T4K3.news

Airbnb expands payment options in the US

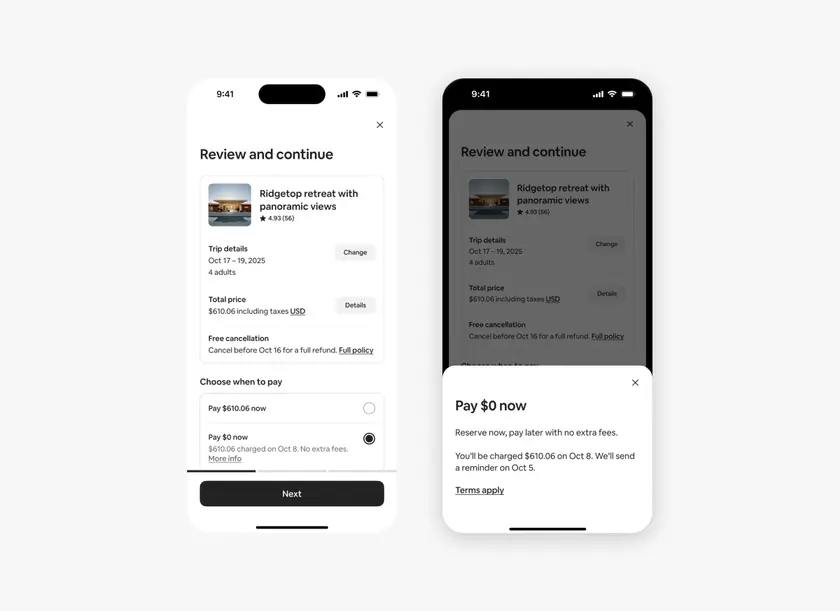

US travelers can reserve stays without paying upfront on listings with flexible or moderate cancellations, with full payment due before the cancellation window ends.

Airbnb launches Reserve Now Pay Later in the US, allowing reservations without upfront payment for listings with flexible or moderate cancellation terms.

Airbnb lets US users reserve stays without upfront payment

Airbnb has introduced a new feature called Reserve Now Pay Later in the United States. The option applies to listings that offer flexible or moderate cancellation policies, letting travelers reserve a stay without paying the full amount upfront. Full payment is due before the end of the listing’s free cancellation window, and users will receive a reminder to pay before that date. The policy mirrors earlier experiments, including a 2018 program to split payments and a 2023 partnership with Klarna for four installments over six weeks. A survey cited by Airbnb from Focaldata shows 55% of respondents prefer flexible payment options, while 42% said they missed out on properties due to payment logistics.

Key Takeaways

"Flexible payments reshape how people plan trips"

Editorial take on behavior change

"If you can pay later you can plan better"

Comment on access to payment options

"Cancellations become part of the deal"

Observation of policy dynamics

"This shift could broaden access to stays for families"

Impact on inclusion and access

The move fits a wider shift in travel toward buy-now, pay-later options. It could make trips easier to plan for people who need flexibility, particularly families and group travelers. At the same time, it shifts payment timing and introduces new risks for both sides of the marketplace, including debt buildup for some guests and revenue uncertainty for hosts if cancellations spike. The feature also highlights how platforms balance consumer flexibility with trust and cash flow, a dynamic that will draw scrutiny from investors and consumer advocates as BNPL-like tools become more common in travel.

Highlights

- Pay later plan smarter book with confidence

- Flexibility changes how people travel

- Money timing shapes trust between guests and hosts

- Access to stays grows with payment options

Financial and operational risks tied to pay later option

The new payment timing could raise consumer debt risk for some travelers while creating cash-flow uncertainty for hosts if cancellations rise. Regulators may also scrutinize BNPL-like features in travel and their effect on pricing and access.

Travel planning evolves as finance meets convenience, but responsibility stays with guests and hosts.

Enjoyed this? Let your friends know!

