T4K3.news

Russian economy set for near-zero growth by 2025

The Central Bank forecasts minimal GDP growth ahead as military spending impacts civilian investment.

Russia's economy is projected to face minimal growth as military spending disrupts civilian investment.

Russian economic growth stalls as war spending takes toll

The Russian Central Bank has issued a stark warning about the country's economic future, forecasting near-zero GDP growth by the end of 2025. As military spending continues to drive war-related economic activity, this expansion is significantly limiting civilian investment and private consumption. Following a 1.4% growth in the first quarter of 2025, growth slowed to 1.8% in the second quarter and is projected to decline further, with estimates of 0-1% by the year's end. Comparatively, the global economy is set to grow by nearly 3%. The International Monetary Fund has similarly downgraded its growth forecast for Russia to just 0.9% for 2025. The Kremlin's focus on defense spending, now 6% of GDP, has worsened capital shortages in civilian industries and increased pressures on the workforce. Inflation concerns are leading to potential price controls on essential goods. Polls indicate that rising prices are now a greater worry for citizens than the ongoing war.

Key Takeaways

"Our autocracy relies on the expertise of capable managers."

This quote underscores the tension between Russia's governance style and economic management.

"Russia is now shifting toward a fully planned, command-style system."

This quote highlights the potential dangers of price control measures in Russia's economy.

"Rising prices are now the top concern, overshadowing the war."

This indicates a significant shift in public sentiment regarding economic issues.

The predicted slowdown in Russia's economy reflects a dangerous trend where dependence on wartime spending stifles broader economic health. The Kremlin's significant investment in defense comes at a cost, as civilian sectors face growing resource shortages and economic stagnation. This model raises questions about long-term sustainability. As inflation pressures mount, the government’s move toward controlling prices signifies a shift from a market-driven approach to a more command-style economy. This could lead to not only economic inefficiencies but also social discontent, as citizens grow increasingly frustrated with rising living costs.

Highlights

- Russia's reliance on military spending is stifling civilian investment.

- The economic health of Russia is on a troubling downward path.

- Rising prices have overtaken the war itself as a top public concern.

- A shift toward price controls might signal deeper economic issues.

Economic instability and public backlash risk

The focus on military spending at the expense of the civilian sector may lead to increased public dissatisfaction, especially with prices rising. As inflation grows and the government considers price controls, social unrest could become a significant concern.

The implications of this trend could reshape Russia's economic landscape for years to come.

Enjoyed this? Let your friends know!

Related News

Trump's deadline for Russian ceasefire approaches

Countries react to Trump's new tariffs

Markets Rally on CPI Beat Spurs Fed Rate Cut Bets

Trump signals peace talks with Russia ahead of Alaska summit

US tariff rates reach highest level since 1930s

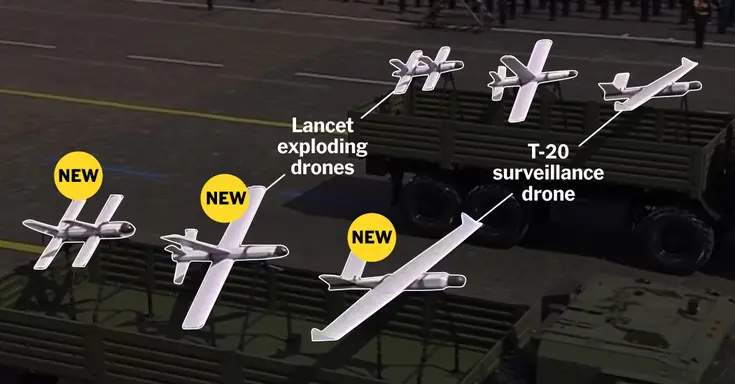

Russia Builds a Wartime Edge

Elon Musk awarded shares worth $29 billion

Business leaders urge Reeves on Autumn Budget