T4K3.news

Glencore stays in London, cancels New York listing plans

Glencore confirms its primary listing will remain in London, unveiling a $1 billion cost-cutting plan.

The Swiss mining giant confirms its commitment to London amid restructuring efforts.

Glencore remains in London following New York listing considerations

Glencore has decided to keep its primary listing in London, dismissing plans to move to New York, citing that such a switch would not enhance value for shareholders. The company, which features prominently in the FTSE 100, had previously mentioned the possibility of a New York listing in February. However, CEO Gary Nagle stated that after reviewing potential exchanges, the costs and uncertainty regarding inclusion in the S&P 500 influenced their choice to remain in London. This decision supports a beleaguered London financial market facing losses due to several high-profile departures. While announcing a $1 billion cost-cutting plan expected to streamline operations and boost profitability, Glencore revealed an increase in net losses to $655 million in the first half, attributed to declining production and commodity prices.

Key Takeaways

"London is where we are happy"

CEO Gary Nagle affirms commitment to London amid listing discussions

"We don’t believe there is a value-accretive proposition to move exchanges right now"

Nagle explains the rationale behind keeping the London listing

"Our adjusted net debt rose to $13.5bn compared with our stated target of $10bn"

Analyst note highlights Glencore's increasing debt levels amid financial challenges

"Impacts of lower prices for thermal coal can be felt across Glencore's operations"

Market conditions lead to significant impairments in coal operations

Glencore's decision underscores the critical challenges that traditional financial hubs like London are facing. With other companies weighing similar moves, the future of London as a mining capital hangs in the balance. Moreover, Glencore's financial struggles highlight broader issues in the commodities market, including declining coal prices and falling production rates. This restructuring aims to not only stabilize Glencore but also reaffirm London's position amidst rising competition from global financial centers.

Highlights

- Glencore circles back to London as New York plans fall flat.

- Staying put, Glencore doubles down on its London roots.

- The decision to remain in London is a small win for the city.

- Glencore's restructuring reflects deep market challenges.

Glencore's financial instability raises concerns

The company's rising debt levels and significant net losses could signal deeper issues within the mining sector, affecting investor confidence and market stability.

The long-term impacts of Glencore's decisions will be closely monitored by investors and analysts alike.

Enjoyed this? Let your friends know!

Related News

UK construction activity sees sharpest drop in five years

Life coach program derails engagement

London Stock Exchange to explore 24-hour trading

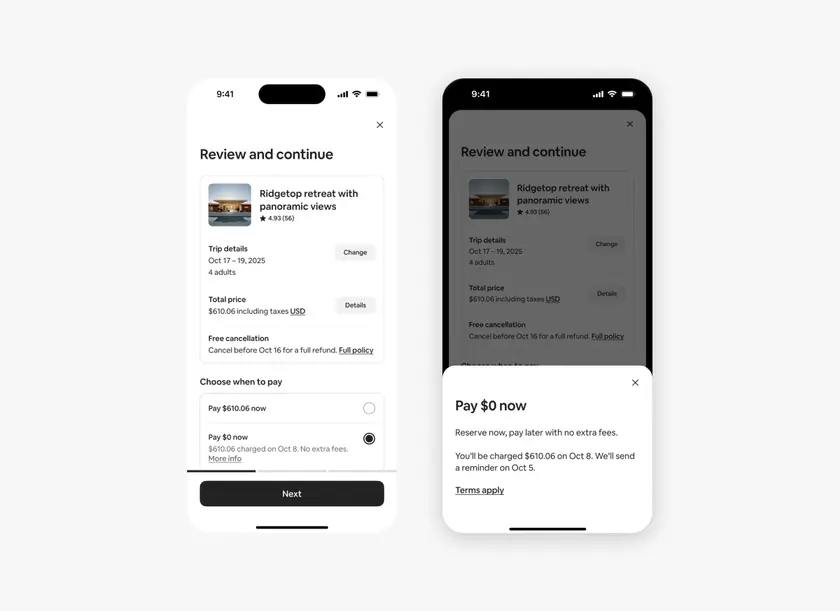

Airbnb expands payment options in the US

New Princes targets autumn London IPO

Bank of England governor blocks Revolut meeting

Major artists announce music and tours for 2025

Global UHNW second homes rise