T4K3.news

UK tax update underway

HMRC will require quarterly digital updates for self employed and landlords earning over £50,000 with the first deadline in August 2026.

HMRC plans quarterly digital updates for those earning over £50,000 from self employment or property.

UK requires quarterly tax updates for self employed landlords

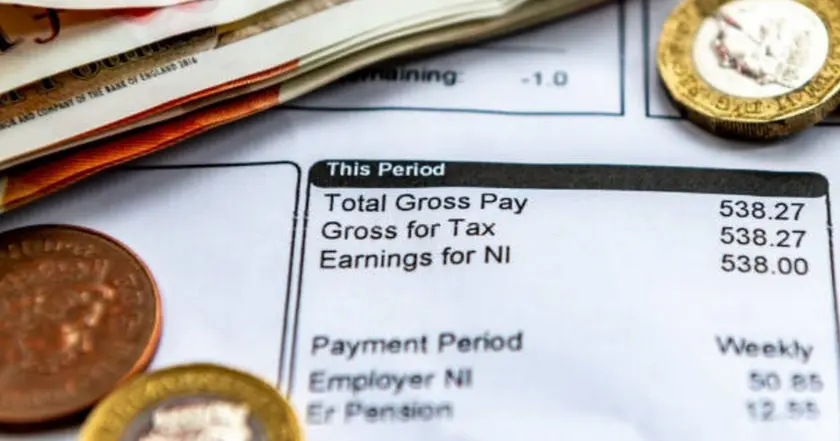

HMRC will require quarterly digital updates for self employed workers and landlords earning more than £50,000 a year. The first three‑month reporting period runs from April 6 to July 5, with the deadline due August 7, 2026. The change sits under Making Tax Digital and asks taxpayers to keep digital records and report income and expenses every three months using HMRC compatible software. The threshold is based on gross income, not profit, and around 780,000 people are expected to be affected in this first wave.

Penalties are clear: late submissions start with a £100 fine, then daily charges of £10 for up to £900, plus further penalties of up to £300 or 5% of tax owed after six and twelve months. The scheme will expand in 2027, dropping the threshold to £30,000 and bringing nearly another million taxpayers into the system, and to £20,000 in 2028. People with both property and self employment income will need two sets of records and two quarterly filings. Officials say the aim is to modernise the tax system and improve accuracy, while advisers warn of upfront costs for software and training. HMRC has urged those affected to join its voluntary testing program to work out issues ahead of the deadline and reduce disruption.

Key Takeaways

"Logging income and expenses as you go could save hundreds in fines"

Accountant stressing ongoing record-keeping

"This digital shift could reduce errors if the rollout stays smooth"

HMRC spokesperson describing benefits

"This is a big change for small business cash flow and planning"

Small business owner expressing concern

"Modernising tax data is necessary but the rollout must stay affordable"

Economic analyst

The move marks a broader shift toward data driven tax administration and could push the system toward real time reporting. If the rollout goes smoothly, it could lower errors and speed up processing for taxpayers and the tax office alike. But the timetable is demanding for many small operators who must buy software, learn new processes, and continuously manage quarterly deadlines. The risk is that glitches or delays in onboarding could trigger penalties and squeeze cash flow.

As thresholds fall, more people enter the system, which raises questions about fairness and the cost to small businesses. Clear guidance and affordable tools will be essential, and strong outreach from HMRC could determine whether the reform succeeds or becomes a source of frustration. The policy may deliver long term efficiency if managed with care, but the real test is in everyday bookkeeping and timely filing.

Highlights

- Quarterly updates become the new tax rhythm

- Logging income and expenses as you go could save hundreds in fines

- Digital records could become the new normal for thousands

- This move tests how well small businesses can adapt to rules

Tax policy shift brings budget and public reaction risks

The quarterly reporting regime introduces upfront costs and compliance requirements for thousands of households. If software, training, or communication fall short, penalties and cash-flow pressures could mount. The policy’s rapid rollout heightens the potential for public backlash and political scrutiny.

The coming months will show whether digital tax rules deliver on their promise.

Enjoyed this? Let your friends know!

Related News

UK borrowing exceeds £20bn in June

Tax Digital update for high earners

FTSE 100 share index reaches 9,000 points

XRP Set for 20% Price Rally Amid Regulatory Changes

Keir Starmer to discuss steel tariffs with Donald Trump

MTD ITSA expands to self-employed and landlords

Government promotes new measures for hospitality industry

Bitcoin reaches record high ahead of Trump's inauguration