T4K3.news

Poppi sold to Pepsi for 1.9B

Rohan Oza led the Poppi exit, signaling a major shift in celebrity backed brands and distribution power.

Rohan Oza steered Poppi's sale to Pepsi for 1.9 billion and maps his next moves.

Mastermind Behind the 1.9 Billion Poppi Sale

Rohan Oza built a career by pairing brands with celebrity power. He helped Vitaminwater and Smartwater reach a 4.1 billion exit in 2007 and later backed Bai, which sold for 1.7 billion in 2016. In 2018 he joined Poppi on Shark Tank, investing 400000 for 25 percent and rebranding the company from an apple cider vinegar drink to a bright prebiotic soda. The packaging shifted from glass to cans and the brand moved from a farmers market vibe to mass market appeal. Under his guidance, Poppi climbed from Kroger shelves to Walmart and expanded with Albertsons, Stop & Shop and Costco, building a following among influencers and celebrities.

Pepsi announced a sale price of 1.9 billion in May, with Oza owning about 21 percent and Cavu another 37 percent. The deal will bring Poppi into Pepsi’s vast distribution network, aiming to reach 100000 locations. Online and Amazon sales helped Poppi become the top selling soda on Amazon, and revenue reached about 500 million in 2024. The agreement includes a potential earn out of hundreds of millions. Oza says he is not done and points to future exits in Skinny Dipped and Once Upon a Farm.

Key Takeaways

"There’s no consumer audience in the world that is willing to embrace new brands as rapidly as Americans are."

Oza on consumer adoption speed in the US market

"This is the product I’ve been looking for."

Oza describing Poppi during the Shark Tank relaunch

"We proved that celebrities could bet on themselves and win big—and that’s exactly what he continues to do."

Curtis Jackson on the Vitaminwater era and Oza’s impact

"He wows celebrities the same way he wows retail buyers."

Chris Hall on Oza’s ability to connect brands with buyers

Oza’s play blends branding, celebrity connections and retailer relations. The Poppi pivot from a vinegar drink to a fizzy, fashionable soda shows how a sharp repositioning and a strong packaging story can ignite momentum. The story also highlights how a private equity backed strategy can unlock distribution firepower that is hard to replicate for small brands.

Yet the path ahead carries risk. A high profile sale creates expectations for outsized returns and depends on sustained growth across channels. The model hinges on continued retailer support, credible health messaging around prebiotics, and keeping the celebrity angle relevant without oversaturating the brand. The next steps will test whether a well built brand can stay durable beyond the moment of the deal.

Highlights

- Bold bets turn soda into a nationwide shelf story

- A brand reborn can outrun giants on shelves and in clicks

- The exit is only the beginning when the brand is built to scale

- Investing in taste packaging and pop culture is a rare trifecta

Financial risk in high value exit

The 1.9 billion sale places Poppi on a high value pedestal. Sustained growth beyond the deal hinges on ongoing momentum, integration with Pepsi’s network and the earn-out reaching its targets.

The next chapter will show how far a brand can travel when the pace of growth meets the pace of the market.

Enjoyed this? Let your friends know!

Related News

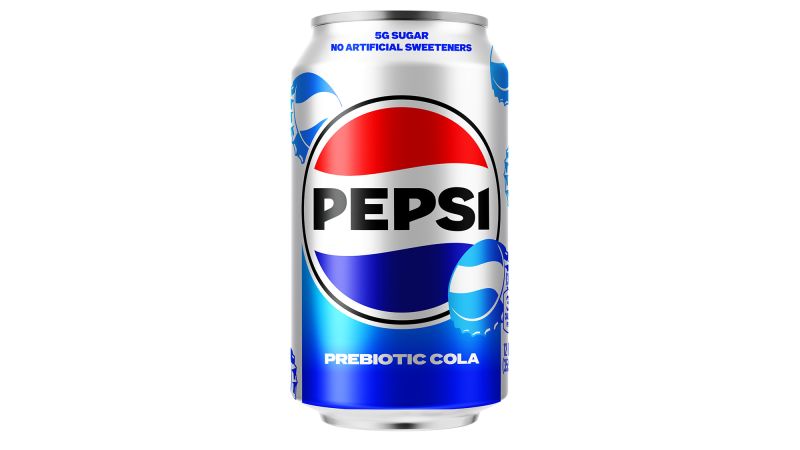

Pepsi launches new prebiotic cola

Pepsi to introduce prebiotic cola

Muhammad Ali's trunks sell for $1.2 million

Nintendo Switch 2 Sells Over 5 Million Units Globally

Nintendo Switch 2 sets record with 1.6 million units sold

Director banned over sale of historic cars

Nintendo Switch 2 breaks sales records in Japan

Stellar Blade Hits 1 Million Sales on PC