T4K3.news

GSE IPO Timetable Faces Doubt

Trump signals a 2025 IPO for Fannie Mae and Freddie Mac, but details and timing remain uncertain.

Trump hints at a 2025 IPO for Fannie Mae and Freddie Mac with limited official detail.

Trump seems to confirm 2025 timing for Fannie Freddie IPO

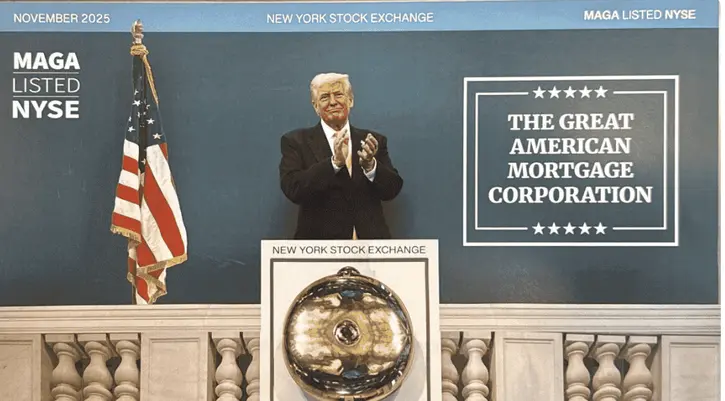

President Trump posted on Saturday that he plans to take Fannie Mae and Freddie Mac public by the end of the year, a move not yet backed by an official White House statement. The Wall Street Journal reports the initial offering could raise about 30 billion dollars and valuing the two companies at 500 billion or more. Some versions of the plan envision a single entity called the Great American Mortgage Corporation, though details remain unclear.

Analysts warned that such a large IPO would be hard to complete within a few months. Bose George of KBW cautioned that finishing by year end is unlikely due to capital and regulatory steps. Wells Fargo analysts Mario Ichaso and Jonathan Carroll placed the odds at about 40 percent, citing ongoing challenges and higher execution risk. Supporters argue the move would preserve a government guarantee for mortgages while enabling access to private capital; critics worry about political overreach and taxpayer exposure. Industry observers note that pricing and market acceptance would heavily depend on maintaining some level of government backing for the GSEs, a goal Trump has tied to his economic plan. Housing observers say that social posts may reflect exploratory signaling rather than a firm plan, underscoring the uncertainty surrounding the timeline.

Key Takeaways

"I feel like getting it all done before the end of the year seems very difficult."

KBW analyst Bose George on timing and feasibility.

"We now place the odds of release at 40% as fundamental challenges remain and execution risk is elevated."

Wells Fargo analysts Mario Ichaso and Jonathan Carroll on likelihood.

"The most important thing about an IPO of Fannie and Freddie is that the administration provides some type of government support to the companies so pricing doesn't get hit."

Housing market analyst Logan Mohtashami on the role of government backing.

The issue here is not just a corporate IPO. It is a political bet aimed at shaping mortgage costs and the federal role in housing finance. If the government guarantees stay in place, the perceived safety net could influence pricing and investor demand, but it also locks in a political price for any reform. The lack of official detail invites both market volatility and public scrutiny, especially if the plan shifts taxpayers' risk without a clear transition path for Fannie and Freddie. The timing clash between campaign signals and market readiness reveals a broader tension between political rhetoric and financial engineering.

Highlights

- Public posts don't replace a solid plan and clear numbers.

- Pricing won't be set without clear government backing.

- Timing becomes a market test unless details arrive soon.

- The plan hinges on government guarantees more than private capital.

Political and market risk around GSE IPO timing

The plan involves major political decisions with potential budget implications and market impact. Lack of official confirmation and reliance on social posts create uncertainty for investors and homeowners and may provoke public reaction or backlash if mortgage costs or taxpayer exposure shift.

Developing details will reveal whether this is a genuine policy path or a calculated political signal.

Enjoyed this? Let your friends know!

Related News

Spirit Airlines faces going concern risk after bankruptcy exit

NHS reform plan stalls over redundancy funding

GSE IPO plan reshapes housing finance

NHS reforms stall over £1bn redundancy costs

Kodak Faces Financial Crunch

Chelsea struggles with Colwill injury before season starts

Spirit Airlines faces liquidity risk

Widespread fear of disaster grows among UK citizens