T4K3.news

Intel leadership under political pressure

A political flare around Intel's leadership tests the company's path to regaining chipmaking dominance in the United States.

A look at how leadership missteps political pressure and market shifts have shaped Intel’s decline and its race to reclaim U.S. chip dominance.

Intel Faces Twenty Year Slide Driven by Leadership and Strategy

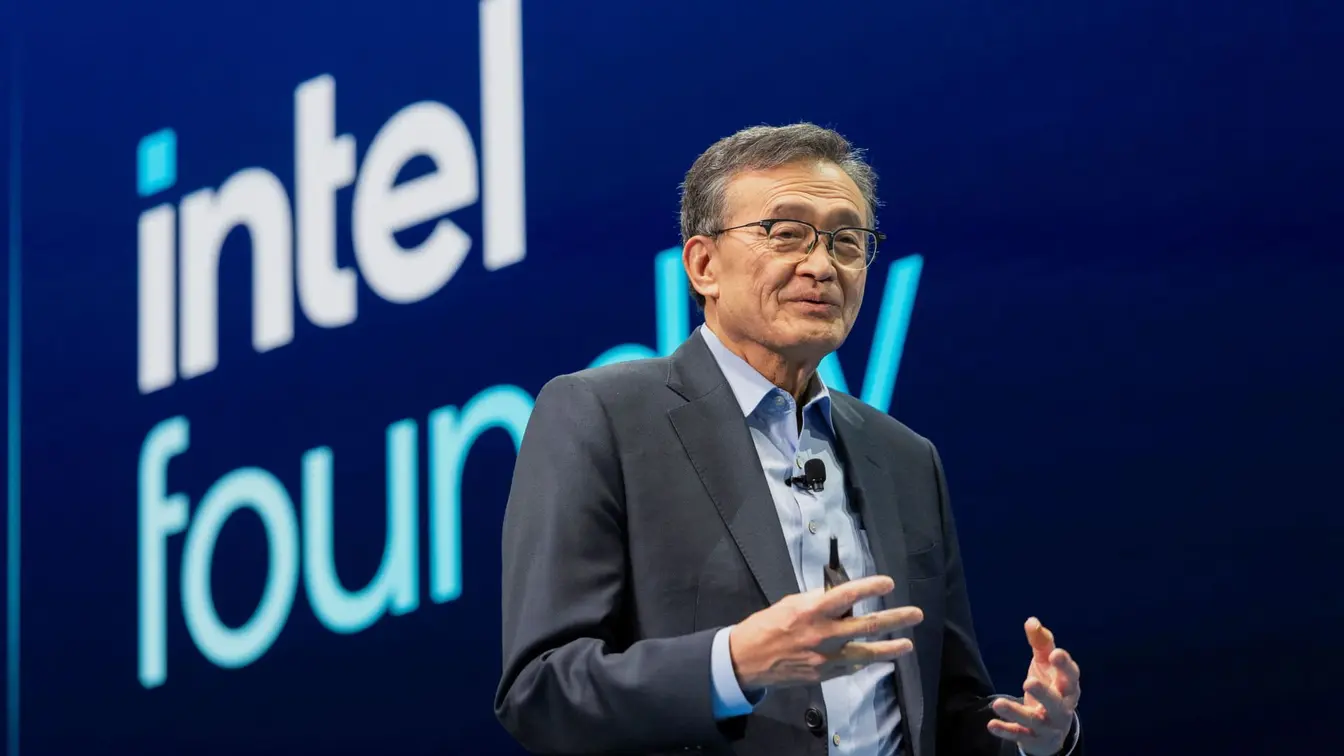

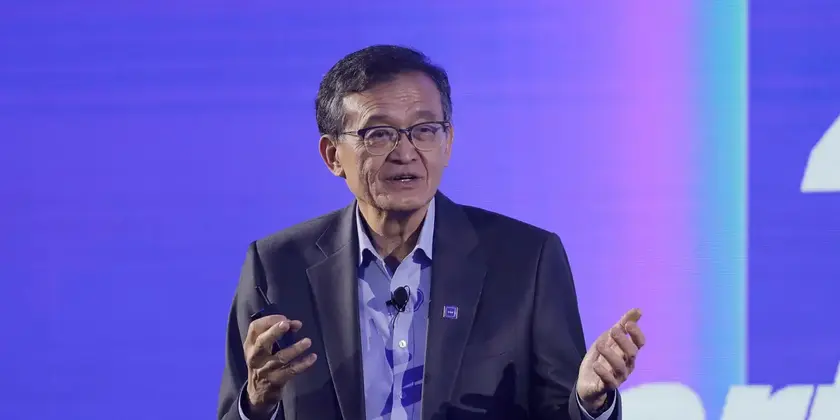

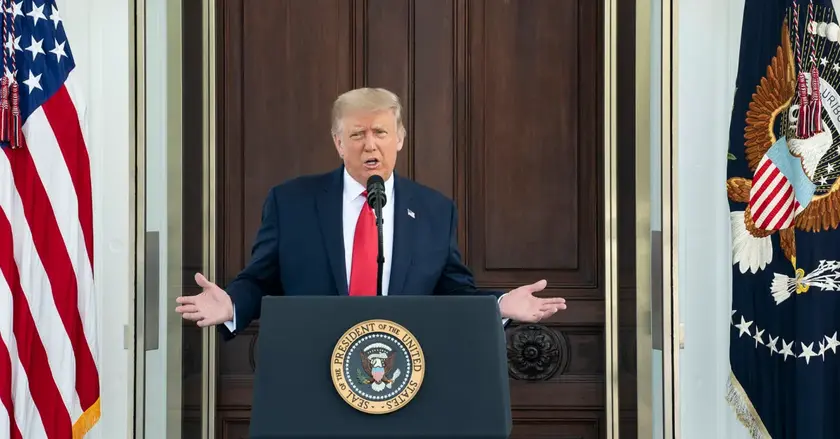

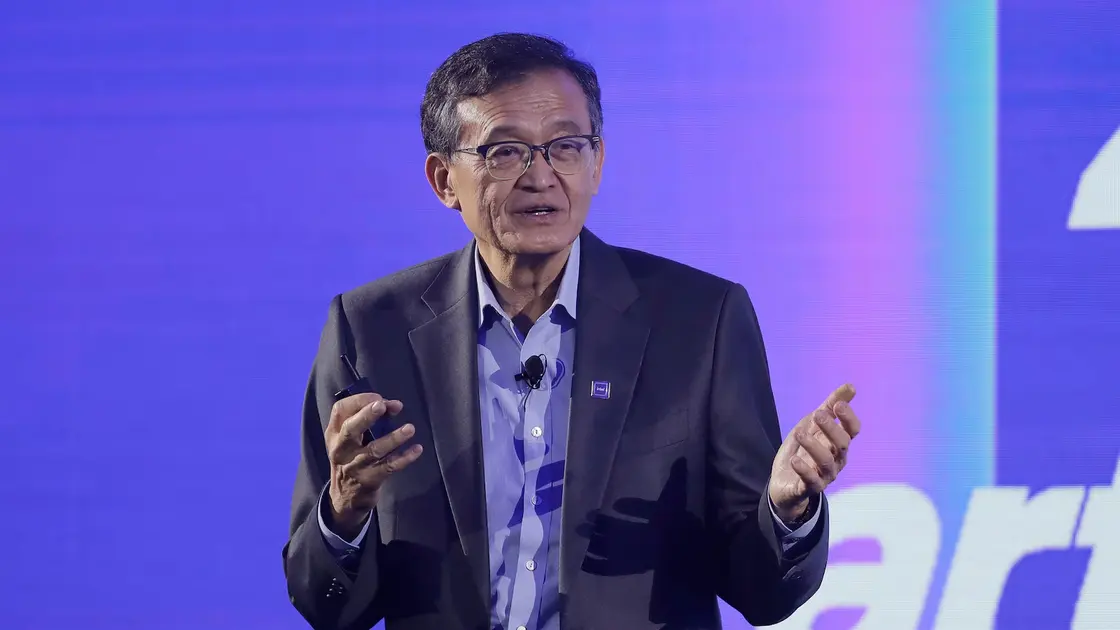

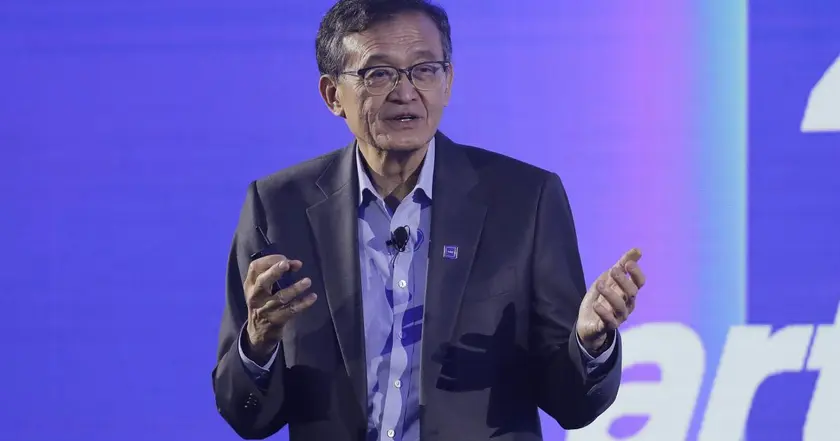

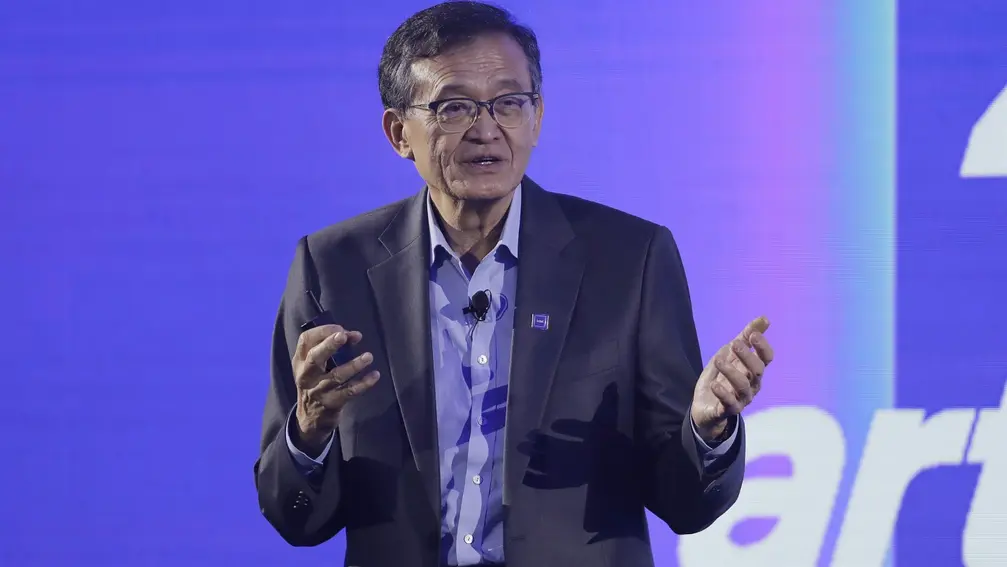

The drama began when President Trump posted a statement on Truth Social calling Intel chief executive Lip-Bu Tan highly conflicted and urging resignation. The post referenced a letter from Senator Tom Cotton alleging Tan links to Chinese companies and past export control cases. Tan later told Intel employees there has been misinformation about his past roles and that he has always operated within the highest legal and ethical standards; the board said it would continue engaging with the administration. The episode coincided with a 5 percent drop in Intel stock on a day when the market was up, underscoring how political currents now press on corporate leadership in a high stakes industry.

Intel’s decline spans two decades. The company pursued acquisitions in telecom and wireless that did not pay off, and a push to build Arm based phone chips around its own x86 architecture failed to secure a lead. Production delays and leadership turnover left rivals ahead, with TSMC and Samsung outpacing Intel as late as 2021. In response, the board brought back Pat Gelsinger to revive the business, only to replace him with Lip-Bu Tan as the stock