T4K3.news

Reeves' tax policies push up food prices

Tax hikes announced by Rachel Reeves are driving up household grocery costs in the UK.

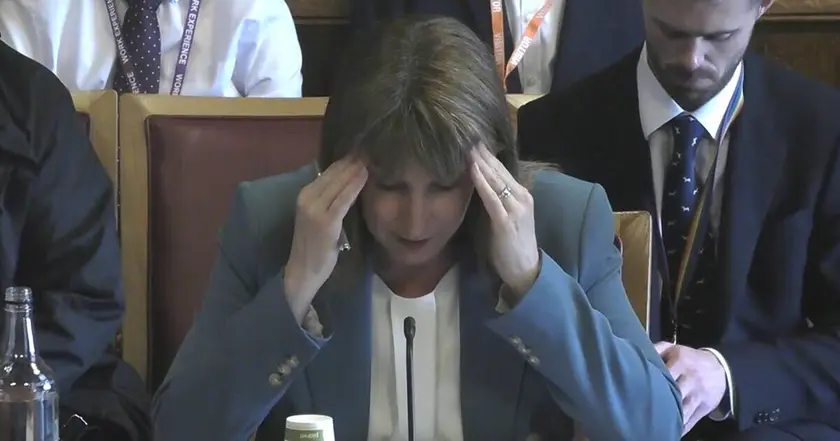

Rachel Reeves' tax strategies are affecting food prices and household budgets.

Rachel Reeves' tax policy raises costs for households and food prices

Rachel Reeves' recent tax changes are having a direct impact on the prices householders face at grocery stores, according to the Bank of England. National Insurance contribution increases and a rise in the minimum wage are among the key factors driving food inflation, which reached 4.5 percent in June, surpassing economists' forecasts. This inflation is predicted to rise to 5.5 percent in the coming month. Retail industry officials warn that these tax increases proposed for the Autumn Budget could further worsen grocery inflation. Furthermore, the Bank's recent interest rate cut to four percent aims to ease mortgage burdens but comes at a cost to savers. The Bank suggests that increased employment costs linked to the minimum wage have significantly contributed to rising food prices. Businesses are responding to these pressures by reducing employee numbers and relying more on technology.

Key Takeaways

"This fifth interest rate cut since the election is welcome news, helping bring down the cost of mortgages and loans for families and businesses."

Rachel Reeves highlights the positive aspects of recent interest rate cuts while addressing broader economic challenges.

"Government policies would add £7 billion to retailer costs this year."

Helen Dickinson from the British Retail Consortium underscores the looming financial impact of government taxation on retailers.

"Labour's economic mismanagement is turning the screw on hard-working families."

Sir Mel Stride criticizes the government's economic policies in light of rising food prices and living costs.

"Food prices have already been climbing steadily, and this is only the beginning."

Helen Dickinson warns that food price increases are likely to continue, affecting those on lower incomes the most.

Rachel Reeves' approach to taxation is central to the current crisis facing households in the UK. By imposing higher National Insurance contributions, the government seems to focus on stabilizing its budget at the expense of families already struggling with food price inflation. Amid rising living costs, consumers are adjusting their spending habits, leading to increased demand for budget options in supermarkets. The conciliatory measures, like interest rate cuts, may soothe some borrowers but do little to alleviate the fundamental issues of food pricing. Observers suggest that unless significant changes occur, families will continue to bear the brunt of these policies, revealing a critical tension between government fiscal strategies and everyday living costs.

Highlights

- Rising food prices are putting stress on household budgets.

- Families bear the brunt of tax hikes while trying to save money.

- Tax policies should not come at the expense of ordinary families.

- Shoppers are adjusting spending by opting for cheaper options.

Potential backlash from tax increases on households

The proposed tax hikes could exacerbate financial strain on families already facing rising food prices, leading to public discontent.

As policymakers navigate economic challenges, the impact on everyday families is increasingly becoming a central concern.

Enjoyed this? Let your friends know!

Related News

Bank of England cuts interest rates to 4%

Retailers warn of rising costs from tax increases

Pension triple lock tests Reeves

New Princes targets autumn London IPO

Rachel Reeves announces record £2.2 billion inheritance tax receipts

Bank of England expected to lower interest rates by 0.25%

US tariff rates reach highest level since 1930s

Rising costs push restaurants toward a critical moment