T4K3.news

Citigroup weighs crypto custody options

Citigroup is assessing custody infrastructure for stablecoins and crypto ETFs as regulators tighten controls and stablecoins see inflows.

Citigroup weighs a custody push for stablecoins and crypto-linked ETFs as regulators tighten scrutiny, and stablecoins record strong weekly inflows.

Citigroup explores stablecoin custody and crypto asset services

Citigroup is examining the infrastructure needed to offer custody and payments for stablecoins and crypto-linked exchange-traded products. Biswarup Chatterjee, Global Head of Partnerships and Innovation within Citi’s services division, says the focus is safeguarding the reserves backing stablecoins. The move fits with policy shifts in the United States that promote stablecoins for payments and settlements when backed by safe assets such as Treasuries or cash, potentially enabling Citi to serve as a custodian for these reserves and even explore issuing its own stablecoin. The article notes that regulatory conditions have shown signs of improvement under the Trump administration, which could ease traditional banks’ entry into the space. Separately, stablecoins themselves saw a notable inflow this week, highlighting ongoing institutional interest in the asset class alongside growing regulatory attention.

Key Takeaways

"Providing custody services for the high-quality assets backing stablecoins is our first area of focus."

Citi's stated focus on safeguarding reserves

"This move signals a cautious but growing role for traditional banks in the crypto space."

Editorial framing of Citi's strategy

"Regulation will decide the pace at which crypto assets can scale in payments and holdings."

Policy relevance noted in the article

"Hong Kong regulators tightening oversight shows a global tightening trend in crypto markets."

Regional regulatory response observed

Traditional banks dipping a toe into crypto custody signals a turning point for the market. If Citi builds trusted infrastructure to hold stablecoin reserves, it could unlock deeper participation from institutions that crave safety and clear settlement paths. Yet the same regulatory wave that creates opportunity also raises risk: policy changes, political signals, and cross-border scrutiny can shift quickly and affect funding, pricing, and liquidity. Hong Kong’s tightening of asset speculation adds another layer of global caution, reminding readers that the crypto space remains a space of evolving rules rather than settled certainty. The balance between safeguarding assets and enabling innovation will shape how quickly and how boldly Citi, and others, move.

Highlights

- Custody becomes the backbone of a trusted stablecoin era

- TradFi eyes the crypto future with cautious steps

- Regulation will decide the velocity of this space

- Treasuries and cash back stablecoins hinge on strong safeguards

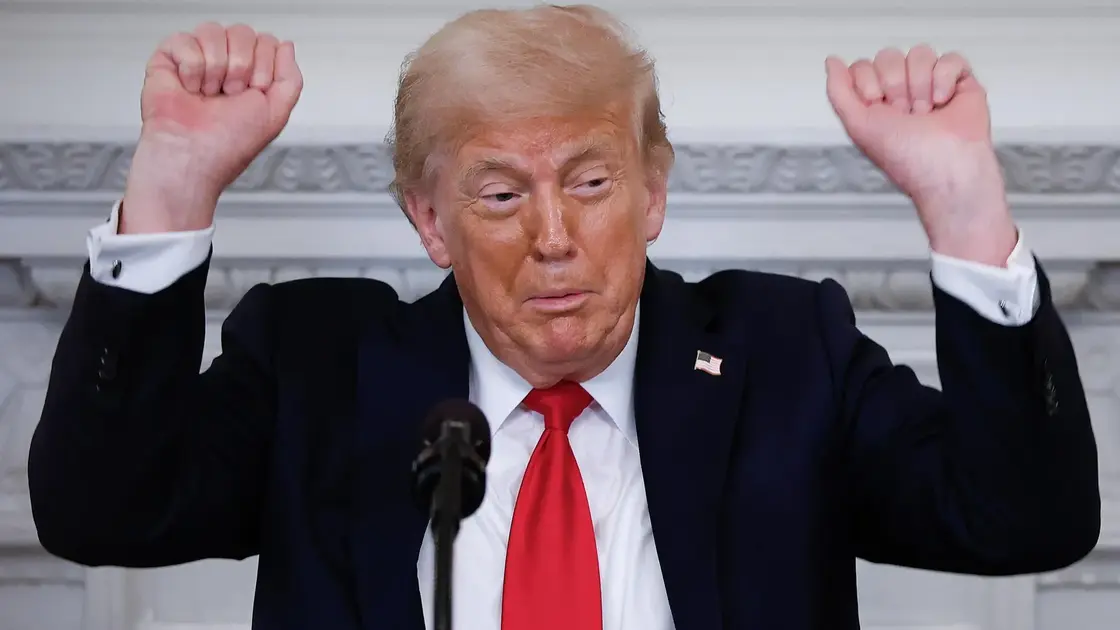

Regulatory and political risk surrounding crypto custody expansion

The story touches on political and regulatory topics that could affect Citi’s plans and market sentiment. Sudden policy shifts or backlash could alter funding, timing, or the feasibility of new custody services.

Markets move when trust meets custody.

Enjoyed this? Let your friends know!

Related News

Citigroup tests crypto custody and payments

Bitcoin investing strategies attract new U.S. investors

Private assets move closer to many 401k plans

Bitcoin Reaches New All-Time High

Trump Media holds $2 billion in bitcoin and plans for future crypto investments

Trump signs 401k crypto policy expansion

Explore top launchpads for crypto tokens

Coinbase adds DEX trading in app