T4K3.news

OpenAI Chief Sees ChatGPT Outpacing Humans

Altman says ChatGPT could eventually have billions of conversations daily, signaling a once-in-a-generation shift in AI scale.

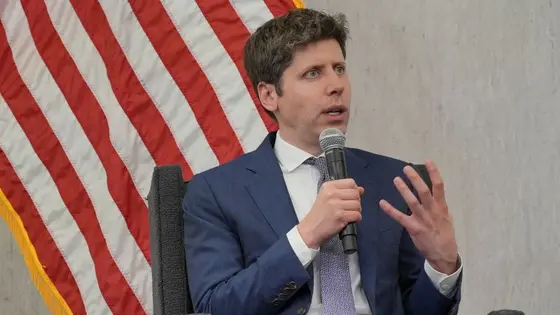

OpenAI CEO Sam Altman defends rapid growth for ChatGPT while acknowledging backlash to GPT-5 and signaling large future investments.

OpenAI Chief Sees ChatGPT Outpacing Humans

OpenAI CEO Sam Altman spoke at a San Francisco dinner about the company’s next moves for ChatGPT. He argued that the model could eventually handle billions of conversations daily, and he warned against pinning all users to a single personality. The remarks followed a contentious rollout of GPT-5, which led OpenAI to pause access to GPT-4o before reversing the move after user backlash.

Altman acknowledged a bubble in AI funding but said the underlying technology will be transformative. He suggested there will be a much broader product offering to fit diverse use cases and hinted at plans to spend trillions on data centers in the not distant future. He also spoke about new financial instruments to finance compute and warned that some AI bets will fail even as others deliver big gains, with a rumored stock sale potentially lifting OpenAI’s valuation.

Key Takeaways

"Let us do our thing."

Altman on autonomy in product strategy

"We can design a very interesting new kind of financial instrument for financing compute."

Altman on financing future compute needs

"When bubbles happen, smart people get overexcited about a kernel of truth."

Altman on market cycles and hype

"This will be a huge net win for the economy."

Altman on broad economic impact

Altman's remarks reveal a tension between scale and user experience. A global, multi-use product will need flexible interfaces and strong safety. The push for customization could complicate governance and blur a simple brand promise.

Economically, the note about trillions in compute signals huge potential but also risk. The tech bubble analogy underscores that hype can distort markets even when the technology is real. Regulators, investors, and workers will watch closely as AI infrastructure becomes a financial battleground.

Highlights

- Let us do our thing.

- We can design a very interesting new kind of financial instrument for financing compute.

- When bubbles happen, smart people get overexcited about a kernel of truth.

- This will be a huge net win for the economy.

Budget and investor risk in large scale AI buildout

OpenAI signals multi trillion dollar compute spend and new financing ideas. This scale could strain budgets, affect investor choices, and invite regulatory scrutiny. A miss or sudden policy shift could trigger financial losses and public backlash.

The test ahead is not only technical but social and financial.

Enjoyed this? Let your friends know!

Related News

AGI race deepens

Tariff era reshapes chip deals and AI plans

AI testing raises caution about history tools

OpenAI CEO warns about AI fraud crisis

Ex-Google exec warns of AI job losses

AI mimics human writing style in alarming ways

Alexandr Wang appointed Chief AI Officer at Meta

Sam Altman strengthens his grip on OpenAI