T4K3.news

Norway reviews investments in Israeli firms

Norway's wealth fund will reassess its stake in Israeli companies due to ethical concerns.

Pressure builds as Norway reassesses investments in Israeli companies linked to the Gaza conflict.

Norway's wealth fund reviews Israeli investments amid diplomatic isolation

Norway's sovereign wealth fund, the largest globally, is under scrutiny following reports of its investment in Israeli companies involved in the ongoing conflict in Gaza. The fund, valued at nearly $2 trillion, holds a significant stake in Bet Shemesh Engines Ltd, a company providing parts for Israeli aircraft. Amid rising global criticism of Israel's actions in Gaza, Norwegian leaders have publicly expressed their concerns, prompting a full review of investment practices for companies associated with the conflict. Prime Minister Jonas Gahr Stoere and Finance Minister Jens Stoltenberg have both voiced unease, stressing the need for ethical investment practices during troubling times.

Key Takeaways

"We must get clarification on this because reading about it makes me uneasy."

Norwegian Prime Minister Jonas Gahr Stoere's response to the fund's investments

"The war in Gaza is contrary to international law and is causing terrible suffering."

Finance Minister Jens Stoltenberg explains the ethical dilemmas in the fund's investments

"In light of … the deteriorating situation in Gaza, I will today ask Norges Bank and the Council on Ethics to conduct a renewed review."

Stoltenberg announces a review of the fund's Israeli investments in response to the Gaza conflict

Norway's decision highlights a growing trend among global investors re-evaluating their positions regarding companies involved in controversial regions. With public sentiment shifting against Israel due to the humanitarian crisis in Gaza, financial institutions may face increasing pressure to disassociate from Israeli businesses linked to the conflict. Norway's actions could signal a turning point, as other European nations similarly assess their investments. Public influence, particularly through movements like Boycott, Divestment and Sanctions, appears to be shaping investment decisions, pushing governments to align their portfolios with ethical standards reflecting current humanitarian considerations.

Highlights

- Norway's wealth fund is questioning its role in Israeli conflicts.

- Pressure mounts as ethical investing takes center stage.

- Divestment from Israel marks a shift in global financial attitudes.

- Public sentiment could reshape how nations invest.

Potential backlash over ethical investments

The decision to review investments in Israeli companies may face backlash both domestically and internationally as geopolitical tensions rise. Norway's actions could impact investor relations with Israeli firms and provoke criticism from pro-Israel groups.

The implications of these divestments could resonate across financial markets as ethical investing gains priority.

Enjoyed this? Let your friends know!

Related News

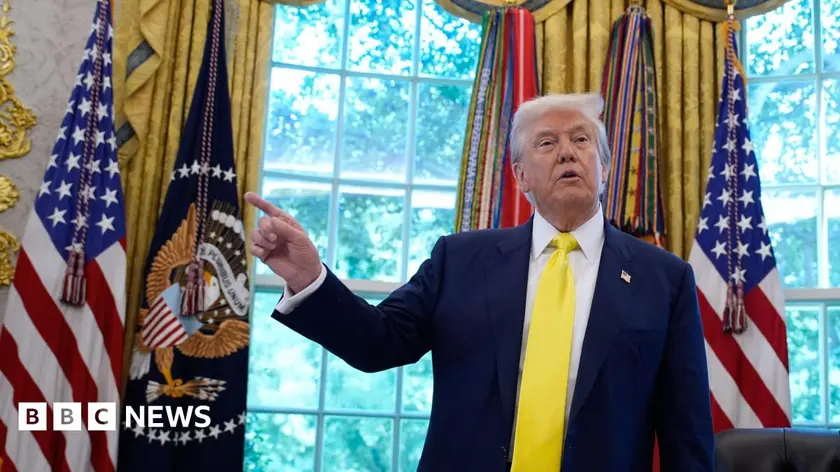

Retirement investors could gain new options

Trump expands retirement account options to include cryptocurrency

Bands pull out of Boardmasters festival

Chancellor Reeves announces financial strategy

Israel launches first state-owned communications satellite

Twenty-five nations call for end to Gaza war

Palo Alto Acquires CyberArk for $25 Billion

Egypt expands Israeli gas deal