Related News

US Treasury accepts Venmo for debt donations

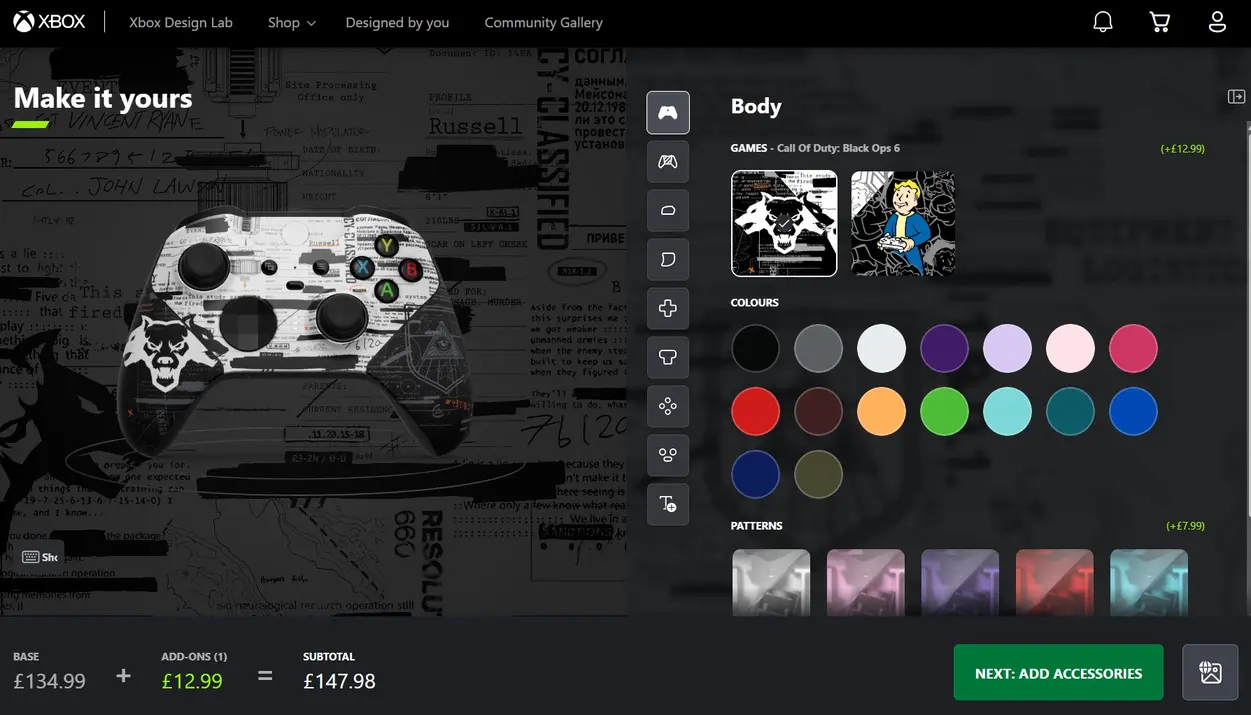

Xbox Design Lab reopens after long break

ECB adviser warns digital euro is insufficient against USD stablecoins

Lucid announces Q2 2025 financial results

Windows 10 ESU Program Covers Multiple Devices

Netflix expands Sussexes deal

Citroen expands stop drive recall to 106000 UK cars

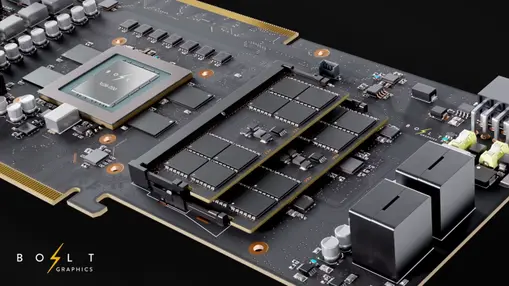

Bolt Graphics Unveils Zeus GPU with Bold Performance Claims