T4K3.news

Bitcoin could hit 150K this year executives say

Canary Capital's Steven McClurg tells CNBC BTC could reach 140 to 150 thousand this year before a bear market next year.

Canary Capital CEO Steven McClurg predicts Bitcoin could hit 140 to 150 thousand this year before a bear market.

Bitcoin Set to Reach 150K Before Bear Market Says Exec

Canary Capital chief Steven McClurg told CNBC that Bitcoin could reach 140 to 150 thousand this year, with a greater than 50 percent chance of hitting that range before a bear market next year. At current levels around 117 thousand, the move would imply a 19 to 27 percent gain. He credits ETF inflows and large treasury purchases with driving price action and notes that sovereign wealth funds and major institutions are increasingly involved.

The piece also mentions that other forecasts diverge. Michael Saylor argues that winter is not coming back and suggests Bitcoin could surge to a million if it does not go to zero. Bitwise chief investment officer Matt Hougan says 2026 could be an up year and the bull run may last longer than some expect. The story also points to macro signals like possible Fed rate cuts in September and October that could support higher prices, though the outlook remains uncertain.

Key Takeaways

"There is a greater than 50% chance Bitcoin goes to the 140 to 150 range this year."

McClurg's CNBC forecast.

"Winter is not coming back."

Saylor's bullish stance.

"If Bitcoin's not going to zero, it's going to $1 million."

Saylor's long-term forecast.

"We are broadly in for a good few years."

Hougan's outlook.

This forecast shows how crypto markets now ride on big money inflows and macro signals. The contrast between McClurg's base case and Saylor's extreme forecast exposes a market with wide disagreement about the path ahead. The split reflects optimism about institutional demand while underscoring sensitivity to policy shifts.

Readers should note that price targets in crypto hinge on external factors. If macro conditions shift or policy surprises emerge, upside paths can fade quickly, leaving smaller investors exposed to sharp moves and potential losses.

Highlights

- Big money moves crypto, not breadcrumbs.

- Markets ride on money from vaults, not rumors.

- Forecasts are bets with risk.

- Institutional money can move markets fast.

macro and investor risk

The forecast relies on macro trends and large institutional inflows. If rate policies shift or liquidity changes, price paths could deviate and provoke investor reaction.

Markets watch the macro and the money that moves it.

Enjoyed this? Let your friends know!

Related News

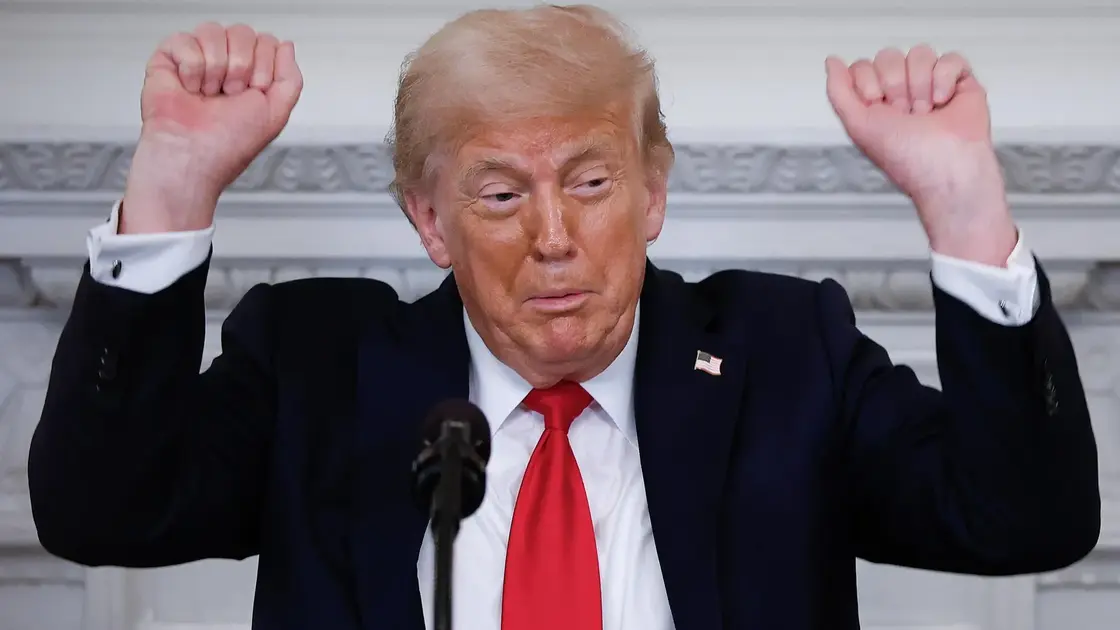

Bitcoin reaches record high ahead of Trump's inauguration

Bitcoin climbs, Ethereum questioned

Trump signs 401k crypto policy expansion

Stellar's Price Set for Rise After Trump's Crypto Bill

Crypto gains ground in Washington and Wall Street

Crypto bets shift to real world utility and AI infrastructure

Broncos sign Zach Allen to major contract extension

UK flight delays due to air traffic control technical issues