T4K3.news

Trump tariffs take effect; Bank of England set to cut rates

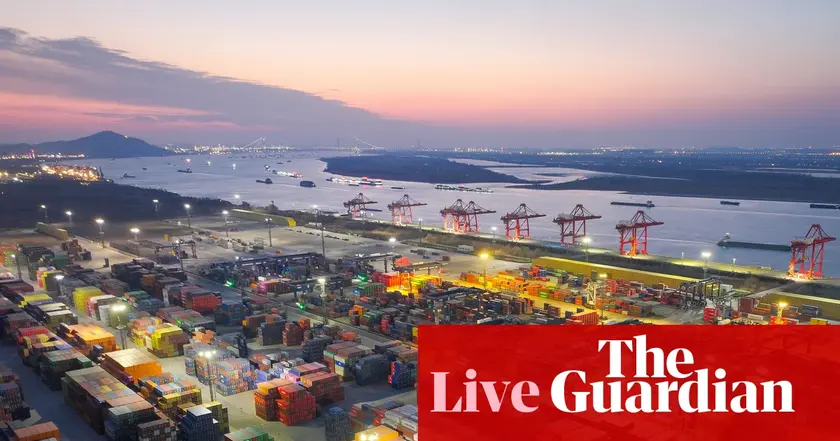

New tariffs have begun impacting global markets as the Bank of England prepares to announce its rate decision.

Current developments show the impact of tariffs on global markets amid potential UK rate changes.

Trump tariffs officially take effect as Bank of England weighs rate cuts

This morning, tariffs imposed by President Trump officially took effect, leading to significant reactions in various markets. The Bank of England is set to announce its decision on interest rates today, with expectations leaning towards a quarter-point cut. Analysts predict that the economic challenges, including rising unemployment and a struggling economy, play a role in this decision. Guillermo Felices, a global investment strategist, suggests that a reduction in the base interest rate from 4.25% to 4% is highly likely, indicating ongoing concerns about inflation and economic activity. The response to Trump's trade policies continues to unfold, influencing various sectors and countries, including a notable effect on semiconductor imports from the Philippines and India's stock market, which has reacted negatively to additional tariffs.

Key Takeaways

"I expect these to add approximately 0.5 percentage points to UK inflation by mid-2026."

Professor Costas Milas discusses the inflationary impact from trade wars.

"We expect a further 50 basis points of rate cuts over the three following meetings."

Guillermo Felices shares insights on future cuts by the Bank of England.

"The U.S. tariff hike lacks logic."

India’s foreign ministry reacts to the new tariffs imposed by the US.

The imposition of tariffs signals a bold approach by the Trump administration to reshape trade dynamics, yet the ripple effects are already visible across various sectors. While some companies, such as Maersk, adjust their outlook positively, others like Toyota brace for heavy financial losses. Policymakers in the UK face a delicate balancing act as they weigh the immediate need to cut rates against the inflationary pressures stemming from international trade conflicts. This situation reflects a larger trend of increased interconnectedness in global economies, where local decisions can have far-reaching impacts.

Highlights

- Tariffs have a real impact on global markets and economic stability.

- The Bank of England faces tough choices in a turbulent economic landscape.

- Despite trade wars, some sectors adapt and thrive amid uncertainty.

- Trade dynamics are shifting, revealing vulnerabilities in various markets.

Financial and Economic Risks from Tariffs

The tariffs imposed by Trump lead to financial instability in various sectors, notably semiconductors and auto manufacturing. This situation is likely to incite political backlash both domestically and internationally.

As global trade tensions rise, market responses will continue to evolve dramatically.

Enjoyed this? Let your friends know!

Related News

Bank of England expected to lower interest rates by 0.25%

US tariff rates reach highest level since 1930s

Bank of England to cut interest rates to four percent

Gold prices rise as tariffs enter the market

Wall Street slips as tariffs take effect

Trump's economic week critical for policy impact

Pensioners face loss of savings as interest rates decrease

Trump criticizes US Fed as economy experiences import decline