts."

Pantheon Macroeconomics view of fiscal strategy

Analysts say the figures test Labour’s fiscal strategy and the chancellor’s rule of avoiding tax-rate changes while stabilising debt. The July dip in borrowing offers a temporary relief sign, yet the four‑month picture suggests the path to balance remains fragile. Observers expect potential tax adjustments or spending restraints to close the forecast gap, a prospect that tests political credibility as competing priorities press on households and public services.

The data keep pressure on policymakers to spell out how they will fund promised improvements in schools and hospitals while keeping debt on a sustainable path. The autumn Budget will be watched for concrete steps that could affect living costs, public services, and the political narrative around fiscal responsibility.

Highlights

- Britain has a borrowing problem because politicians have a chronic spending addiction

- The public finances are in chronically weak condition

- We think the Chancellor will need to resort to sin and stealth tax hikes

- Borrowing this July was the lowest July figure for three years

Budgetary and political risk

The debt rise and potential tax reforms create political sensitivity and public reaction concerns.

The financial story will hinge on whether promises translate into affordable, durable policy.

Enjoyed this? Let your friends know!

Related News

Union pay demands raise fiscal risk

UK borrowing exceeds £20bn in June

Budget risks debated as Reeves plan moves forward

Thames Water contingency plans approved

Starmer downplays tax hike warnings

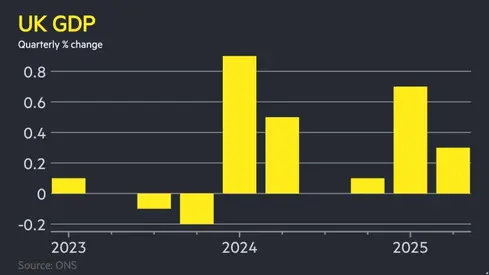

UK growth slows in Q2

Treasury weighs IHT tweak up ahead of budget

Trafficking rings target young victims in Britain