T4K3.news

Woodford fines issued

The FCA has imposed penalties on Neil Woodford and his firm after the fund collapsed, but investors say the harm extends beyond the fines.

Penalties on Woodford and his firm come as investors say the harm goes beyond numbers and demands broader safeguards.

Woodford fines fail to compensate retirees losses

The Financial Conduct Authority fined Neil Woodford £5.89 million and Woodford Investment Management £40 million after finding that Woodford made unreasonable investment decisions and had a narrow view of his responsibilities. The Woodford Equity Income fund collapsed in 2019, trapping about 300,000 investors who could not withdraw their money. It was suspended on June 3, 2019 and wound up later that year as liquidity problems persisted and assets were hard to sell.

Investors such as Ian and Linda Duffield estimate losses of around £100,000 from their £234,000 investment. They have recovered about £134,000 from the fund and the redress scheme, but say the rest of their retirement plans are lost. The redress scheme had aimed to return up to 78p per pound, but the overall payout is described as much smaller, with some victims still waiting and others facing long-term impacts on retirement plans. The fund’s assets included illiquid smaller companies, which made selling holdings difficult as withdrawals mounted. The overseeing entity Link Fund Solutions and the FCA defended their actions while acknowledging the scale of harm, and Woodford Investment Management carried liabilities that appear large relative to available assets.

The case also places a spotlight on how savers are protected and how quickly regulators respond to liquidity crises. MPs have renewed calls for a formal inquiry into the FCA’s handling of the Woodford saga, arguing trust in financial markets is at stake. For many investors, the penalties do not erase the emotional and financial scars of a crisis that unfolded over several years.

Key Takeaways

"It's not even going to scratch the surface, it's a disgrace."

Investor reaction to the fines.

"Fining a bankrupt company £40 million shows the scale of the problem, not the cure."

Reaction to the firm’s liability.

"There were signs for years that regulators should have acted sooner."

Critique of FCA oversight.

"There are no shortcuts to holding those responsible to account in complex cases like this."

FCA response.

The penalties aim to punish those responsible, but the human cost suggests the punishment may not match the harm. Retirees trusted professionals with their savings, and the impact goes beyond money — the stress and uncertainty linger long after the court papers are filed. This episode tests the accountability of both a celebrated manager and the institutions that regulated, marketed, and facilitated access to his fund. It also highlights the tension between punitive penalties and meaningful compensation for victims.

Beyond the courtroom, the Woodford episode raises questions about platform responsibility, regulator speed, and the design of redress schemes. The scale of investor losses and the limited assets of the accused firm suggest enforcement may face practical limits. As MPs press for a formal inquiry, the sector faces a moment of reckoning about liquidity risk, investor education, and how to restore confidence in a system that many now view as fragile.

Highlights

- Fines that look big do little for retirees

- Trust in the system will not return with a press release

- Liquidity failures expose gaps in regulation

- Punishment today, protection tomorrow not yet balanced

Investor losses and regulatory scrutiny risk

The Woodford case highlights potential backlash against market participation and increased political scrutiny of regulators. The penalties may not fully address the harm to savers, and ongoing questions about platform responsibility and redress adequacy raise reputational and policy risks.

Trust in the financial system must be earned through action, not headlines.

Enjoyed this? Let your friends know!

Related News

Neil Woodford challenges FCA fine

Neil Woodford fined for fund mismanagement

Neil Woodford fined £46 million over fund collapse

Neil Woodford fined £46 million for fund mismanagement

FCA fines Woodford £46 million for management failures

Neil Woodford fined nearly £46 million for fund collapse

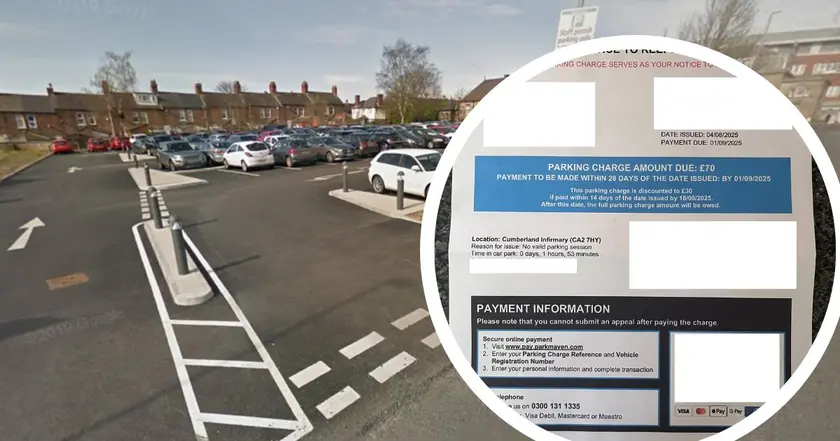

ParkMaven to cancel erroneous parking notices

Nurse fined 23 times for parking at Warwick Hospital