T4K3.news

Bitcoin climbs, Ethereum questioned

Canary Capital projects Bitcoin at 150K by year end as ETFs draw institutional money; Ethereum faces headwinds from newer chains.

Canary Capital CEO Steven McClurg projects a 150K Bitcoin by year end while he doubts Ethereum’s staying power amid competition.

Canary Capital Chief Bets Bitcoin at 150K This Year Ethereum Rally Faces Headwinds

Bitcoin could climb as high as 150,000 by year’s end, according to Steven McClurg, CEO of Canary Capital. He attributes the rally to ETF inflows and a growing base of institutional buyers, including sovereign wealth funds, pensions, and corporate treasuries. Bitcoin touched a record high near 124,128 this week as markets priced in continued demand for regulated crypto products.

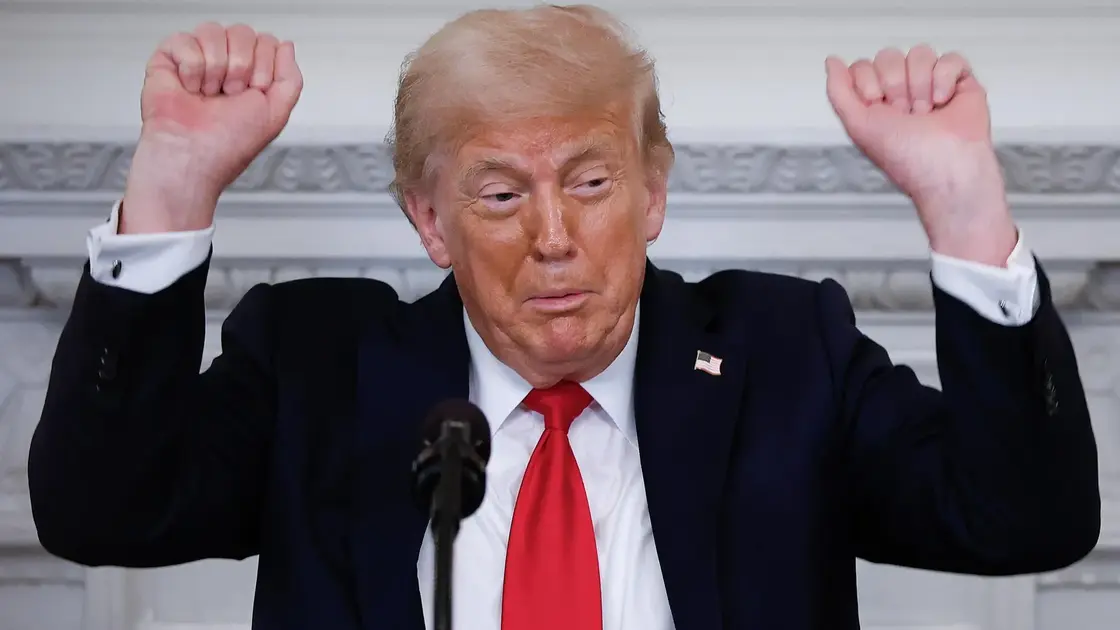

McClurg said there is a greater than 50% chance Bitcoin reaches the 140,000 to 150,000 range this year before a anticipated bear market in 2026. Canary Capital has filed ETF applications for several altcoins, including XRP, Sui, Cronus, Hedera, and a Solana based meme coin tied to President Trump, but not for Ethereum. He argues Ethereum is an older technology and favors newer blockchains that he sees as faster, cheaper to transact, and more secure. The piece notes that Ethereum has recently led gains among major cryptocurrencies but cooled with the broader market.

Analysts contacted by Decrypt offered mixed views. One cautioned that Ethereum’s large developer ecosystem creates strong network effects that are hard to replace, while Canary’s pitch stresses channeling new money into alternative protocols. The story also mentions Canary’s float of a Litecoin ETF and notes the seasonality of crypto markets, which can add volatility in coming months.

Key Takeaways

"There’s a greater than 50% chance that Bitcoin goes to the $140,000 to $150,000 range this year before we see another bear market next year"

McClurg in CNBC interview outlining his Bitcoin forecast

"I’m not a big fan of Ethereum, only because it is an older technology"

McClurg on Ethereum staying power

"Ethereum owns the developer ecosystem"

Greg Magadini on ETH network effects

"Litecoin has the ability to process Ordinals a lot faster"

McClurg on Litecoin potential

The article spotlights a core tension in crypto markets: the pull of big money versus the pace of tech innovation. McClurg’s Bitcoin forecast hinges on ETF inflows and a broad appetite for regulated exposure, framing Bitcoin as both digital gold and a risk asset. Canary’s ETF filings for altcoins signal a strategy beyond BTC, but the approach invites scrutiny about diversification versus speculative bets. The debate over Ethereum’s staying power highlights a longer run conflict between incumbents with entrenched ecosystems and newcomers promising speed and lower costs.

Beyond individual tokens, the piece hints at market structure questions. If ETF demand begins to sway prices more than on-chain fundamentals, the risk is a disconnect between price and real use. Ethereum’s network effects complicate any simple evaluation of newer chains. In short, the next wave will test whether tech quality or capital momentum drives crypto prices higher.

Highlights

- Bitcoin to 150K this year driven by ETF inflows

- Ethereum owns the developer ecosystem despite rivals

- Solana and Sui lure funds Canary says

- Litecoin could stage a fast comeback for small transactions

Investor impact and regulatory risk around ETF filings

The piece discusses ETF filings and large investor participation, which could influence prices and trigger regulatory scrutiny or market backlash.

The market keeps weighing tech promises against price momentum.

Enjoyed this? Let your friends know!

Related News

Trump era crypto boom reshapes wealth map

BitMine expands stock sale to boost Ethereum holdings

Bitcoin and Ethereum Struggle to Gain Momentum

Arthur Hayes sells $8.3M in Ethereum as SharpLink invests $100M

Bitcoin Reaches New All-Time High

Ethereum shows signs of potential correction

Trump signs 401k crypto policy expansion

Trump Media applies for Truth Social Crypto Blue Chip ETF