T4K3.news

Tax Digital update for high earners

HMRC will require quarterly updates for those earning over £50,000 starting 2026, affecting about 700,000 households.

HMRC will require quarterly updates under Making Tax Digital for Income Tax for people earning more than £50,000, affecting about 700,000 households.

HMRC imposes quarterly tax filings on earners above £50,000

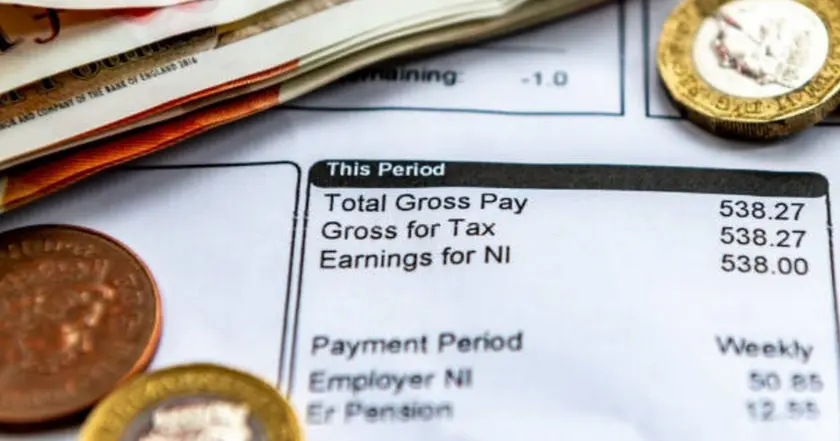

HMRC will require quarterly updates under Making Tax Digital for Income Tax for people earning more than £50,000. The change moves filings from an annual cycle to a four times a year rhythm, starting in the 2026-27 tax year. The threshold captures self employed workers and landlords whose qualifying income crosses the line. HMRC says the plan will improve real time tax collection and reduce end of year errors, while pushing more taxpayers to keep digital records. About 700,000 households are expected to be affected.

The first quarterly return will cover income and expenses from 6 April to 5 July and is due on 7 August. Penalties are harsh: a £100 fine for late filing, rising to daily penalties of £10, up to £900, if the return remains outstanding for three months. After six months, a further charge of either £300 or 5% of the tax owed applies, with the same penalty at 12 months. If tax is unpaid, interest accrues on the amount due. The shift is a big change for people who used to handle everything in January; software and digital record keeping become essential to avoid a last minute rush.

Key Takeaways

"From April 2026, self-employed individuals and landlords earning over £50,000 will need to start submitting quarterly updates to HMRC under Making Tax Digital."

rollout timeline

"Missing it could trigger serious financial consequences."

warning about penalties

"Even if you submit your returns on time, not paying your tax can still lead to penalties."

penalties for non payment

"The last-minute rush just won’t work anymore."

shift away from January deadline

The policy sits at the intersection of public finance and daily life. It signals a broader push to digitize tax collection, which could improve data quality and timeliness but also raises costs and learning curves for households and advisers. For some, the quarterly rhythm may be manageable; for others, especially those with limited software access, it could mean dedicated time and money to stay compliant. Public messaging will matter as much as policy design, because clarity on deadlines and penalties shapes uptake.

If HMRC can pair this reform with practical guidance and affordable digital tools, it could reduce end of year errors and improve revenue timing. Without that support, the change risks missed deadlines, penalties, and uneven adoption that could strain trust in a faster digital tax system.

Highlights

- Quarterly updates become the new tax habit

- Digital records are no longer optional

- The clock is ticking to adapt to a quarterly rhythm

- Late filing carries sharper penalties than before

Budget and public reaction risks

The shift to quarterly filings could raise compliance costs for high earners, self-employed and landlords. It may trigger public backlash and heightened political scrutiny as households adjust to a faster reporting cadence.

The clock is ticking for households to prepare for a new tax routine.

Enjoyed this? Let your friends know!

Related News

UK tax update underway

XRP Set for 20% Price Rally Amid Regulatory Changes

MTD ITSA expands to self-employed and landlords

Social Security faces 2033 funding cliff threatening seniors

Audi A8 D3 faces costly upkeep after 20 years

Bitcoin reaches record high ahead of Trump's inauguration

High earner shares struggles of financial satisfaction

Tax breaks lure bankers to Milan