T4K3.news

Trump faces uphill battle with rising interest rates

President Trump's bid for lower interest rates confronts significant structural economic factors.

The challenges behind interest rates extend beyond Federal Reserve actions.

Trump faces deeper issues with rising interest rates

President Donald Trump has expressed a desire for lower interest rates, but this goal encounters significant hurdles beyond the influence of Federal Reserve Chair Jerome Powell. Structural factors are pushing borrowing costs higher. Increased government and corporate debt, fueled by tax reductions, military outlays, and investments in technology, is creating a heightened demand for credit. Simultaneously, as Baby Boomers retire and the US reduces its economic ties with China, the availability of savings needed to support such loans is becoming increasingly limited.

Key Takeaways

"The cost of borrowing is not just shaped by the Fed."

This statement highlights that rates are influenced by broader economic structures.

"The demand for credit is increasing alongside government debt."

This observation points to the underlying pressures on interest rates.

"Policymakers must navigate complex financial trends to achieve lower rates."

This emphasizes the challenges facing those aiming to influence rates.

The call for lower interest rates from Trump underscores a critical issue in the current economic landscape. While the Federal Reserve's policies are often blamed for rate hikes, the reality is that complex structural dynamics, such as splintering global relationships and demographic shifts, play a significant role. The current increase in borrowing costs reflects broader financial trends that policymakers must navigate, challenging simplistic narratives around central bank influence alone.

Highlights

- Debt is rising as savings dry up.

- Economic shifts redefine our borrowing landscape.

- Trump's push for lower rates faces powerful headwinds.

- Interest rates reflect deeper economic truths.

Rising interest rates pose economic challenges

The increasing borrowing costs reflect deep structural issues within the economy, complicating efforts for policymakers and potentially leading to public backlash over economic management.

Navigating these broader issues will be essential for future economic stability.

Enjoyed this? Let your friends know!

Related News

Federal Reserve faces scrutiny over renovation costs

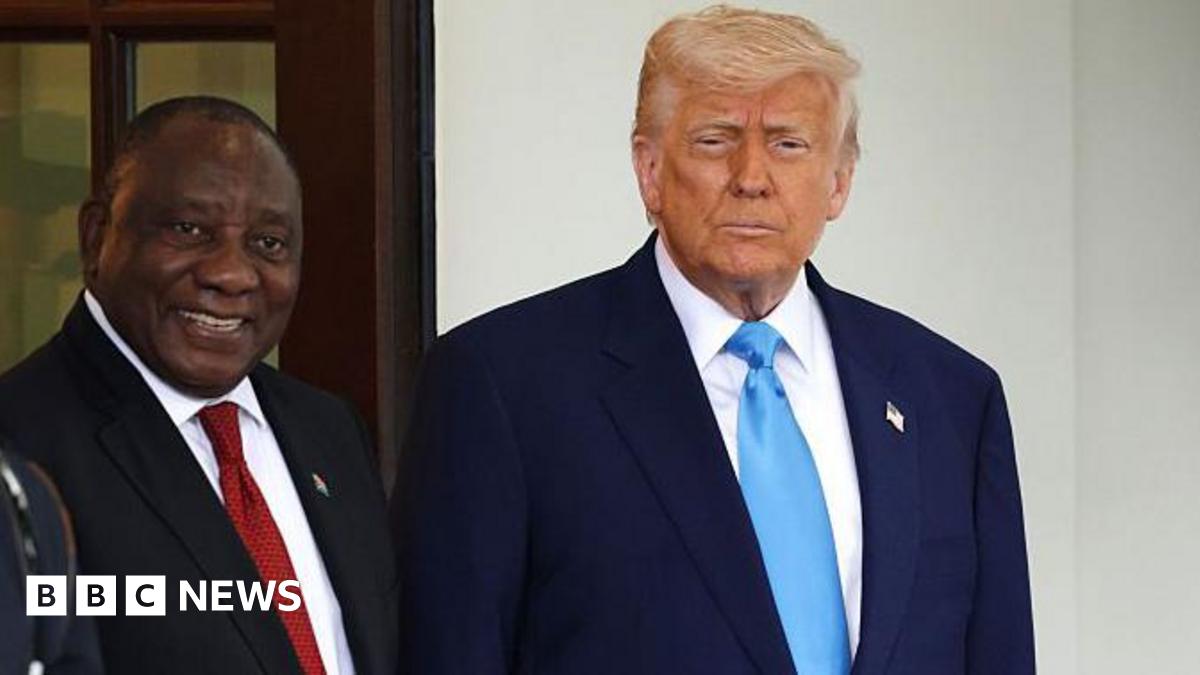

Trump announces 30% tariffs on South Africa

Supreme Court overturns convictions of two City traders

Trump advocates for interest rate cut to lower home prices

FTSE 100 reaches record high of 9,000 points

Inflation rises in the US as tariffs increase

Keir Starmer to discuss steel tariffs with Donald Trump

Stock market exceeds Buffett’s risk indicator