T4K3.news

Bullish aims for $4.2 billion valuation in IPO

Bullish has filed for a $629 million IPO, targeting a valuation up to $4.2 billion.

Bullish aims for a significant IPO, aligning with a trend in crypto exchanges pursuing public listings.

Bullish seeks $4.2B valuation with IPO amidst rising crypto interest

Bullish, a cryptocurrency exchange backed by investor Peter Thiel, has filed for a $629 million initial public offering (IPO) aiming for a valuation of up to $4.2 billion. This move attracts notable interest from prominent investors like BlackRock and ARK Investment Management, who are looking to purchase $200 million worth of shares. The company plans to offer approximately 20.3 million shares priced between $28 to $31 each. Bullish’s IPO filing follows a previously confidential submission to the SEC and positions the firm well amid a growing investor appetite for digital assets, especially following the success of Circle's recent public debut.

Key Takeaways

"We now intend to IPO because we believe that the digital assets industry is beginning its next leg of growth."

This statement from CEO Tom Farley highlights Bullish's confidence in the future of cryptocurrencies and the importance of compliance.

"Major exchanges like OKX, Kraken, and Gemini are also signaling readiness to go public."

This illustrates the growing trend of cryptocurrency firms seeking public investment and recognition.

The Bullish IPO emerges as a significant development within the cryptocurrency sector, which is experiencing renewed vigor. With multiple exchanges like Gemini and Kraken also eyeing public listings, this shift highlights a broader acceptance of cryptocurrencies among traditional investors. Tom Farley, Bullish’s CEO, indicates a strong belief in the industry's growth. His emphasis on transparency and regulatory compliance suggests that the exchange aims to appeal to cautious investors seeking assurance in a previously volatile market. This IPO might set the stage for future firms to follow suit, potentially reshaping the crypto landscape.

Highlights

- Bullish is betting big on the crypto wave with a significant IPO.

- A successful IPO could reshape investor perceptions of crypto.

- The digital assets space is preparing for its next wave of growth.

- Transparency and compliance are Bullish's guiding principles.

Potential Risks with Bullish's IPO

Investor sentiment may be tested as Bullish encounters regulatory scrutiny and market volatility. The cryptocurrency sector remains unpredictable, and public reaction to its IPO could significantly impact its valuation.

The unfolding events may signal a new chapter for cryptocurrency exchanges as they seek legitimacy in public markets.

Enjoyed this? Let your friends know!

Related News

Stock Markets Climb as Earnings Reports Approach

Stocks Decline as Powell Shares Outlook on Interest Rates

Bitcoin Reaches New All-Time High

New Princes targets autumn London IPO

XRP Wave 5 targets 7 to 10 dollars

Stellar's Price Set for Rise After Trump's Crypto Bill

Stocks Retreat as Investors Await Key Technology Earnings

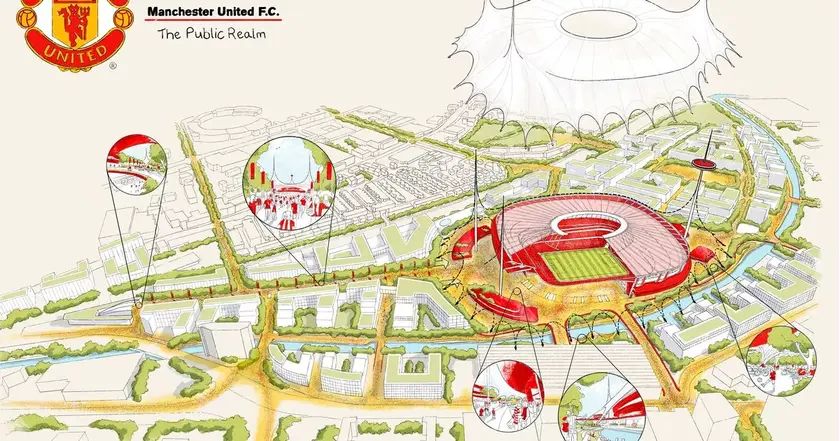

Manchester United stadium project faces delays