T4K3.news

Reeves defence of non-doms backed by data

Payroll data undercuts fears of wealth flight; calls for stronger data on wealth to guide tax reform.

A data check on the non-doms reform shows forecasts of wealth flight did not materialize.

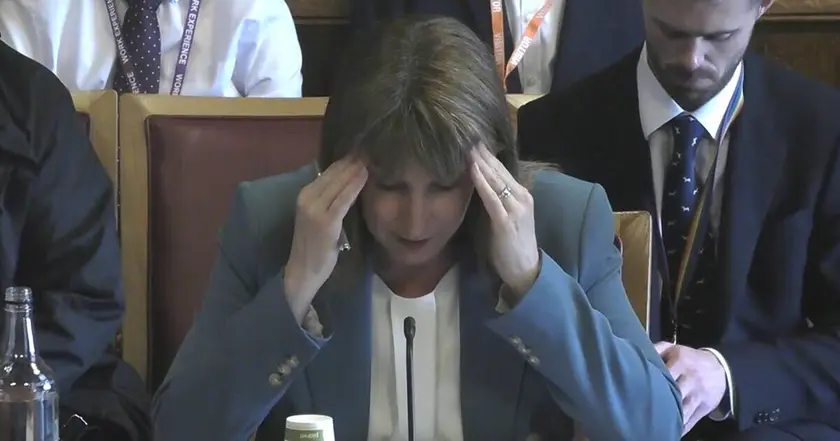

Reeves proves non-doms reform works

Britain’s debate over scrapping the non-doms status took a data turn when HMRC payroll figures were released. The numbers show top earners on PAYE remained steady, contradicting fears that the reform would trigger a mass exodus of wealthy residents. The forecast exodus, once a dominant line in the press and from some advisers, did not appear in the real world. The latest data suggests the policy can endure scrutiny and still raise revenue over the coming years.

The article underscores a deeper problem: while income tax data is trackable month by month, wealth and ownership sit in a murkier field. The UK lacks a live, comprehensive grasp of who owns what. Land Registry records property transactions, but overseas owners can hide through shell companies or trusts. Beneficial ownership filings have gaps. Companies House began tightening verification only recently. Offshore holdings hover outside official sight lines. In short, wealth taxation faces a data deficit that weakens policy debates and invites cynicism about reform.

Because wealth drives economic power in ways income does not, the gap between how earnings are taxed and how capital is taxed remains a political fault line. Without reliable data, arguments about taxing wealth fairly stay open to lobbying and delay. The piece argues that building a robust information framework would let policymakers price wealth shifts with more confidence and could determine whether further reforms—like capital gains alignment or tighter inheritance tax rules—are worth the political cost.

Key Takeaways

"The rich did not run"

Reeves' takeaway from the HMRC data

"Governing by data wonkery"

Editorial motto on how policy should be framed

"Policy built on plausible revenue estimates can survive scare stories"

Editorial insight on policy design

"We govern wealth in a data desert"

Describes the lack of data on asset ownership

The core idea is simple: policy thrives when it rests on solid numbers, not fear. The non-doms episode showed that steady data can blunt a powerful scare machine. The lesson isn’t just about one reform; it’s about how governments can govern modern economies by building the tools to measure what matters. The piece pushes for an information infrastructure that can map wealth, ownership, and the inflows and outflows around assets. That shift would make future policy debates less about headlines and more about verifiable consequences.

Yet there is a political risk. Pushing wealth taxation will draw pushback from investors and sectors that benefit most from the current system of delays and loopholes. The piece argues that data won't erase politics, but it can reduce the fog that makes policy easy to attack. If ministers can articulate a credible, data-backed case for wealth taxes, they may win the upper hand in autumn tax debates. The broader implication is clear: strong data becomes political currency.

Highlights

- Numbers beat headlines when policy meets reality

- Governing by data wonkery is a durable approach

- The rich did not run

- We govern wealth in a data desert

Political and budget sensitivity around wealth taxation

The piece discusses reforms to wealth taxation and data infrastructure, topics with potential political backlash and investor sensitivity. The analysis relies on policy outcomes and data gaps that could become flashpoints in public debate.

Data can protect reform only if it is built to last beyond one headline.

Enjoyed this? Let your friends know!

Related News

Rachel Reeves announces record £2.2 billion inheritance tax receipts

Treasury weighs IHT tweak up ahead of budget

Underrated FPL gems shine ahead of Gameweek 1

Europe to fund Ukraine defense continues

Elon Musk awarded shares worth $29 billion

Ray Dalio warns UK may be trapped in debt cycle

Severe Hunger Crisis in Gaza

Reeves eyes broad tax hikes in Autumn Budget