T4K3.news

Martin Lewis urges savers to act following interest rate cut

Money expert Martin Lewis advises immediate action as the Bank of England lowers rates.

Money expert Martin Lewis urged people to act following the expected rates change which was announced this afternoon.

Martin Lewis advises savers to act as interest rates fall

Martin Lewis has called on savers to take immediate action following a drop in interest rates by the Bank of England, which decreased from 4.25% to 4%. This move, confirmed today, marks the lowest level since March 2023. The Bank's Monetary Policy Committee noted a decline in pay growth and concerns about U.S. tariffs as reasons for this decision. Savers are expected to see slower growth in their accounts because savings rates typically follow the Bank's base rate. Although good for debtors, this interest cut poses challenges for those wanting to maximize their savings. Lewis has previously highlighted that savers should prepare for such changes, recommending options like fixed savings accounts to secure better rates against fluctuating interest rates. Under present conditions, financial institutions are likely to announce adjustments to their savings products soon.

Key Takeaways

"Good news for some with debt, but a sign savers need to take action."

Martin Lewis emphasizes the necessity for immediate action in response to falling interest rates.

"Most analysts believe the Bank of England will likely cut the UK base rate again."

Lewis shares the consensus among financial analysts before the rate cut was announced.

The reduction in interest rates complicates the financial landscape for many savers. Martin Lewis's advice underscores the necessity for proactive management of personal finances in light of changing economic conditions. As debt becomes cheaper, homeowners rejoice while savers grow anxious. This duality highlights a growing tension within the economic framework that affects different demographics in varied ways. For those with savings, quick action might mean locking in higher rates before banks adjust to the new base rate. Those in debt may find temporary relief, yet the growing cost of living remains a pressing concern, complicating fiscal well-being across the board.

Highlights

- Savers need to take action now, while rates are down.

- Debt becomes cheaper, but savers face tougher times ahead.

- Locking in a good rate now can protect your savings later.

- Financial prudence is critical in today's shifting landscape.

Potential financial risks for savers

As interest rates decrease, savers may struggle to find favorable returns on their investments, risking long-term growth.

As economic conditions shift, both savers and borrowers must remain vigilant and informed.

Enjoyed this? Let your friends know!

Related News

Move your money before upcoming interest rate decision

Savings beat base rate today

Major banks urge customers to close accounts

US tariff rates reach highest level since 1930s

Transfer news intensifies as deadline approaches

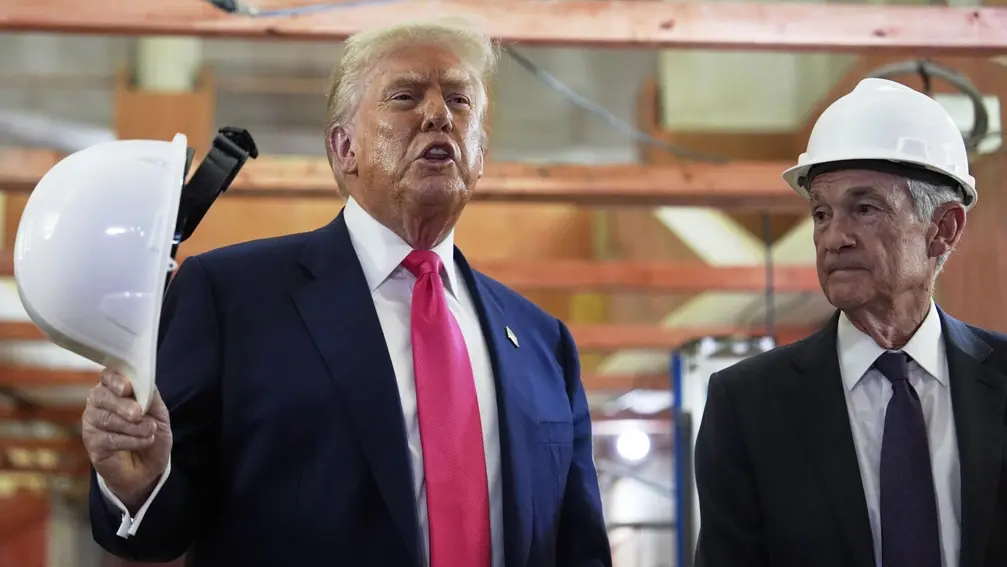

Trump tariffs take effect; Bank of England set to cut rates

Trump calls for Fed to lower rates amid leadership changes

Trump urges Fed board to intervene in rate decisions