T4K3.news

US tariff rates reach highest level since 1930s

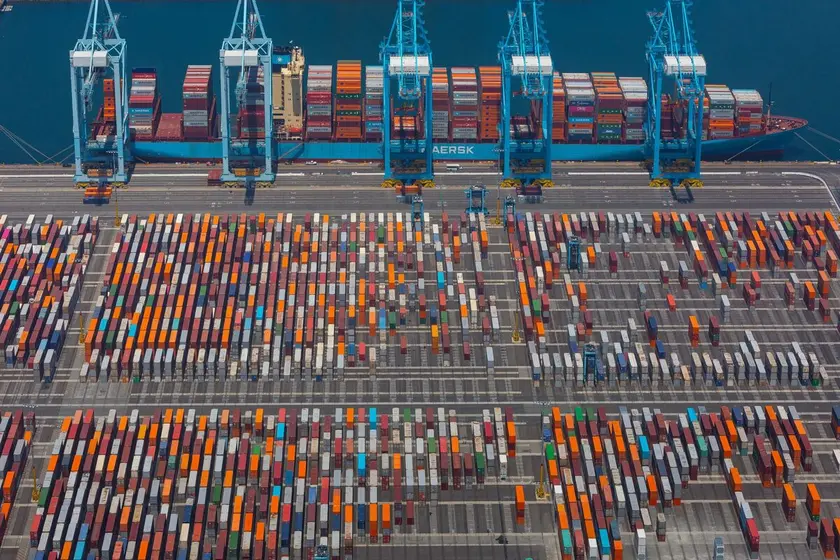

New tariffs raise average effective rate to 18%, impacting consumers significantly.

New tariffs implemented by the Trump administration impact US consumers while the Bank of England makes key decisions.

US consumers face highest tariff rates since the Great Depression

US consumers are now facing the highest tariff rates since the Great Depression, following the introduction of tariffs that elevate the average effective rate to around 18%. This surge is attributed to new reciprocal tariffs effective as of today. Kathleen Brooks from XTB highlighted that this situation coincides with the Bank of England's meeting, where an interest rate cut is anticipated amidst rising economic pressures. The tariffs, reminiscent of those enacted during the Smoot-Hawley Tariff Act, have raised concerns over potential negative impacts on trade and the economy.

Key Takeaways

"The high tariff rates today echo the mistakes of the past from the Great Depression."

Kathleen Brooks emphasizes the historical parallels of current tariff policies with those that caused economic distress in the 1930s.

"We must all prepare for varying impacts as the tariffs shake up the economy."

Professor Costas Milas predicts the economic ripple effects of the new tariffs.

The imposition of high tariffs in the US represents not just a significant policy shift but also a potential threat to global economic recovery. As the Bank of England prepares to make its decision, the landscape is marked by uncertainty. The interplay between domestic monetary policy and external trade pressures showcases the complexities that policymakers face. Economists are especially wary, predicting that these tariffs could add to inflation in the UK, heightening the need for strategic responses from the Bank of England.

Highlights

- Trump's trade wars now impact consumers like never before

- 18% tariff rates put a severe strain on US households

- The Bank of England faces tough decisions amid high tariffs

- UK inflation could spike due to unpredictable tariffs

Global economic risks from high US tariffs

The new tariffs pose significant risks by disrupting trade and increasing inflation, leading to a potential backlash in both consumer confidence and investor behavior.

As the situation develops, both consumers and policymakers must navigate the complexities of an evolving economic landscape.

Enjoyed this? Let your friends know!

Related News

Trump achieves key trade goals amid turbulence

Trump announces new tariffs affecting global trade

Stock market approaches record high

Bitcoin reaches record high ahead of Trump's inauguration

US-EU trade deal limits tariffs to 15%

Elon Musk awarded shares worth $29 billion

U.S. trade deficit falls to lowest level in two years

Markets rise after Trump tariff agreement with Japan