T4K3.news

Lowe's beats earnings and pushes pro strategy

Lowe's reports solid Q2 results and expands pro business through two acquisitions, lifting its full-year outlook.

Lowe's reports solid second quarter and expands its professional customer focus with two acquisitions.

Lowe's builds pro push with two big buys after solid quarter

Lowe's posted a stronger than expected second quarter, beating Wall Street on earnings per share by three cents and matching revenue forecasts at about $23.96 billion. The retailer also signaled a clear shift to serving home professionals, announcing the acquisition of Foundation Building Materials for about $8.8 billion, and confirming a prior deal to acquire Artisan Design Group. The company raised its full-year outlook to $84.5 billion to $85.5 billion in sales with flat to up to 1% same-store sales growth and an EPS range of $12.10 to $12.35.

CEO Marvin Ellison framed the moves as a way to bolster Lowe's solutions for professional customers, noting that the two deals strengthen the company’s offerings for builders, property managers and other pro clients. In the quarter, Lowe's said it performed well on both its do-it-yourself and pro-facing sides, even as overall home improvement demand remained moderated by higher mortgage costs. Net income rose to $2.4 billion, or $4.27 per share, from $2.38 billion a year earlier, as revenue climbed year over year. The company had previously warned that DIY activity would face headwinds in a higher-rate environment, making the pro channel a focal point for growth. Shares moved higher in premarket trading following the results, underscoring investor focus on the pro strategy and the outlook.

Key Takeaways

"strengthen our solutions for our growing Pro customers"

CEO comment on pro strategy

"Pro work is Lowe's quiet engine for growth"

Editorial takeaway about pro push

"The full-year outlook now sees revenue at 84.5 to 85.5 billion"

Outlook update in earnings release

"Lowe's is betting on pros as a steadier tide"

Industry analysis comparison

Lowe's is betting that a stronger pro business will steady revenue as DIY demand cools. The acquisitions align with a broader industry trend where Home Depot and Lowe's chase professional customers who tend to spend more per project and show resilience when homeowners pull back. The strategy carries higher execution risk, including debt load from large purchases and the challenge of integrating two distributors into one coherent sales and service ecosystem. If the housing market remains constrained, the pro segment could be the make-or-break driver of margin expansion or pressure, depending on how efficiently Lowe's can cross-sell services with products.

Highlights

- Pro work is Lowe's quiet engine for growth

- Acquisitions carry debt and integration risk

- Lowe's is betting on pros as a steadier tide

- When housing heals, Lowe's pro bet could pay off

Acquisitions raise debt and integration risk

Lowe's adds two large distributors to its balance sheet and product mix as it trades a slower DIY market for pro customer growth. The strategy could boost revenue but increases debt and execution risk if integration stalls or housing demand remains tepid.

The next quarters will show whether pro growth can sustain broader profits amid a mixed housing market.

Enjoyed this? Let your friends know!

Related News

Dividend Focus Turns to High Yield Bets in Turbulent Markets

Retail earnings show tariff pressure

Markets Rally on CPI Beat Spurs Fed Rate Cut Bets

Lowe's to acquire FBM in 8.8B deal

Stocks Decline as Powell Shares Outlook on Interest Rates

Apple leaks highlight budget MacBook and smart home push

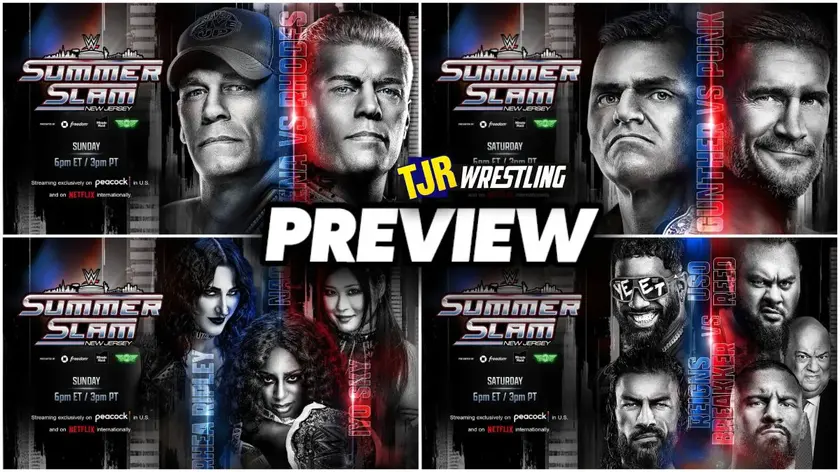

WWE SummerSlam 2025 set to break records

Markets Waver as Nvidia Eyes China Chip Push