T4K3.news

Stablecoins shape debt demand and policy

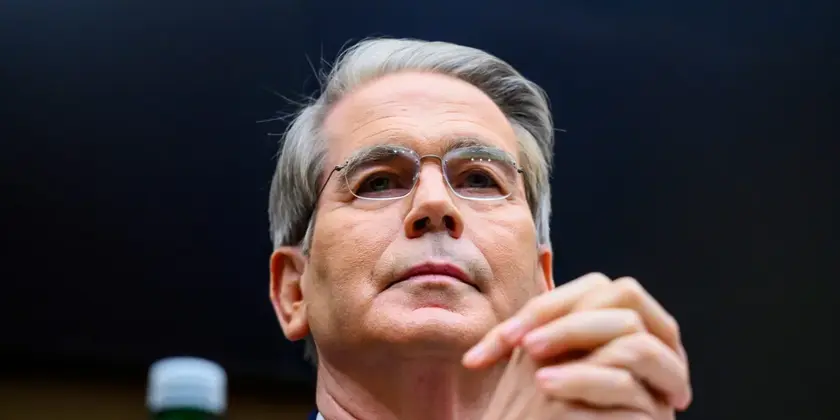

A Goldman Sachs view links stablecoins to Treasury demand amid new regulation

A Goldman Sachs report and related policy moves point to stablecoins boosting demand for U.S. Treasuries

Goldman Sachs sees stablecoins fueling a trillion-dollar market

U.S. Treasury Secretary Scott Bessent signaled that stablecoins backed 1:1 by U.S. dollar instruments could become a meaningful source of demand for U.S. Treasuries. He cited plans around the GENIUS Act to align stablecoin regulation, providing clarity for a growing industry.

Goldman Sachs researchers estimate the global stablecoin market at 271 billion dollars and see USDC share growth of about 40 percent per year through 2027. They argue the market could extend into the trillions as payments expand beyond crypto trading. The BIS study notes that inflows into stablecoins can modestly lower 3 month Treasury yields, while outflows push yields higher. UBS, however, remains skeptical that stablecoins will change overall demand for U.S. debt, arguing the move mostly redistributes money within the system.

Key Takeaways

"This groundbreaking technology will buttress the dollar's status as the global reserve currency."

Statement attributed to Bessent in relation to stablecoins

"Stablecoins are a $271bn global market."

Goldman Sachs research note

"The GENIUS Act provides the regulatory clarity it needs to grow into a multitrillion-dollar industry."

White House description of GENIUS Act

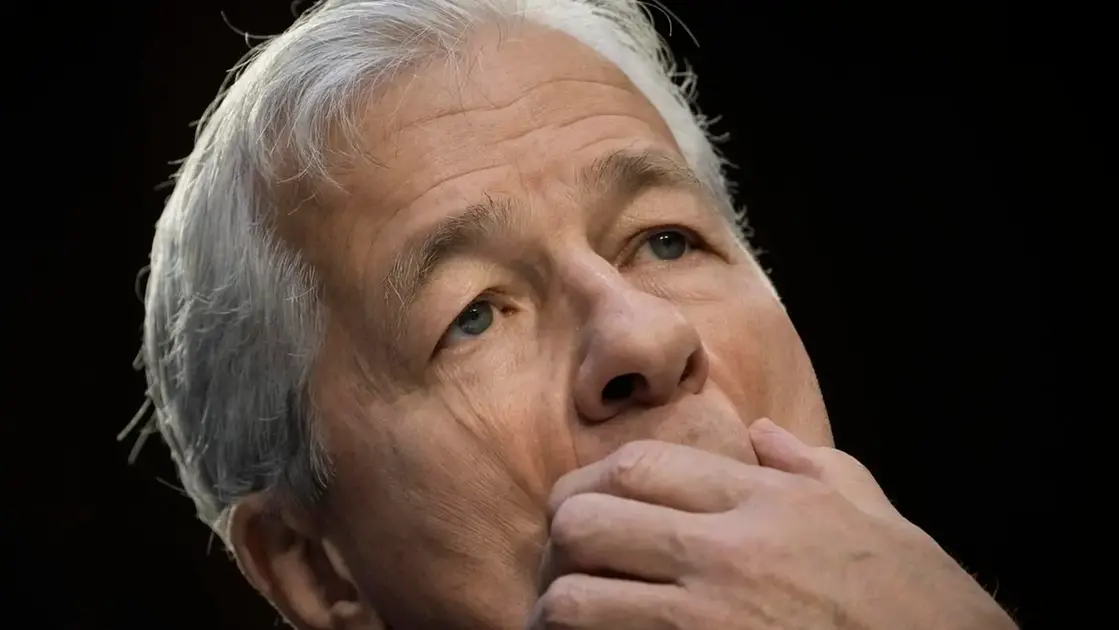

"stablecoins are more about redistributing money supply."

UBS analyst Paul Donovan explaining the critique

From a policy angle, the idea links financial innovation with government debt dynamics. If regulators give firms a clear path, stablecoins could push more dollars through the bond market. The risk is how quickly such a system can scale and how it will handle cross border use and consumer protection.

Market reality may lag forecasts. Even with optimistic numbers, the true impact depends on trust, exchange access, and actual uptake. The article cites credible voices but leaves open how big the effect will be on long term debt costs and the balance between short and long term Treasuries.

Highlights

- Stablecoins turn dollars into a bond market magnet

- The dollar economy rides a crypto wave

- Regulatory clarity unlocks a real market

- Stablecoins are reshaping how money moves

Regulatory and budgetary risk around stablecoins

The article ties stablecoins to government debt issuance and a new act, which could provoke political backlash and affect budget plans. Regulatory shifts could shape market access and investor confidence.

Watch how regulators balance innovation with stability in the coming months.

Enjoyed this? Let your friends know!

Related News

Japan approves yen backed stablecoins this fall

Stablecoin Treasuries Question

Markets Rally on CPI Beat Spurs Fed Rate Cut Bets

Trump faces uphill battle with rising interest rates

Bitcoin Price Slump Signals Policy and Liquidity Watch

Tech stocks retreat as markets pause after record highs

Trump signs law regulating stablecoins

China faces a turning point in growth