fell again and the strategic plan faced execution risks. The company remains crucially important because it is the only U.S. player capable of leading edge chipmaking in America, a fact that has kept lawmakers eyeing subsidies under the CHIPS Act despite mixed progress on the ground.

Subsidies from the CHIPS Act gave Intel billions in support, but industry observers warn that money cannot substitute for execution. The company has yet to scale most of its U.S. manufacturing plans, and analysts say American chip capacity remains uneven while non-U.S. fabs dominate the most advanced production. Some see politics as a risk to long term strategy, while others argue that national security priorities demand steady progress. The key takeaway: politics can open doors, but only delivery will determine Intel’s fate.

Key Takeaways

"There has been a lot of misinformation circulating about my past roles. I have always operated within the highest legal and ethical standards."

Tan addressing claims about his past roles in a company statement

"The plan was that we would have a competitive product within a year, and we ended up not having a competitive product within a decade."

David Yoffie recounting Intel's smartphone chip bet

"They were getting subsidies from the government but could not execute."

Gaurav Gupta on subsidy aid versus execution

"Intel is the only American company that can do it and has not proven delivery."

Analyst comment on the U.S. chip race

The political overlay changes the risk calculus for a company already wrestling with a complex technical roadmap. Public officials can accelerate subsidies or drag their feet; either way, leadership stability becomes a national issue when a single firm sits at the center of U.S. chip independence. This moment reveals how national security goals and corporate governance interact and why markets watch every leadership move with heightened scrutiny.

