T4K3.news

Property tax debate continues

Readers respond to Reeves plan with concerns about fairness and regional differences.

Readers debate the fairness of a £500k property tax threshold and call for regional adjustments.

Reeves property tax plan faces reader pushback

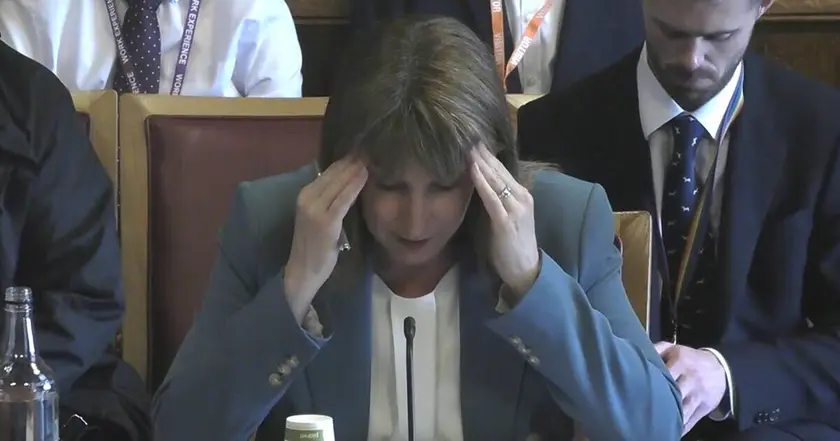

Independent readers are divided over Chancellor Rachel Reeves's plan to tax homes above £500,000. Many argue the threshold hits ordinary homeowners in expensive areas, while others say the proposal targets unearned property wealth and could curb inequality.

Critics warn the policy could reduce housing market mobility by discouraging downsizing and push up asking prices. Supporters say regional differences are needed to avoid unfairly penalising middle class families. The discussion also highlights how pensioners or couples with modest incomes could be affected.

Key Takeaways

"In London and parts of the South East, owning a £500k home does not make you rich"

Reader quote on regional price reality

"Taxing property, targeting unearned income, is what the government needs to do"

Reader support for wealth tax

"Regional variation needed to reflect price gaps across the country"

Reader call for regional thresholds

The debate reveals a broader question about how to balance revenue needs with fairness. A single threshold may punish people living in high priced cities while true wealth is not always tied to home value. A regional approach would require solid data and ongoing adjustment.

Policy design matters as much as the idea itself. If the plan becomes a political flashpoint it risks eroding trust in tax reform. The future will hinge on credible regional thresholds and clear use of funds.

Highlights

- In London and parts of the South East owning a £500k home does not make you rich

- Taxing property targeting unearned income is what the government needs to do

- Regional variation is essential to avoid penalizing middle class families

- Downsizing should be encouraged not taxed out of existence

Political and budget sensitivity in property tax debate

The plan touches on budget choices and regional disparities, which could trigger political backlash and public reaction across the country. Implementation details will influence support or opposition.

Policy must balance fairness with practicality as the debate continues.

Enjoyed this? Let your friends know!

Related News

SoftBank invests in Intel for 2 percent stake

Police will share suspects ethnicity and nationality

Rachel Reeves announces record £2.2 billion inheritance tax receipts

Reeves eyes broad tax hikes in Autumn Budget

Families face surprise inheritance tax bills

Inheritance tax issues may surprise families

US tariff rates reach highest level since 1930s

Lucid announces Q2 2025 financial results