T4K3.news

GSE IPO plan reshapes housing finance

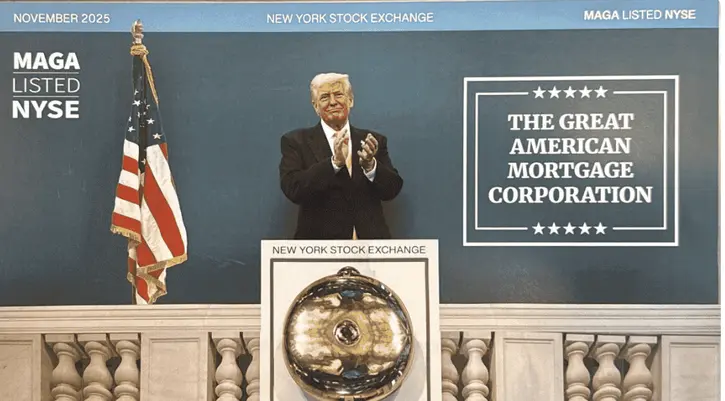

Trump plans to list 5 to 15 percent of Fannie Mae and Freddie Mac, potentially raising about 30 billion while keeping implicit guarantees.

Trump proposes partial privatization of Fannie Mae and Freddie Mac through IPOs, raising questions about guarantees and market impact.

GSE IPO plan reshapes housing finance

The Trump administration is planning to list between 5% and 15% of each government sponsored enterprise, Fannie Mae and Freddie Mac, and could raise about 30 billion in one of the largest stock offerings in U.S. history. The plan may list the two separately or together, and could involve issuing new shares, selling existing ones, or a mix of both. Major Wall Street banks are being asked to advise on pricing and structure as the Treasury weighs how much to dilute government ownership while pursuing liquidity.

The move comes after years of conservatorship following the 2008 crisis. The companies have returned to profitability and paid dividends, but they remain under government control with an implicit backstop. Analysts warn that preserving that government guarantee remains crucial for ratings and funding costs. If the guarantee weakens or ends without a clear framework, mortgage costs could rise and the system could become less liquid. Proponents say privatization could unlock capital while preserving market stability, but critics argue the plan risks political risk and market disruption during a fragile housing market.

Key Takeaways

"Maintaining the explicit government guarantee is essential if privatization proceeds."

Lawrence Gillum of LPL Financial on the pricing and guarantees

"Ending conservatorship without a clear legislative or financial framework risks delivering no value and could leave the system less liquid and stable."

Commentary by Jim Parrott and Mark Zandi

"I am working on TAKING THESE AMAZING COMPANIES PUBLIC, but I want to be clear, the U.S. Government will keep its implicit GUARANTEES."

Donald Trump on social media regarding the IPO plan

The plan tests the line between private profit and public backstop. Privatizing a cornerstone of the housing market while keeping the guarantee suggests a staged approach, but the timing and design matter. If lawmakers fail to create a solid framework, the market could overvalue the backstop or misprice risk, hurting borrowers and taxpayers alike. The upside for investors and underwriters is clear, yet the price of that win could be higher than markets anticipate if confidence in the backstop erodes.

Highlights

- Public profits, private risks.

- Privatize with guardrails not guards down.

- Taxpayer backstop at stake as IPO clock ticks.

political and financial risk

The privatization plan involves sensitive political decisions that could attract backlash from borrowers, taxpayers, and investors. It also hinges on maintaining an explicit or implicit government guarantee, a move that carries major implications for mortgage pricing and financial stability. If not managed carefully, the plan could face regulatory hurdles, market volatility, and public scrutiny.

The coming steps will reveal how far the system can adapt without breaking public trust or market stability.

Enjoyed this? Let your friends know!

Related News

GSE IPO Timetable Faces Doubt

LVMH completes $800 million investment in Flexjet

Trump promotes cryptocurrencies at Bitcoin Conference

Bullish aims for $4.2 billion valuation in IPO

Heathrow expansion faces strong opposition from rival proposal

Trump proposes removal of AI regulations to boost innovation

Postmaster General Steiner opposes USPS privatization

Reeves announces major deregulation to promote economic growth