T4K3.news

Stablecoin Treasuries Question

Stablecoins now hold a growing share of Treasuries, raising policy and market considerations.

The rise of stablecoins as major holders of Treasuries is prompting questions about policy, risk, and market stability.

Stablecoin Giants Expand Treasuries Footprint Reshaping the U.S. Economy

Stablecoins have moved from niche crypto trading to the mainstream of U.S. finance after Congress passed the Genius Act in July. The issuers back their dollar pegs with large holdings of U.S. Treasuries, with Tether reporting over 100 billion dollars in Treasuries and Circle’s USDC market cap nearing 65 billion dollars as it completed a public listing. A July report from Apollo estimated the stablecoin industry is the 18th largest external holder of Treasuries. The market has also seen Circle grow its footprint after a major public listing and a surge in USDC’s use across payments and transfers.

Key Takeaways

"Having stablecoin issuers always be there is a massive boost in terms of giving confidence to the Treasury about where to place debt"

Yesha Yadav, Vanderbilt Law School on debt management

"There’s a lot of hype, and the numbers are still tiny compared to what we see in normal TradFi"

Kim Hochfeld, State Street on scale and risk

"There are trillions of dollars in money market funds. Ultimately, it didn’t affect banks being able to make loans"

Anonymous stablecoin executive on traditional banking impact

"New demand for Treasuries from stablecoin companies could lower long term interest rates"

David Sacks, White House crypto czar on policy outcomes

The shift creates a dual dynamic. A growing stablecoin presence could help stabilize Treasury supply by attracting a steady domestic buyer, but it also transfers a chunk of the debt market to private, profit seeking firms. If stablecoins become gargantuan holders, policy makers must consider how this changes monetary policy transmission and liquidity management. Regulators will need guardrails without stifling the growth of a payments technology that promises faster cross border transfers.

Highlights

- Stablecoins are becoming the new plumbing of the dollar system

- Debt markets meet a crypto influx that keeps the Treasury busy

- Regulation must catch up as wallets hold trillions in Treasuries

- A fast growing rails network could redefine policy levers

Regulatory and market risk as stablecoins become major Treasuries buyers

Growing holdings of Treasuries by stablecoin issuers could complicate policy, liquidity management, and bank funding dynamics. It invites political scrutiny and investor uncertainty about stability and governance.

As stablecoins grow, watchers will demand safeguards that protect both markets and everyday users.

Enjoyed this? Let your friends know!

Related News

Trump criticized for diverting attention from Epstein files

Democrats push legislation that may aid Trump’s cryptocurrency plans

Trump era crypto boom reshapes wealth map

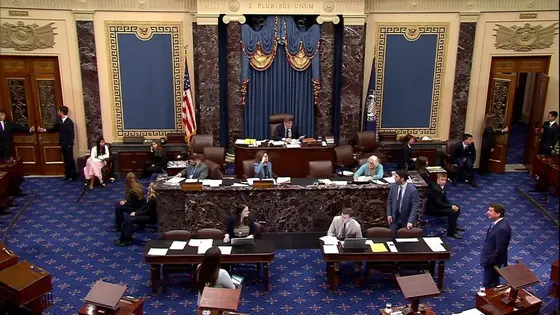

Senate passes stablecoin bill for regulatory clarity

Senate approves GENIUS Act for cryptocurrency regulation

Ether Machine plans IPO with $1.5 billion ETH treasury

Stellar's Price Set for Rise After Trump's Crypto Bill

SharpLink Gaming becomes largest corporate ETH holder