T4K3.news

Crypto gains ground in Washington and Wall Street

Crypto supporters push for wider use as policy talks and industry funding shape a new regulatory landscape.

A growing political and financial interest in digital currencies is reshaping policy and markets in Washington and beyond.

Crypto gains ground in Washington and Wall Street

Bitcoin 2025 in Las Vegas drew about 35,000 attendees, showing crypto has moved from a niche topic to a broader movement that attracts investors, developers and believers alike. Speakers praised the potential of digital assets while warning of scams and volatility, underscoring a split view on the asset class.

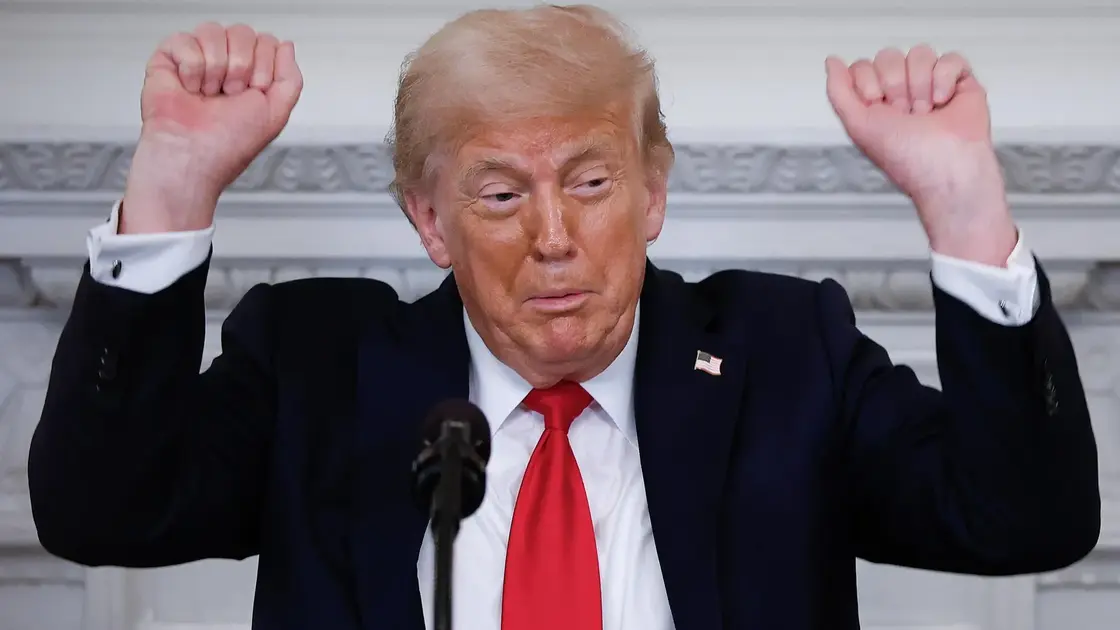

In Washington and the White House, crypto has become a policy issue with real stakes. The campaign has aligned crypto advocates with the idea that digital currencies can be mainstream, and lawmakers are weighing bills to regulate trading while encouraging retail and corporate experimentation. The GenIus Act opens doors for large retailers to issue their own digital currencies, while a congress- p pro-crypto push has drawn money to friendly candidates. Meanwhile, the Biden and Trump administrations have shifted approaches on enforcement, complicating the path for consumers and businesses caught in the crossfire.

Economic signals have followed the attention. The Federal Reserve notes only a small share of Americans own crypto and even fewer use it for purchases, but crypto markets have recently hit new highs with bitcoin briefly surpassing 120000 a coin. Revenue from token sales linked to political and business figures also drew scrutiny as the White House distanced itself from potential conflicts of interest. Regulators and lawmakers say the goal is to protect consumers while not stifling innovation, a line that remains difficult to draw.

Key Takeaways

"Crypto is highly volatile. It's highly speculative."

Amanda Fischer, former SEC official, on crypto risk

"Unlike, say, a stock crypto is not backed by any sort of business that is producing goods and services."

Fischer explaining crypto's lack of fundamental backing

"We want our fellow Americans to know that crypto and digital assets, and particularly Bitcoin, are part of the mainstream economy and are here to stay."

Vice President JD Vance on crypto’s place in the economy

"I wish that was the case, that'd be fantastic. But no, it's not true."

David Bailey on whether regulation will be written by the industry

The story here is not just about crypto prices. It is about how politics and money intersect with new technology. Washington is fast becoming a testing ground for how far the state will go to regulate digital assets while the industry tries to shape rules that favor growth. That tension creates a risk of policy capture, where writing the rules could become a negotiating chip for those who stand to benefit from the industry’s success.

A central worry is consumer protection. As the industry spends heavily on influence, some experts warn that enthusiasm could outpace safeguards, leaving everyday users exposed to fraud and losses during a period of high volatility. The challenge for officials is clear: encourage innovation and access, while building a framework that reduces risk for households and small investors.

Highlights

- Crypto moves fast policy must move faster

- Power and profits can write the same story

- If crypto wants legitimacy it must answer to consumers

- Mainstream money meets fast moving coins

Regulatory influence and conflicts risk

The article highlights potential conflicts of interest and intense political lobbying around crypto policy. As lawmakers consider new rules, there is a real risk of policy capture where industry funding and advocacy shape regulations more than consumer protections.

The debate over crypto will shape policy, markets and daily life for years to come.

Enjoyed this? Let your friends know!

Related News

Kremlin presses Donetsk surrender in ceasefire offer

Trump signs 401k crypto policy expansion

Twenty-One Capital prepares for public launch

Fed chair decision under political lens

US stocks show resilience amid Israel-Iran conflict

Ethereum rallies 20% as institutional support grows

Stocks Decline as Powell Shares Outlook on Interest Rates

Bitcoin Reaches New All-Time High