T4K3.news

Ripple settlement reshapes crypto regulation

The SEC drops its Ripple appeal, signaling a shift toward clearer rules for digital assets.

The SEC has dropped its appeal against Ripple, signaling a shift in how digital assets may be regulated in the United States.

Ripple Wins as SEC Drops Key Crypto Case

The U.S. Securities and Exchange Commission and Ripple Labs have reached a settlement that ends their civil fight. The appeals are dismissed and Ripple will pay a $50 million penalty as part of the deal; the lower-court judgment of $125 million remains in place. The 2023 ruling by Judge Analisa Torres found that XRP sales on public exchanges did not count as securities transactions, a key win for Ripple and for tokens traded on open markets.

The exit leaves a mixed legacy: the ruling suggests not all digital assets are securities, and the SEC’s enforcement-first approach is called into question. The settlement implies regulators may seek clearer rules rather than mounting courtroom crackdowns, a shift that could influence how other projects navigate U.S. markets.

Key Takeaways

"The end and now back to business"

Stuart Alderoty, Ripple’s chief legal officer, on X after settlement

"This settlement narrows the SEC's blanket reach"

Editorial assessment of the settlement’s significance

"Not all digital assets are automatically securities"

Judge Analisa Torres’ 2023 ruling remains intact

"A new chapter in the crypto Washington standoff begins"

Editorial view on policy implications

The settlement marks a turning point in how the United States shapes crypto policy. It reduces immediate risk for token projects and hints at a future where rules are clearer, not just won in court. Yet the decision also tests the appetite for rapid policy action in Washington and could spur new legislative efforts or oversight scrutiny.

If lawmakers respond with a clearer framework, the crypto industry could move toward more predictable rules. If not, pressure and legal challenges may continue to shape the timeline for compliant projects. The next chapter will test how quickly federal guidance can catch up with fast-moving technology.

Highlights

- Regulation by enforcement is losing its edge

- Main Street wins when rules become clearer

- This is a reset not a retreat for crypto

- The law catches up to the idea that not all tokens are securities

Regulatory and political risk rises for crypto sector

The settlement signals a potential shift in how crypto firms are regulated but may provoke political backlash and scrutiny of enforcement-led approaches. It could influence investor confidence and funding for blockchain projects, raising questions about future budgets and regulatory policy.

Clearer rules are taking shape, but the work to regulate crypto remains unfinished.

Enjoyed this? Let your friends know!

Related News

Ripple wins lawsuit as SEC drops case against the company

Ripple SEC case ends

XRP nears new highs after legal victory

Citigroup weighs crypto custody options

Banking groups urge OCC to halt crypto charter decisions

Ripple case final judgment stands

Stablecoin Treasuries Question

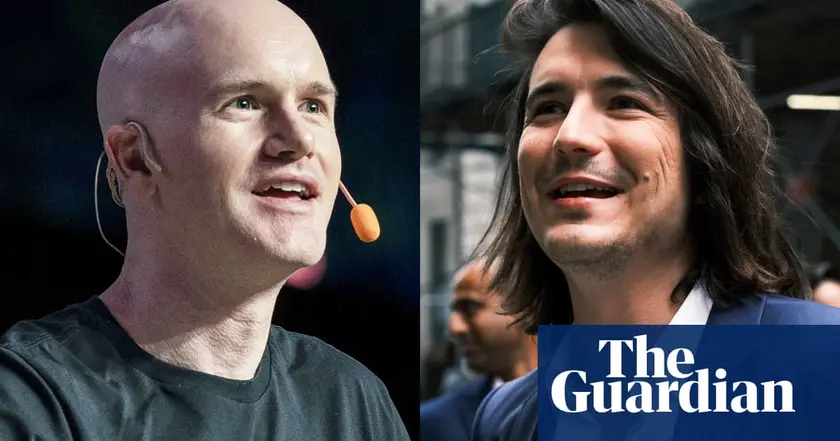

Crypto executives to attend Trump signing of stablecoin bill