To recover, Intel may need structural clarity and a sharper path to execution. Some analysts suggest reorganizing around core chip design while spinning off manufacturing to specialist partners or creating a stronger alliance with foundries. The board’s willingness to rethink structure could prove crucial because the real test is delivering cutting edge chips not repairing headlines. The longer Intel waits, the more the wider market will question whether U.S. manufacturing can sustain a domestic lead in a field where competition is global and relentless.

Highlights

- Intel still holds the keys to America's chip future

- Subsidies help but only execution saves the day

- Leadership matters as much as silicon

- The real test is delivery not promises

Political risk surrounds Intel leadership crisis

The public dispute over Intel leadership and links to export control allegations invites political scrutiny investor anxiety and potential backlash from markets and lawmakers. The case shows how national security policy and corporate governance collide in a sector critical to the U.S. economy.

The next chapters will show if a corporate turnaround can align with national strategy.

Enjoyed this? Let your friends know!

Related News

Trump demands Intel CEO resign amid stock drop

Intel CEO responds to Trump resignation demand

Intel CEO Resists Resignation Demand

Intel faces political pressure after Trump resignation call

Trump calls for resignation of Intel CEO

Trump demands Intel CEO's resignation amid China investment concerns

Trump calls for Intel CEO to resign over China ties

Trump demands Intel CEO resign over conflicts